Demand for coffee outside the home increased substantially in 2021, while traction at the grocery store remained strong – further solidifying the category’s overall appeal and adaptability to shifting consumer behaviors.

According to a recent report from Placer.ai, visits to major coffee chains returned to pre-COVID levels as of April 2021, and foot traffic has consistently outpaced 2019 numbers since May.

This traction comes despite struggles throughout the wider dining sector.

In a 2019 comparison, foot traffic in the coffee space grew 8.4% in November and 7.5% December, while overall dining experienced a decline of 6.4% and 1.8%, respectively.

The data suggests that major coffee space players will continue to thrive in 2022 as the demand for dining continues to recover.

Grocery Movement

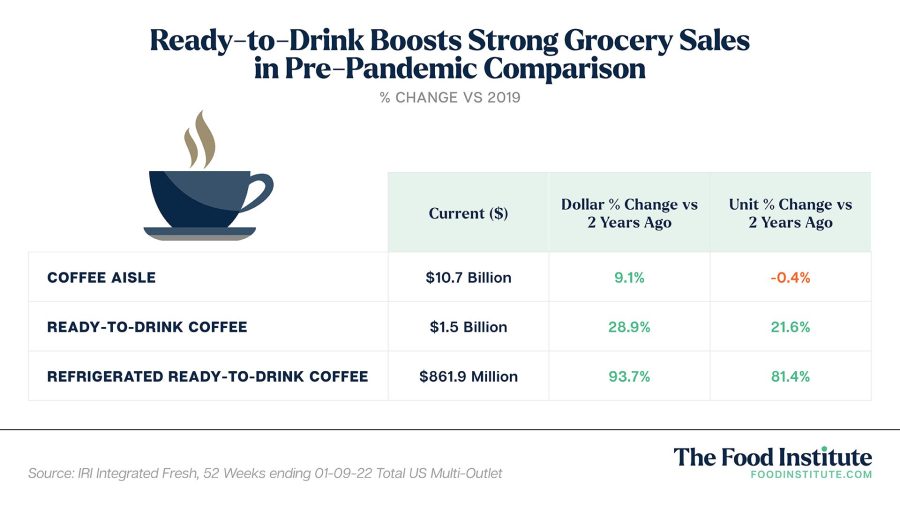

A similar pre-pandemic comparison in the grocery store shows sales normalizing for homemade coffee and spiking for products on the go.

According to IRI data, for the 52-weeks ending January 9, ready-to-drink coffee products experienced phenomenal growth compared to the same time period in 2019.

Meanwhile, unit sales for traditional coffee varieties — including ground, single cup, concentrates, and whole bean — returned to pre-pandemic levels.

Coffee Shop Drivers

Strong grocery sales for on-the-go coffee further illustrate how trips to the coffee shop serve purposes beyond necessity and convenience.

As Placer.ai notes, these include:

Socialization – The role of coffee shops as a “third place” for friends and family to meet outdoors continues to drive visits, particularly among younger consumers. This is significant not just in the short-term, but for the long-term strength it could create in a professional context defined by hybrid work models.

Seasonality – New spring menus generally drive visits as the weather begins to warm up, while fall ushers in a stronger seasonal peak, with brands like Starbucks leveraging marketing techniques and human psychology to drive sales through unique limited-time flavors and experiences

COVID Concerns Remain

Although major players including Dunkin’ Donuts, Starbucks and Dutch Bros enjoyed healthy competition and steady growth throughout the second half of 2021, smaller coffee chains remain vulnerable to COVID-induced fluctuations.

Furthermore, some shifts in visit patterns – specifically shorter visits and more late morning visits at the expense of early evening ones – are still enduring and may affect the type of experience that visitors are after.

Overall, brands that understand what coffee consumers want in 2022 will have a leg up.

While the coffee category is returning to “a period of more stable growth,” coffee shops must recognize changing behaviors and balance the grab-and-go nature of coffee chains with their sense of community, R.J. Hottovy, head of analytical research at Placer.ai, told Retail Brew. (Jan 18)

“It really comes down to knowing who your customers are and formatting your locations to best satisfy those different consumer need states,” Hottovy said.