Inflation has presented a persistent obstacle for grocers since mid-2022. Nevertheless, some supermarket chains are defying trends and outpacing the competition.

New research from analytics firm Placer.ai noted the steps that successful grocery chains are taking in 2023, including the following:

INSPIRING MISSION-DRIVEN SHOPPING

Recent visitation data suggests that the impact of rising prices has inspired a natural shift in consumer behavior. Mission-driven shopping – taking a strategic approach to one’s grocery outings – is making a comeback.

According to Placer.ai, foot traffic data reveals an increase in median visit duration across grocery chains. Shoppers appear to be approaching their grocery runs more carefully – perhaps planning them during sales – while minimizing extra trips to stick to their tightened budgets during inflation.

OFFERING IMMERSIVE SHOPPING EXPERIENCES

To inspire consumers to choose their chain for their longer (and less-frequent) grocery runs, some supermarket chains are enhancing the overall shopping experience.

For example, Texas powerhouse H-E-B recently unveiled a new store format at one location in Austin. The two-story grocery emporium is nearly double the size of H-E-B’s typical 50,000-sq.-ft. store and includes a café and bar, a full-service pharmacy, several on-site restaurants, and an outdoor department dedicated to gardening. The median visit duration at the new, immersive H-E-B was 27.6% longer than that of its local counterparts, Placer.ai noted.

John Bierfeldt, VP group sales and marketing at Acosta Group, feels immersive shopping experiences have become vital for grocers.

“Today, we need to create a cohesive experience for consumers at the digital and physical shelf,” Bierfeldt told The Food Institute. “One example is our … implementation of the Starbucks Signature Aisle experience across 938 stores. By developing custom wooden fixtures with rotating signage across multiple retailers, we have effectively brought the essence of a Starbucks café to grocery aisles (creating an) appealing atmosphere for shoppers, making their grocery experience reminiscent of visiting an actual Starbucks location.”

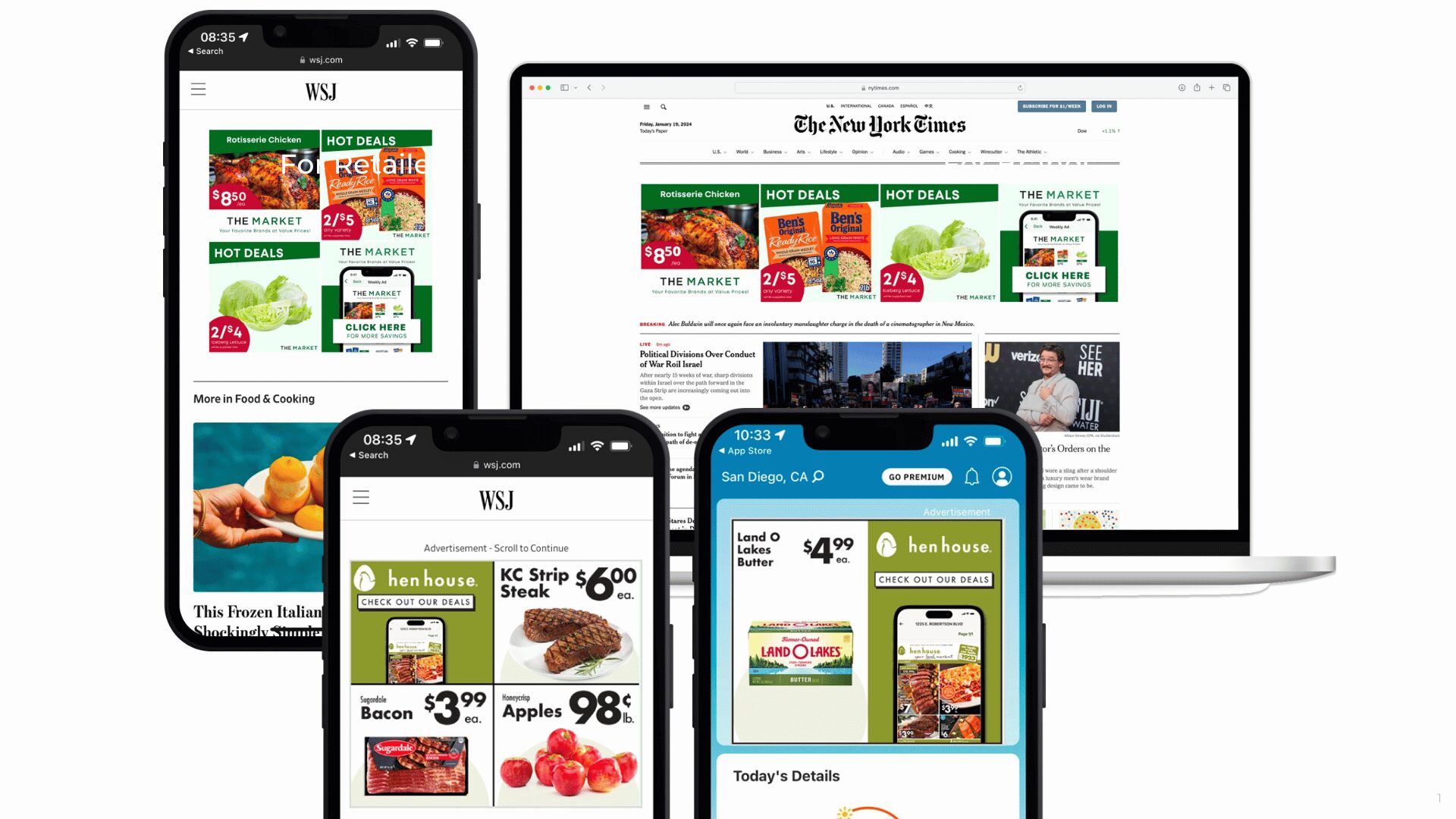

ESTABLISHING RETAIL MEDIA NETWORKS

Analysts predict that the retail media industry will grow from the $40 billion invested in 2022 to $60 billion by 2024. As of Q1 2023, 22% of all grocery visits in the U.S. went to grocery chains that operate retail media networks – and that figure is expected to grow in the foreseeable future.

Sprouts Farmers Market recently announced an online retail media platform in partnership with grocery delivery service Instacart, which launched a retail advertising product called Carrot Ads. Grocers can use Carrot Ads to monetize their owned e-commerce properties and build retail media networks without investing heavily.

The strategic partnership between Sprouts and Instacart presents an opportunity for CPG companies to target specific segments within Sprouts’ online customer base by leveraging the grocer’s first-party data. Still, most grocery shopping continues to take place in person-, so chains that leverage the massive advertising platforms created by a physical store fleet and build omnichannel retail media networks will get the most out of this emerging format, Placer.ai wrote.