Believe the hype – major American retailers and grocers are spending big money on retail media networks (RMNs).

Walmart has Walmart Connect. Target reaches consumers using Roundel. Kroger has its Precision Marketing network, Albertsons its Media Collective, and who knows how many servers they’ll need to keep all users’ data if they merge? The Dollar General media network has over 90 million unique customer profiles, or roughly 25% of the American population.

And 75% of the net retail ad spend in the U.S. is commanded by Amazon Ads.

Retail media networks leverage customer data to enable precise audience targeting, maximizing the effectiveness of marketing campaigns. By analyzing data on shopping habits, brands can refine their marketing strategies, optimize product placement, and customize promotions to meet demand.

“Retail Media Networks are quickly becoming the next big channel for retailers and brands to spend their advertising dollars,” said Maren Kelly, vice president of marketing at PriceSpider, a leading provider of brand commerce solutions that works with some of the aforementioned retailers.

“The industry has already doubled in spend over the last two years and according to Forrester Research, is expected to reach $85 billion by 2026. These retail media networks provide a wealth of untapped data which can be used to provide a full omnichannel experience. Coupled with the growth of shoppable media, all that data empowers brands to let their customers buy anywhere they choose.”

The topic of retail media networks is examined in-depth in the September Food Institute report, available to members on September 5 (to join FI, click here).

The Infinite Feedback Loop of the RMN and Omnichannel

The media writer Marshall McLuhan once said, “We shape our tools and then our tools shape us.”

Such is the case with retail media networks and the greater omnichannel that they comprise—we have created the tools that enable us to eat healthier, try new foods and flavors, even save money (if we’re careful not to go too crazy with ads tailored specifically to our lifestyles).

The future is in the omnichannel, and per recent data from eMarketer, 82% of American advertisers plan to increase their advertising expenditures with RMNs this year. And CPG is one of the most fertile sectors for ROI. And the omnichannel is lucrative—per statista, the global retail market (including omnichannel) was worth over 27 trillion dollars, forecast to reach over 30 trillion by 2024.

“For food and beverage brands in particular, they can allow their customers to buy anywhere without taking them away from where they’re already shopping,” Kelly added. “Consumers can easily ‘buy now’ or learn which retailers have the product already available.”

