Editor’s note: Juan Ruiz is a finance and investment professional with over 30 years’ experience collecting and reviewing wines. He’s a graduate of New York’s Institute of Culinary Education’s Intensive Sommelier Program and a certified sommelier with the Court of Master Sommeliers, Americas.

Few economic sectors were spared from the pandemic’s havoc. The wine industry was no exception, and nowhere was it more immediately visible than in wine retailing and direct-to-consumer (DTC) wine sales.

What started roughly 10 years ago as a gradual and evolutionary process, propelled by occasional forays by large wine retailers into the e-commerce space, has accelerated into what appears to be a sustainable trend toward online wine acquisition and delivery. It could be argued that, in a way, COVID merely acted as a catalyst to changes that were already taking place.

The Good Old Days

Not too long ago, buying wine was almost exclusively a local affair. A quick trip to the neighborhood liquor shop would satisfy the wine acquisition needs of most consumers. The wine shops carried a reasonably wide selection, and the store staff would happily assist prospective buyers with recommendations.

A significant portion of US retail wine sales, however, came from supermarkets (such as Albertsons, or Publix) and large-scale wine retailers like Costco (the largest in the U.S., with $4 billion in annual sales) and Total Wine ($3 billion). They relied on their vast multi-state brick-and-mortar presence, as well as their purchasing power, to move large quantities of primarily mainstream wines.

Direct-to-Consumer wine platforms, like Wine.com and Vivino started as fully online platforms and pursued a nationwide client base. However, until recently they were not very well known. State laws regulating the sale and distribution of wine and other spirits were also conducive to keeping wine sales local — often confusing and archaic, these laws made interstate wine sales difficult.

COVID the Disruptor

COVID turned wine retailing on its head. With the “quick trip to the local wine shop” becoming nearly impossible and foot traffic virtually nonexistent, wine retailers were forced to hastily alter sales models to survive.

Depending on their individual circumstances, retailers ultimately adopted one of three distinct approaches to deal with the COVID pandemic: (1) adapt, “keep calm and carry on”, (2) embrace and intensify e-commerce efforts and (3) seek “outside” help. The last two approaches are worthy of further analysis since they’re likely indicative of where wine retailing may be heading (or already is).

- Adapt, “Keep Calm and Carry On”

Brick and mortar giants like Costco, Total Wine and Trader Joe’s mainly focused on adapting their stores to the new COVID reality. Costco treats wine the same way it does all its other products (toilet paper, anyone?), so it made no significant, wine-specific changes to its platform.

Total Wine’s COVID approach was similar to Costco’s. Able to keep most of its stores open during the pandemic (as they were deemed “essential businesses” in many states), the company instead instituted curbside pickup, social distancing and capacity constraints in its stores. It also instituted a temporary, $2 per hour “hazard pay” increase for its workers. However, it expanded its previously small online wine platform to include online wine purchasing, local delivery and shipping. Shipping options, however, are limited to only 17 states, with state regulations being the primary limitation.

