This fall, candy manufacturers are faced with a frightening reality: many shoppers are planning to ease back on Halloween-related purchases.

A new Halloween Spending Trends report revealed 73% of Americans said their shopping for the holiday will be impacted by economic challenges. The report by Power Reviews also found that 34% of respondents will buy cheaper Halloween candy this year.

“Retailers should look to optimize pricing strategies and prioritize affordability through loyalty programs and coupon incentives,” Sean Turner, CTO of Swiftly, told The Food Institute. “Retail media networks can [also] enable retailers to partner with candy manufacturers to give discounts and incentives that reduce the pain of inflation on consumers.”

In surveying nearly 19,000 U.S. consumers, Power Reviews found that 34% also plan to forgo buying Halloween decorations this year due to the impact of inflation.

The news isn’t entirely negative for the industry, though; about 30% of respondents to the survey plan to spend $250 or more this Halloween. Financial expert Scott Lieberman feels there’s no need for retailers to discount Halloween candy just yet considering the consistent sales figures of years past.

“History tells us that, during times of economic hardship, candy sales still rise,” said Lieberman, founder of the touchdownmoney.com financial advisory site. “During the Great Recession years [starting in] 2008, candy sales rose each year, according to the National Confectioners Association.”

Red-hot Items

Non-chocolate candy has certainly been popular in recent years, with brands like Skittles, Sour Patch Kids, and Jolly Rancher making significant gains; in 2022, non-chocolate chewy candy sales were $2.2 billion, up 13.9%, for instance (per CStoreDecisions).

Jonathan Prescott, VP of e-commerce at CouponBirds, told FI that themed candies featuring popular, pop-culture characters are expected to gain popularity this season, and added:

“Leading up to Halloween 2023, the most popular candy products are expected to be a mix of classic favorites, innovative themed treats, healthier options, and candies influenced by social media.”

