With the U.S. inflation rate at an elevated 8.7% for July 2022, consumers, manufacturers and retailers alike must remain agile to adapt to ongoing economic pressures.

“The past few years of COVID-19 have brought enormous disruptions to the CPG environment,” Ray Florio, Growth Consultant at IRI wrote in a recent blog post. “Inflation brings additional disruption and further hastens shifts in the ways shoppers research, purchase and use food, beverage and non-food items.”

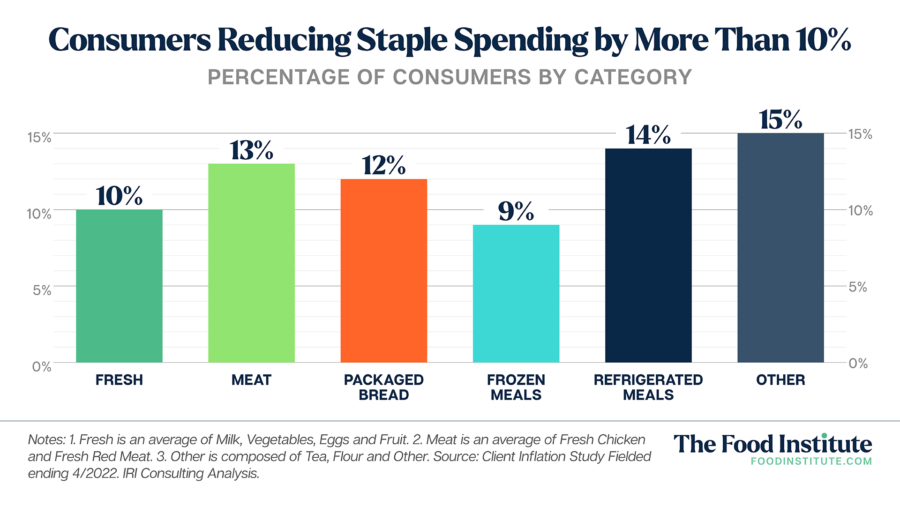

Recent IRI research revealed that a significant percentage of consumers are cutting back on top staples and, in some cases, migrating to value brands.

To achieve continued, sustained growth and provide a better value proposition to the shopper, Florio highlighted four strategies that manufacturers and retailers should consider:

1. Capitalize on current pricing leverage stemming from existing brand strengths to answer questions such as: “Which items must compete on price, and which can support premium pricing?”

2. Strengthen margins with lower impact when the volume tradeoff is positive to answer questions such as: “How can we better capture certain consumer segments based on our price and pack offerings?”

3. Drive even stronger differentiation and shore up gaps versus other brands to answer questions such as: “How can we change the consumer preference for our product through different on-pack communications?”

4. Tailor the innovation pipeline around brand strengths to drive profitable growth to answer questions such as: “What are the opportunities for premium innovation to drive growth in an otherwise stagnant category?”

“While disruption can be disconcerting, it also creates opportunity,” Florio concluded. By considering the strategies above and answering the additional questions put forth in the blog post…”savvy brands and retailers will gain a deep understanding of the factors that drive shopper decisions and can then devise and execute the right strategies to capitalize upon them.”