Fast food chains that shifted focus to takeout, drive-thru, and delivery are seeing benefits, reported The Wall Street Journal (July 29).

Several chains expect these efforts to pay off longer term as the pandemic shows no signs of fading and some consumer habits could change permanently. Many fast food companies brought down staffing levels and cleaning costs by closing dining rooms—and aren’t in a rush to reopen.

“For quick-service restaurants, they don’t want to reopen their dining rooms because this drags down profitability and increases costs,” said Andrew Charles, an analyst at investment bank Cowen Inc.

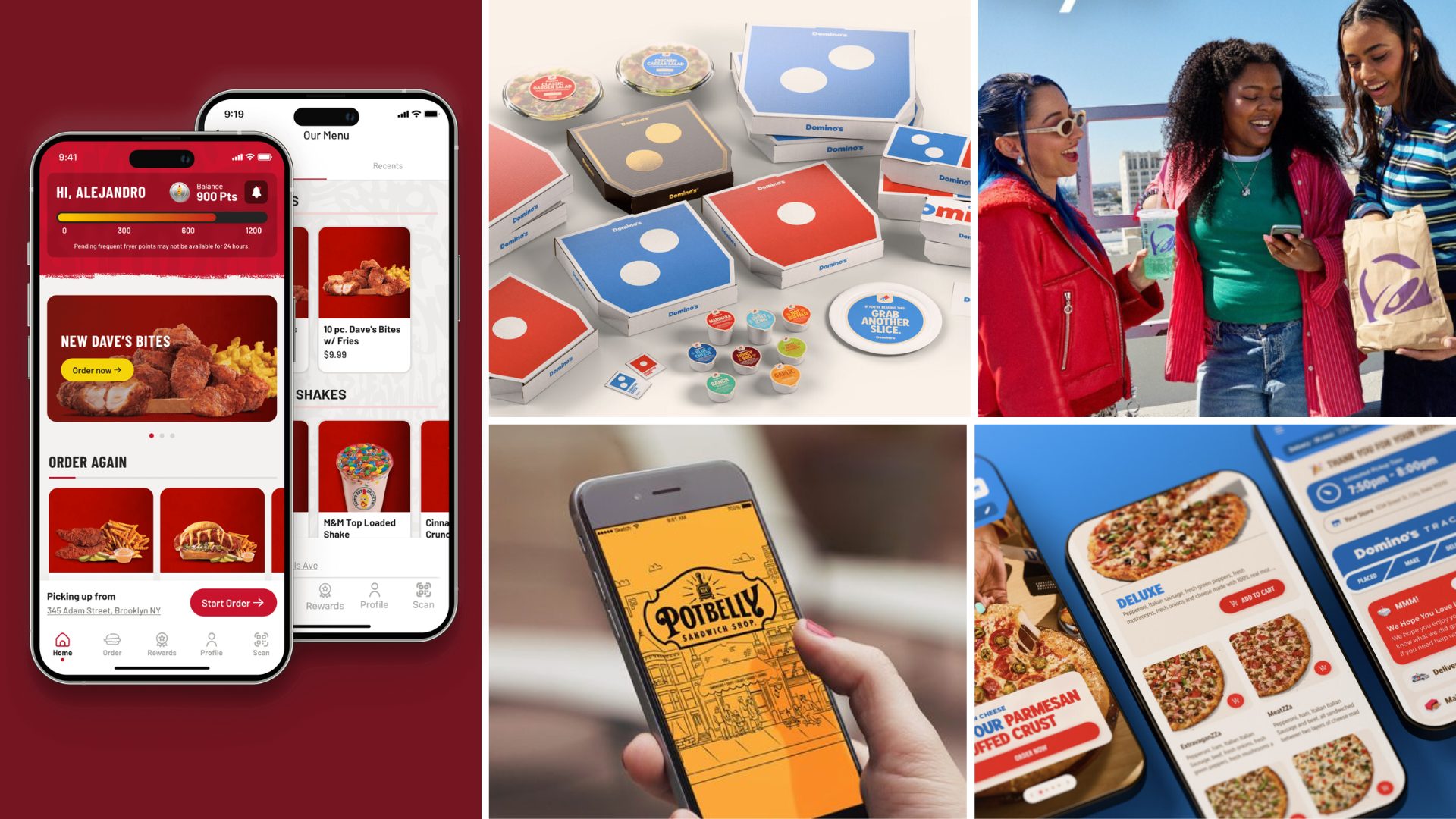

For example, Restaurant Brands International (RBI)—which owns Burger King, Tim Hortons, and Popeyes—boosted its digital offerings and delivery services. “COVID acted as an accelerator for some of the trends that we already identified in our strategy,” said Matthew Dunnigan, CFO of RBI.

The company relied on its digital sales when the pandemic hit, according to Dunnigan. RBI extended curbside pickup, drive-thru, and delivery.

Thirty-six percent of consumers reporting using a drive-thru window to get their food, compared to 21% in 2019, according to research from The Hartman Group. Among all restaurant sourced eating occasions, Millennials are now significantly more likely to use a drive-thru, at 39%, while Boomers are more likely to order order ahead by phone, app, or website, at 45%, as well as use a drive-thru, at 35%.

Atlanta-based Church’s Chicken, which specializes in fried chicken, also focused on drive-thrus. “We have been working on this for years, and it paid off. It really benefited our business,” said finance chief Louis “Dusty” Profumo. Profumo noted a 15% to 20% increase in drive-thru sales since March, with those sales now accounting for nearly all of Church’s business.

Chipotle is also opening more stores with drive-thru lanes for digital orders. More than 60% of new stores will include the “Chipotlanes,” which are only for picking up orders placed in advance online. Despite stay-at-home orders in recent months, Chipotle successfully navigated the first quarter with digital sales growing more than 80% year-over-year.

Starbucks is also “steadily recovering” worldwide as most of the chain’s stores have reopened, reported Reuters (July 28). Like other businesses, Starbucks relied more on delivery and drive-thru to make up for lost business. In fact, mobile orders rose 6% from a year ago to make up 22% of total transactions in the quarter. Furthermore, Starbucks plans to deploy new handheld point-of-sale devices for employees to take orders in drive-thru lines to speed up service.

This is similar to Chick-fil-A, where “face-to-face” ordering expedites the process, reported QSR Magazine (July 29). Before COVID-19, this was taking place about 60% of the time at Chick-fil-A, where employees are positioned outside to take orders from a tablet, walking upstream from the speaker box to accept orders. The service allowed Chick-fil-A to greet guests as soon as they arrived and open more time in the back of the house to prepare orders, leading to higher quality and accuracy.

Starbucks CEO Kevin Johnson said crowded drive-thrus and speed of service have long weighed on Starbucks. Lines often go around the building and into streets. “Where we deploy this handheld point-of-sale, we can now have a Starbucks partner out there taking orders walking through that line of cars, which is going to dramatically increase the throughput at drive-thru,” Johnson said.