Numbers of Note

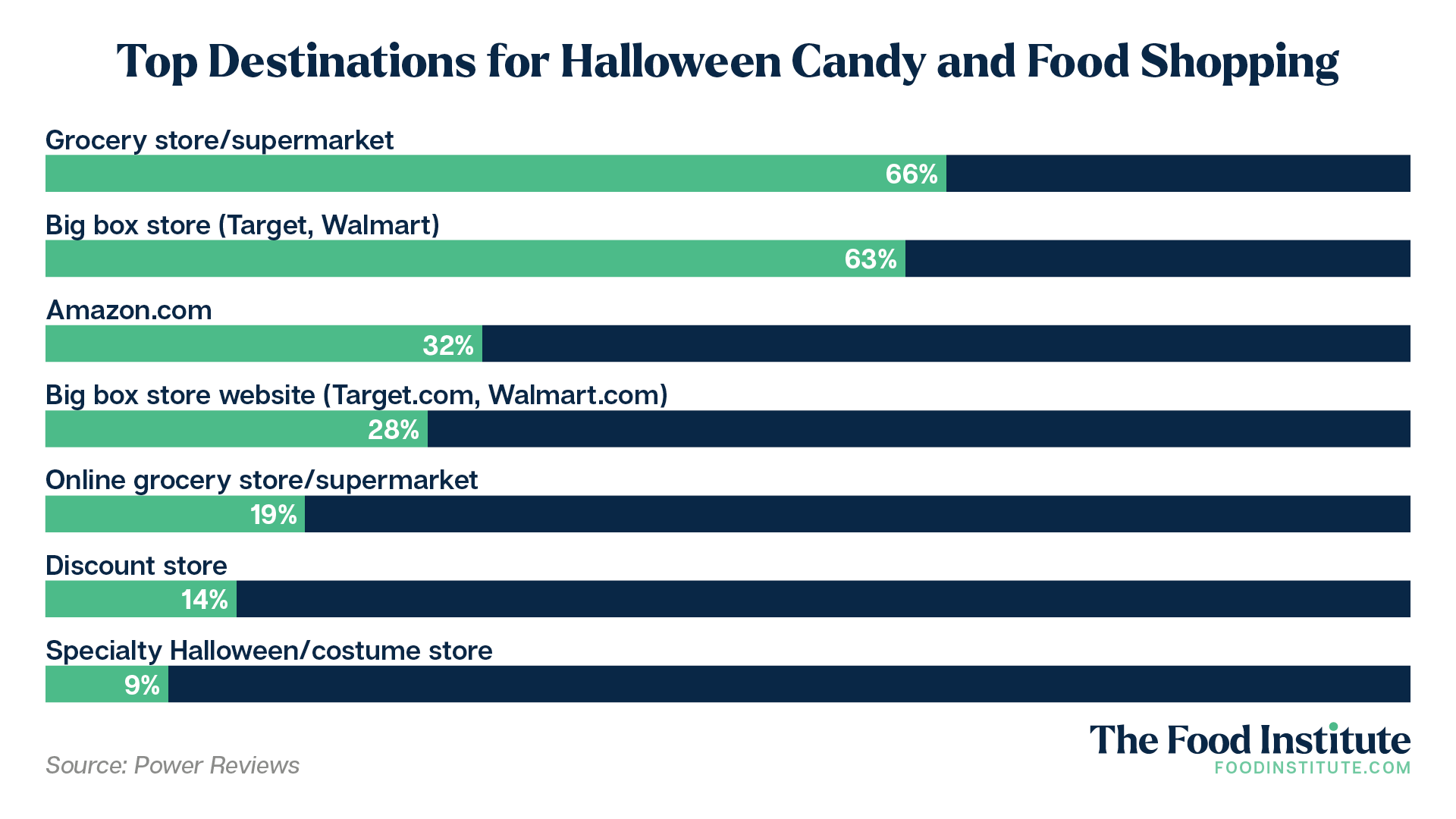

Noteworthy survey findings from Power Reviews include the following:

- 87% of Gen Z, as well as 87% of millennials, are willing to purchase from a new vendor or brand for Halloween treats

- 65% of all respondents said price is their top consideration when purchasing Halloween candy

- 39% of women consider Halloween a significant shopping period for their household (compared to 34% of men)

Advice for Businesses

Advice for Businesses

Prescott feels food manufacturers and retailers can overcome shoppers’ inflation concerns by taking a few careful steps. He advises businesses to offer smaller Halloween candy sizes, provide customizable candy options, and to utilize social media to create anticipation of the holiday.

“Businesses focusing on discounts experience a sales boost of 10 to 15 percent,” Prescott said. “Retailers and manufacturers can offer a variety of discount options, such as buy-one-get-one deals, [or] bulky discounts.”

Offering early-bird discounts on holiday candy online can prove effective, too. Analysis reveals that customers who made Halloween candy purchases in August 2022 had an average order value of $106, Prescott noted, which is $31 higher than those who bought it in October 2022.

In 2023, businesses must consider every data point available when it comes to setting prices.

“In the face of inflation, CPG brands must analyze their data to better understand consumers and adjust to their needs,” said Brooke Hodierne, EVP of strategy consulting for Insite AI. By using AI, the executive added, “CPGs can determine price elasticity based on demand at an individual item and store level. Doing so helps set the optimal base price and promotional strategy for their products.”

Something to Chew On

An intriguing footnote from Power Reviews’ recent survey: About 22% of consumers say it’s “never too early” for Halloween items to be showcased online or in stores. Perhaps that’s why some experts remain optimistic about candy sales this season.

“Candy is a relatively cheap treat,” Lieberman said. “People who are having a tough time financially are already scaling back vacation plans, nights dining out, new clothes, and major purchases. They feel like they deserve some enjoyment in their lives, and delicious candy is just what the doctor ordered.”

Advice for Businesses

Advice for Businesses