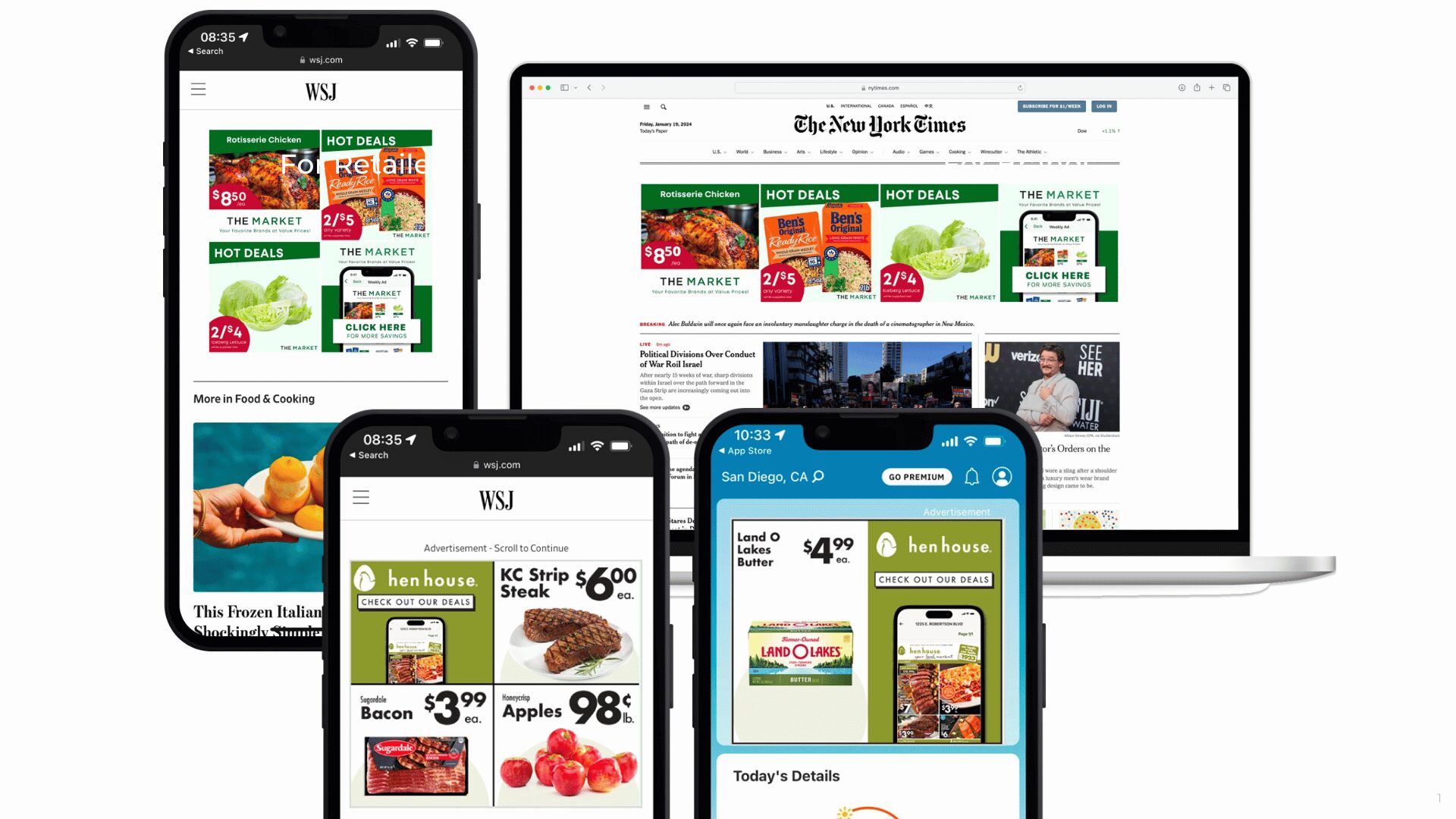

While original, on-brand content within the aisles of Walmart, Target, or regional grocers such as Sprouts or Hy-Vee would be an expensive proposition—and one that’s almost surely coming—licensing that ad space out to third parties is much more palatable.

Mark Boidman is head of media at Solomon Partners and says in-store retail media spend is still quite small today. “The lion share of retail media network dollars come from apps and online shopping,” he said in a statement to The Food Institute. “Networks can leverage their own first-party data and are less vulnerable to privacy-based limitations on data usage and targeting.”

“The rest of the field, meaning smaller players, will fare better turning their available online real estate into a monetizable part of their platform,” said Yaron Toren, chief marketing officer at Shopic.

“They should add more touchpoints with shoppers to their RMNs and more media space for display ads and promotions. We would also see tighter integration between the various touchpoints—online, mobile, physical stores—which will result in fuller shoppers’ profiles (just like social media platforms.)”

Hence, the omnichannel. And with it, everything.

Curtis Seare is vice president of emerging technology at The Variable, an advertising and innovation agency. He says that we’ve truly entered the Renaissance of retail advertising, and that while the digital age has democratized access to information, RMNs democratize consumer access to products and the ideas borne from them. In grocery, this might be as simple—and spendworthy—as a new recipe or flavor combination.

“These networks are redefining advertising paradigms, offering brands unparalleled transparency, performance, and most importantly, connections with their audience.”

In many ways, the beauty of RMNs wouldn’t be possible without the mobile devices in our pockets constantly chirping, buzzing, and vibrating with updates to and from the omnichannel and enabling a seamless shopping experience.

“Imagine a scenario where a customer searches online for a new gluten-free pasta brand,” Seare told The Food Institute. “They see an ad for it and decide to purchase it during their next store visit. As they enter their local grocery store, they receive a notification on their mobile app guiding them to the aisle where the gluten-free pasta is located, along with a special discount. This seamless integration ensures the brand is present at every pivotal moment of the consumer’s journey, from online browsing to in-store purchase.”

The New Electronic Independence

“The new electronic independence,” McLuhan also wrote, “recreates the world in the image of a global village.” Such is the promise of RMNs, bringing the vast and novel within the safe and sterile spaces of the superstore, the regional grocer, the local retailer.

And that’s good, because brand loyalty is wavering. According to the 2023 Consumer Culture Report from 5WPR, brand loyalty is declining yet the customer experience is rising in its ability to influence point-of-sale purchases, both in-store and online. For consumers in the omnichannel—and the brands benefiting from their purchases—more data equals more intel, yielding highly targeted ads specific to their likes, dislikes, needs, and desires, culminating in a grocery and/or retail experience in which consumers aren’t just purchasing products; they’re making informed decisions about the brands whose identities and values resonate with them, helping define not just a meal, but their communities, their families, and themselves.

“Grocery retailers have the power to redefine the consumer experience,” Seare continued.

“The future I envision is one where data isn’t just collected but is also reciprocated with value; imagine a world where your grocery store knows your dietary preferences, offers personalized recipes, takes you on virtual global market tours, and even gamifies your shopping experience. This isn’t just the future; it’s the imminent reality.

“The future of RMNs is not just about ads; it’s about experiences. It’s about creating moments that matter, forging lasting connections, and building bridges between brands and consumers.”

The Food Institute Podcast

What’s plant-based, gluten-free, and of South African origin? Turns out, chakalaka is just that, but what is this product? Chakalaka Brands founder Leeto Tlou joined The Food Institute Podcast to explain his pivot from the finance world to the food industry, the South African cuisine’s history, and how its flavors could be perfect for the American palate.