In 2023, C-store offerings are no longer limited to sad hotdogs rotating into oblivion on a rotisserie. Nay, the C-store landscape has changed drastically over the last several years.

From loyalty programs and retail media networks to substantial growth driven by new foodservice and beverage options, C-stores are rapidly evolving. And Scott Love, SVP of Retail Client Solutions at Circana (formerly IRI and NPD) broke it all down on the latest Food Institute Podcast.

Here are a few highlights from that wide-ranging conversation:

A renewed focus on loyalty programs

“We’re seeing now in convenience what we saw in other channels 10 years ago,” said Love. “There’s a heavy push by retailers to grow their loyalty programs… and use those as tools to better engage and understand their shoppers.”

To be clear, many C-stores have had loyalty programs for quite a while, but the focus on growing and expanding these programs is newer to the channel.

“We’re really seeing retailers focus on them. Using initiatives like exclusive offers for loyalty cards, cash and fuel discounts, online ordering for delivery orders—a number of means to drive that loyalty participation,” said Love.

When customers participate, loyalty programs can provide retailers with a wealth of valuable data. Savvy retailers use these insights to better understand traffic patterns and better engage with their shoppers.

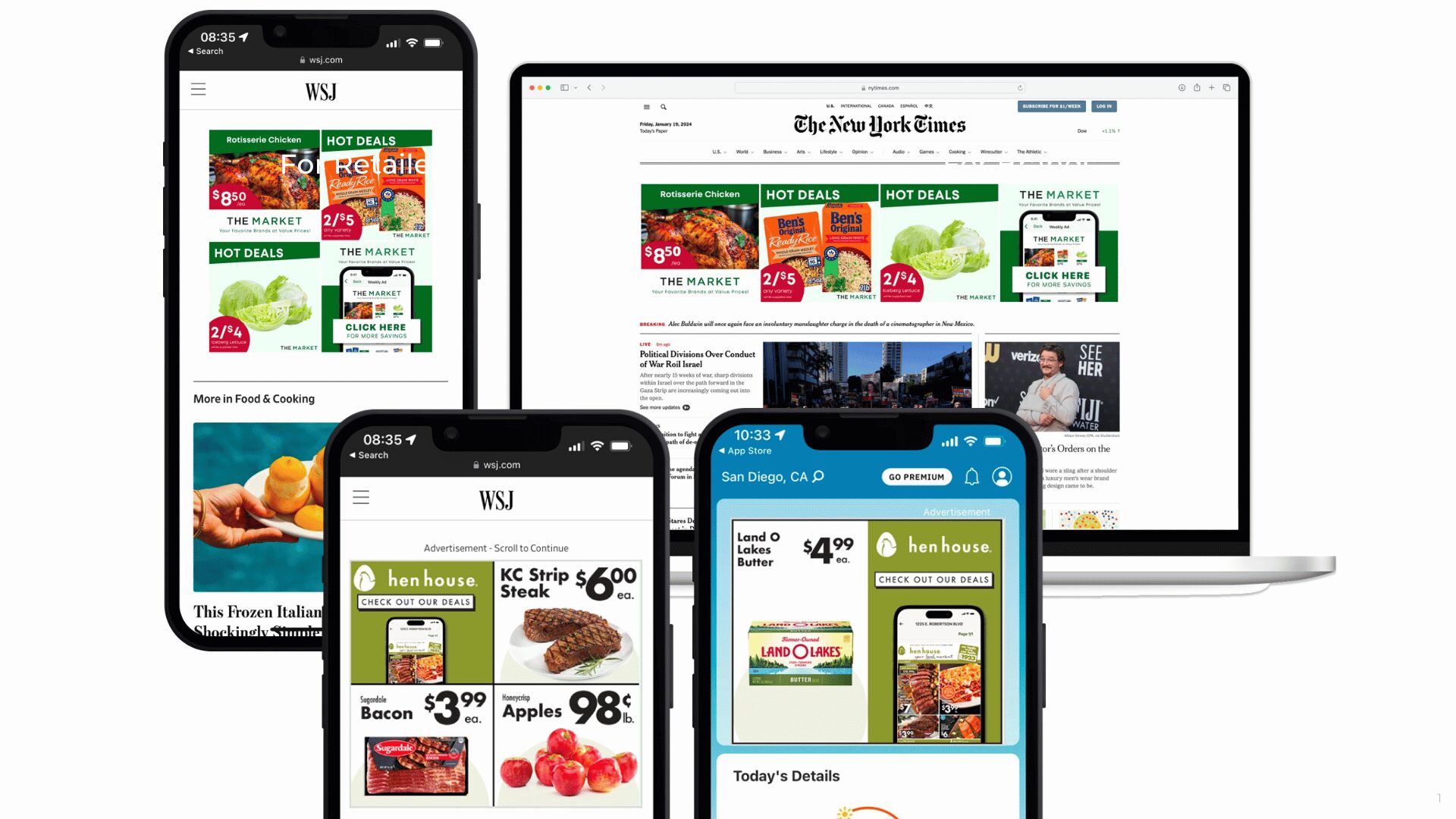

The promise of retail media networks

And when it comes to engaging with consumers, a retail media network is one of the most effective tools available today. Some of the biggest grocery outlets have already established their own retail media networks, and Love says “there’s a large opportunity” for C-stores to do the same.

In fact, the few C-store retail media outlets that already exist are delivering exponentially above expectations, Love explained. “They’re getting really creative with it,” he said.

C-store retailers can expose shoppers to ads in ways that a grocery retailer may not. For example, C-stores can run targeted ads on the monitor at the gas pump.

Retail media networks also provide an opportunity for C-stores to partner with manufacturers and test new products with a specific audience in mind. Retailers can monitor the response from targeted campaigns advertising new items and report back to manufacturers—a win/win for both parties.

“And so, I think you’re going to see a wave of [retail media networks] come out, like we’ve seen in grocery,” said Love.

Beverage sales get shaken up