- Embrace and Intensify E-Commerce

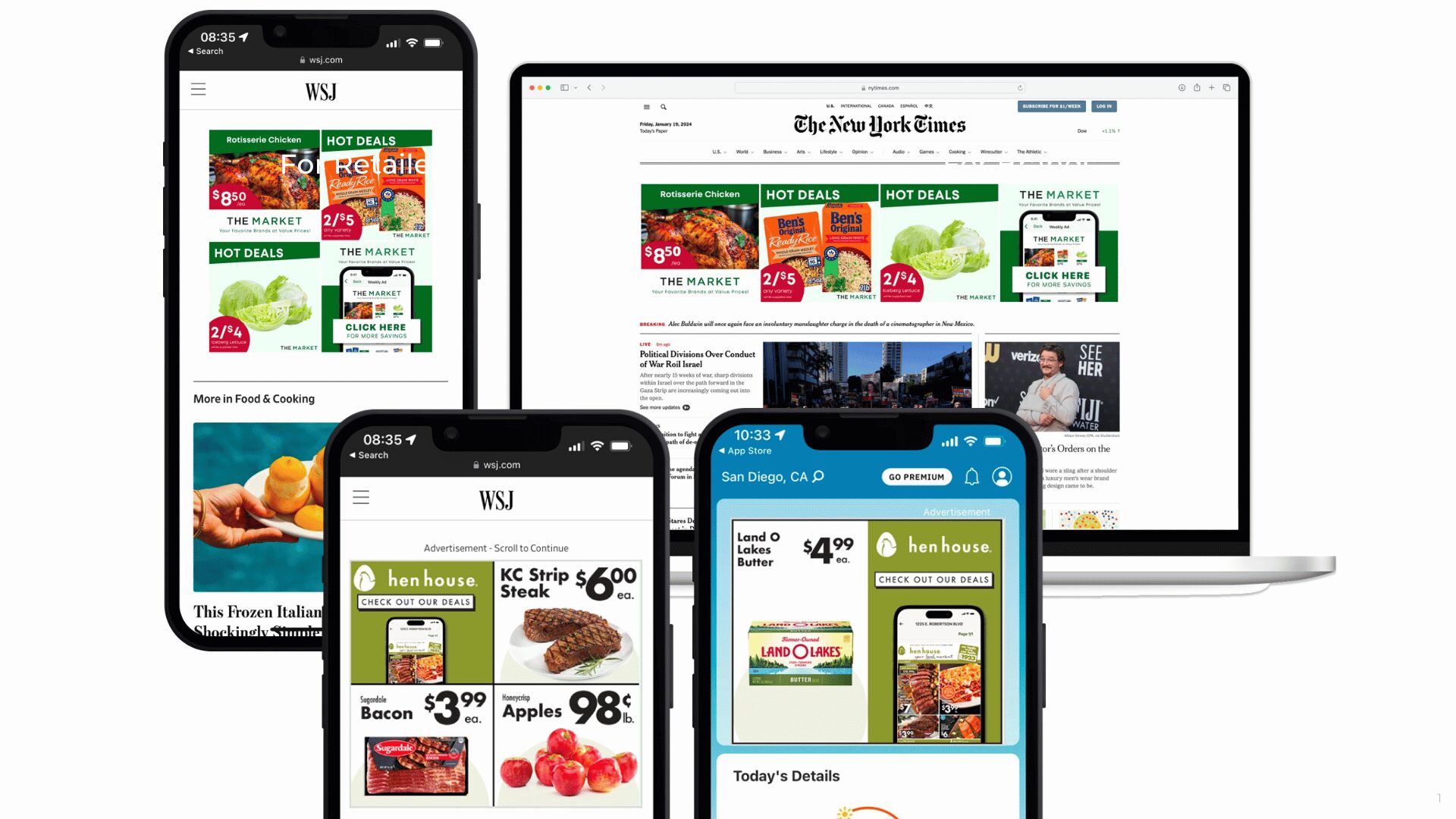

Most regional and large local retailers already enjoyed existing online sales platforms, which provided local delivery and shipment options for out-of-state customers. Accordingly, these retailers chose to focus heavily on e-commerce for additional sales, providing curbside pickup, greatly expanding local delivery areas and competitively pricing their FedEx/UPS shipping costs.

As a substitute to instore wine advice and recommendations, retailers significantly expanded their use of “professional wine ratings” from publications like Wine Spectator and The Wine Advocate to better inform their online customers.

- Seek Outside Help

Small, independent wine stores were the hardest hit by COVID, with many forced to close down temporarily (or, in some cases, permanently). In several states, like New York, wine stores were deemed “essential businesses” which ameliorated some of the impact. Small wine shops quickly instituted local delivery, and those who already had an online presence dedicated significant effort to bolster the alternative sales channel. However, the small wine shops that lacked an established local/regional “brand” found it difficult to gain traction in the e-commerce space. With limited name/brand recognition and ever dwindling revenues, another alternative was needed. Fortunately, one was readily available…

Drizly.com: The “Killer App”?

Drizly.com (recently acquired by UberEATS for $1.1 billion), was founded in Boston in 2016 as a beer, wine and alcohol delivery service, promising delivery times measured in hours instead of days. Drizly’s business model is hardly revolutionary – it’s essentially an alcohol delivery version of UberEATS — but for many small wine retailers it was a godsend. Unlike Vivino and Wine.com which operate strictly on the Web and ship wine nationwide through online ordering and centralized warehouses, Drizly merely partners with local alcohol stores in their delivery areas, and sources product directly from them. Further, Drizly doesn’t mark up the prices offered by its retail partners and only charges a fee for its service instead of taking a cut of the sales.

The net results? Drizly’s presence and reach have increased significantly during the pandemic. Revenues increased 350% in 2020 versus a year prior. As of December 2019, Drizly had just under 2,000 retail partners. By the end of 2020, that number had swelled to more than 4,000 and it’s on pace to add an additional 2,000 in 2021. Presently, Drizly’s coverage is still limited to major metropolitan areas, but that’s changing quickly, and its acquisition by UberEATS will further accelerate its growth.