Shoppers have historically gravitated to store brands when economic times get tough. But despite record-high prices, private label food and beverage sales continue to dip below their national counterparts at retail.

Overall, store brand dollar sales maintained their ground against the double-digit dollar gains in 2020, increasing 1% by years end, according to the 2022 report by the Private Label Manufacturers Association (PLMA). Meanwhile, national brands grew 2.7%.

By impacting on-shelf availability, supply challenges have contributed to a slowdown in sales across both store and national brands.

However, according to a January consumer report by IRI, additional stimulus dollars and reallocation of household budgets have also dealt a blow to store brands by empowering consumers to make more premium purchases and experiment with new flavors at home.

Food & Beverage Focus

Storewide, dollar sales for edibles totaled $696.2 billion in the 52-week period ending February 13, with both national brands (-3.5%) and private label products (-5.5%) witnessing unit sales decrease year-over-year.

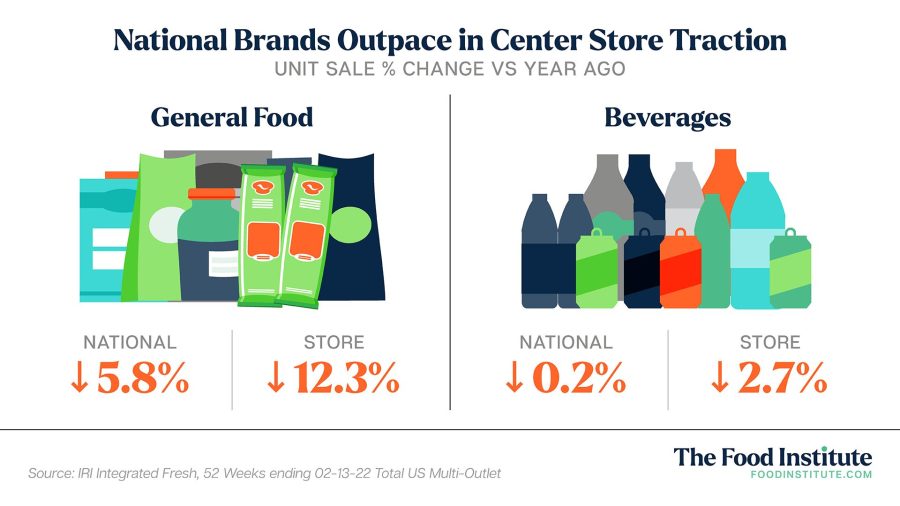

In center store, private trailed national in overall unit sales across the two largest edible categories — general food and beverages.

This drop coincides with a noteworthy year for large CPG manufacturers, who grew share in 2021 for the first time in five years. Unit sales for private label CPGs dropped 6.6% for the year compared to a 3% decline for national brands.

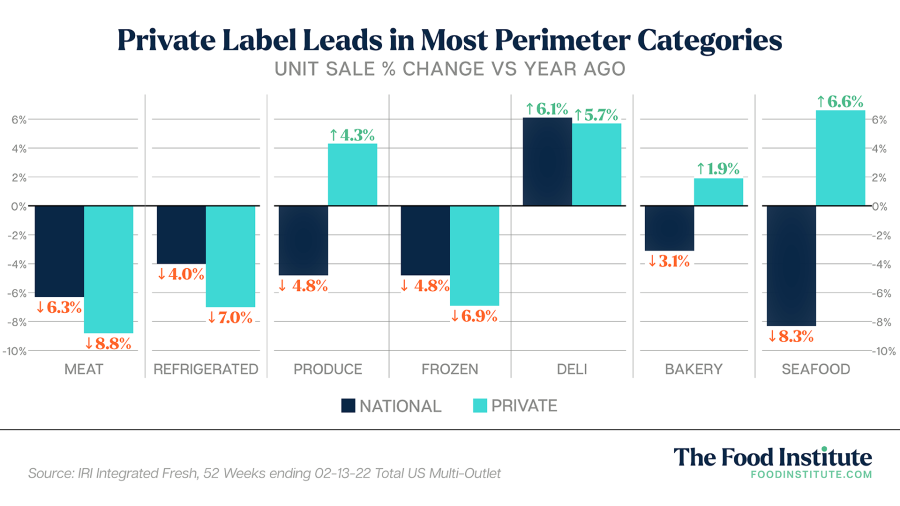

Across the perimeter, unit sales performance fluctuated significantly.

Overall, private label exhibited stronger traction with gains in fresh departments including seafood, deli, and produce.

However, according to the IRI report, private brands hold a large category share of perimeter, where options are fewer and retailers may narrow the selection to one option each for private and national.

By share percentage, the top five private label edible categories are:

- Frozen Fruit (80%)

- Refrigerated Pizza (69%)

- Pies & Cakes (66%)

- Refrigerated Meat (64%)

- Frozen Seafood (62%)

Consumer Considerations

While store brands hold stronger ties to affordability, they are not always the most cost-effective option.

According to a MarketWatch interpretation of Neilson IQ data, national brands had a higher price tag for center store groceries, dairy, and meat in January, but prices were nearly identical in the bakery and seafood departments. Furthermore, private label products were significantly more expensive in the produce department.

Younger generations are also contributing to the deceleration. According to IRI’s report, store brand sales softened across Gen Z (-1.3%) and Millennials (-1.0%) in 2021.

Mary Ellen Lynch, principal of IRI Center of Store Solutions Group, identified four main reasons for this decline, as reported by Convenience Store News:

- Increasing mobility

- The impact of e-commerce as consumers order familiar products online

- Product discounts reducing national brand pricing

- New product innovation by national brands

Younger shoppers are also more likely to seek out companies that offer transparency and information about the goods they consume, Linda Zayer, acting associate dean, faculty & research at Loyola University Chicago’s Quinlan School of Business, told The Food Institute.

“Historically, retailers have been able attract value conscious consumers to their private labels. However, many younger consumers…want to know where and how goods are made, what ingredients are used, where these materials are sourced, and the working conditions and environmental sustainability surrounding the production,” said Zayer. “Once they find a brand that fits their values and needs, they may be less apt to switch, even if that means there are some cost savings.”