According to Love, beverages make up 21% of the total sales in the C-store channel, and the numbers continue to grow.

Energy drinks are an obvious top seller, but lately, specialty coffee, juices, and teas are becoming a hot commodity (though often served cold), with the highest growth in purchase rates.

“C-store retailers are really going after some of the specialty coffee players… and are doing quite well throughout the day in those beverages,” Love explained.

Who’s buying all that midday coffee at their local C-store? Middle-income and middle-aged households.

Gen X has been the top cohort for beverage sales at C-stores over the last three years, and they were the top contributor again over the last 52 weeks. Not to be outdone, younger boomers are also buying more coffee and tea, growing at nearly the same rate as Gen X.

In the alcohol department, beer has been a long-standing C-store staple, but now canned cocktails are growing at a 50% clip year over year.

“I think [canned cocktails are] an interesting opportunity for the channel,” said Love. “You’re seeing some of those sold in places where there’s state liquor control, and so you can’t sell spirits… but canned cocktails and coolers are legal to sell.”

As a result, “they’re grabbing a nice footprint in the channel right now.”

Fresh foodservice offerings add value

Finally, many C-store retailers have started making fresh foodservice items, driving loyalty, extra trips, and incremental value to the channel.

“When you look at who the channel is actually competing with, in [the foodservice] part of the store, it’s not other C-store retailers, and it’s not grocery,” Love explained. “They’re competing with quick-serve restaurants. And they’re doing quite well and growing in various day parts versus quick serve restaurants, especially now as you go into an inflationary period.”

And the C-store has several ways to win against QSRs:

- By stocking a large variety of beverages (because they’re not locked into a contract with one big soft drink company)

- By having staffers that can execute and customize fresh food items

- By offering both indulgent and healthy items

According to Love, when foodservice items are part of a shopper’s trip, those items account for 43% of the overall basket size. Likewise, over half of U.S. consumers purchased foodservice items from a C-store in the last year.

Bottom line: “[Foodservice] is high-penetration, it’s high-value, and the retailers that are doing well with it are really winning loyalty from their shoppers,” said Love.