On March 29, The Food Institute hosted a webinar with some of the most dynamic operators in the QSR space today. Hosted by Lazard’s managing director John Goldasich, the panel included Kim Malek, founder and CEO of Salt & Straw; Aaron Noveshen, founder and CEO of The Culinary Edge and Starbird Chicken; and Riley Lagesen, chair of Greenberg Traurig’s Global Restaurant Industry Group.

They covered many topics with prime examples of what works in the industry today and what doesn’t, including (but not limited to) labor and supply chain challenges, finding good real estate, an update on the California FAST Act and Prop 22, as well as the modern consumer and what makes their businesses and employees happy and successful.

“The national landscape is as diverse as ever and continues to evolve,” Goldasich noted.

“The pandemic turned the industry on its head. When would you see so many employees not return to work? The pandemic changed the way restaurants engaged the workforce, incentivizing them to stick around. Also, how do operators money against COVID and a political and regulatory landscape? Coupled with rising wages, interest rates, and benefits coupled with inflation and layoffs, many restaurants are still doing well all over the country. There’s a healthy amount of development and cautious optimism despite pressure and challenges.”

From there, the panelists dove into several topics; select excerpts are summarized below.

Food Institute members can see the full webinar here.

Labor

Goldasich noted that 75% of operators see labor costs increasing in 2023 amid the ongoing foodservice worker shortage, the changing workscape of recruitment and retention, and perpetual cost increases from a world teetering on recession. How have the guests responded?

Kim Malek – To say it’s been fascinating on this front is putting it lightly. [Salt & Straw] has been fortunate to be fully staffed. From a culture perspective, we’re cashing in our chips. It’s a fun job in a good environment and people like that. There’s lots of open communication – I’m missing our monthly company-wide town hall as we speak.

We’re doubling down and investing in online training systems that people can do on their phones, tiktok-style. We’re trying to stay competitive from a pay perspective. We manufacture our own ice cream and that’s been harder on the manufacturing side and the competition is unbelievable. We’ve had to get creative with scheduling, flexibility, and training a culture that people don’t see in other places. We’ve added additional languages to training programs and focused on folks in non-seeing/non-hearing environments, and we’re looking for folks for first-time employment or who are re-entering the workforce. We need a work environment that supports people; I’m excited to do that.

Aaron Noveshen – Starbird has a similar philosophy. How do you be an employer of choice? It’s a conscious effort – it’s not “if you build it, they will come.” We have to pay our managers well in the San Francisco Bay area.

We feature a bonus structure with no limited upside that we call superbonuses. If people achieve and exceed their budget, they take a share of every extra dollar they make. There’s an entrepreneurial spirit and everyone receives tips no matter their role. Sales cures all ills!

Starbird was also voted one of the best places to work in America. We always battle food costs; we rarely battle labor costs.

We also offer $5,000 per year for employees for education benefits. Not everyone will work here and we want to make an investment in their futures, not just our own bottom lines. We have great educational training and many ESL folks. We invest in language training through mobile technology.

The FAST Act

Riley Lagesen – The Fast Act was passed in September ‘22 to potentially increase the California state minimum wage to $22/hr. It’s characterized as a fast-food restaurant proposition, but if wages are raised in one segment it will move into all other segments. These are significant problems and issues for operators and employees alike; there was a motion to impose joint employer liability between franchisor and franchisees, but that was ultimately removed.

Expect to see similar legislation in other states despite Virginia striking it down. Unionizing a restaurant has to be on a location-by-location basis; it usually occurs in businesses where people want to stay and want to work long-term.

Supply Chain

Same store sales are up yet margins are down for many operators. How can operators mitigate supply chain challenges?

Malek – Dairy was up 40% this past year; it’s about halfway back and we hope to see it move to a more reasonable place. To get ahead of that, we adjusted pricing and are investing in efficiencies. We invested in our kitchen and automation to increase output. We saw margins increase, which we were really fighting for. Yes, sales kills all ills and we were living in a pretty envious position before the pandemic without minding our Ps and Qs; today, we’re managing every line item within our stores and kitchens to make sure every decision is approved and we try to find savings and efficiencies at every turn. We switched suppliers, doubled down on services, and it’s really paying off. We’ll be stronger operators. Sales are rebounding and prices are coming down.

I’m grateful for the diligence we’ve been through. On the other side, the buildout prices of our supply chain were skyrocketing and it was terrifying; we couldn’t have opened seven new stores by June at that rate. We really fought for every dollar to get out ahead. Interestingly, we got through it all and we’re standing and ready to go.

Noveshen – We increased some pricing but didn’t want to overdo it; we don’t want to lose guests. We made up a 20% increase in food costs for sales through everything else. We haven’t lowered prices; we’re promoting more tactically but we’re seeing incredible flow-through.

A new processing partner helped with growth; packaging came down in 2022, and we re-negotiated packaging contracts and got some wins there. We shifted to wings quickly – one of the first items to drop in price during football season – and we’re also known for salads, so we were able to promote items like salads with less of the more promotional items and sold them anyway.

We did a promotion on truffle sandwiches and fries, charged an extra dollar, and brought more margin dollars in that way. This buildout cost has been more problematic than food costs. I have not seen one inch of movement in the cost of construction coming down. We’re paying 50% more for a fryer than we did two, three years ago – there’s no refuge in sight on that end. We’re going line item by line item – do we need this? Do we need custom tile in the bathroom for a business that does 80% of business off-premise?

Real Estate

Noveshen – Real estate is not going down. Real estate is tough; when you’re a brand looking for quality real estate you have to hyper selective – we use analytics and try to understand our consumers. Competition drives up price so we don’t just leap at every site we like.

Malek – We’ve had a similar experience. Deals aren’t less expensive but there are more available. We have to be ready to move quickly. We look at sites and neighborhoods two and three years in advance – which block? Which side of the street? We develop relationships with landlords so we can move with them when we grow. It’s mind-boggling how long it takes to get municipality permits when we’re ready to go. It’s something important to figure out.

Growth

The restaurant business has never been easy, never for the meek or timid. Similar to what we saw coming out of the great recession, there’s a tremendous amount of innovation and development in the restaurant space. Strongly influenced by COVID, restaurants moved to different development options (virtual/ghost, delivery-centric), but now the pendulum is swinging back to what’s always worked – company-owned, high-quality brick and mortar. We’re seeing gravitation back to some level of normal, but in a very different atmosphere. Everyone has changed a little in how they view the foodservice experiment, when and where they want to eat, and how much they’ll pay for it.

In dealing with real estate, as Kim and Aaron said, it is competitive. Good real estate always is. It’s more expensive than anyone wants to pay and you hope the results justify it. As a lawyer, you want exit provisions in your leases!

Patience in real estate is so important in site selection. Make sound real estate decisions; it’s critical to your mental health, well-being, and happiness. People who pick poor sites deal with it for years. It takes so much time and resources. Making good decisions and building a good team has always worked. You have to stay ahead of the game; you have to pay attention.

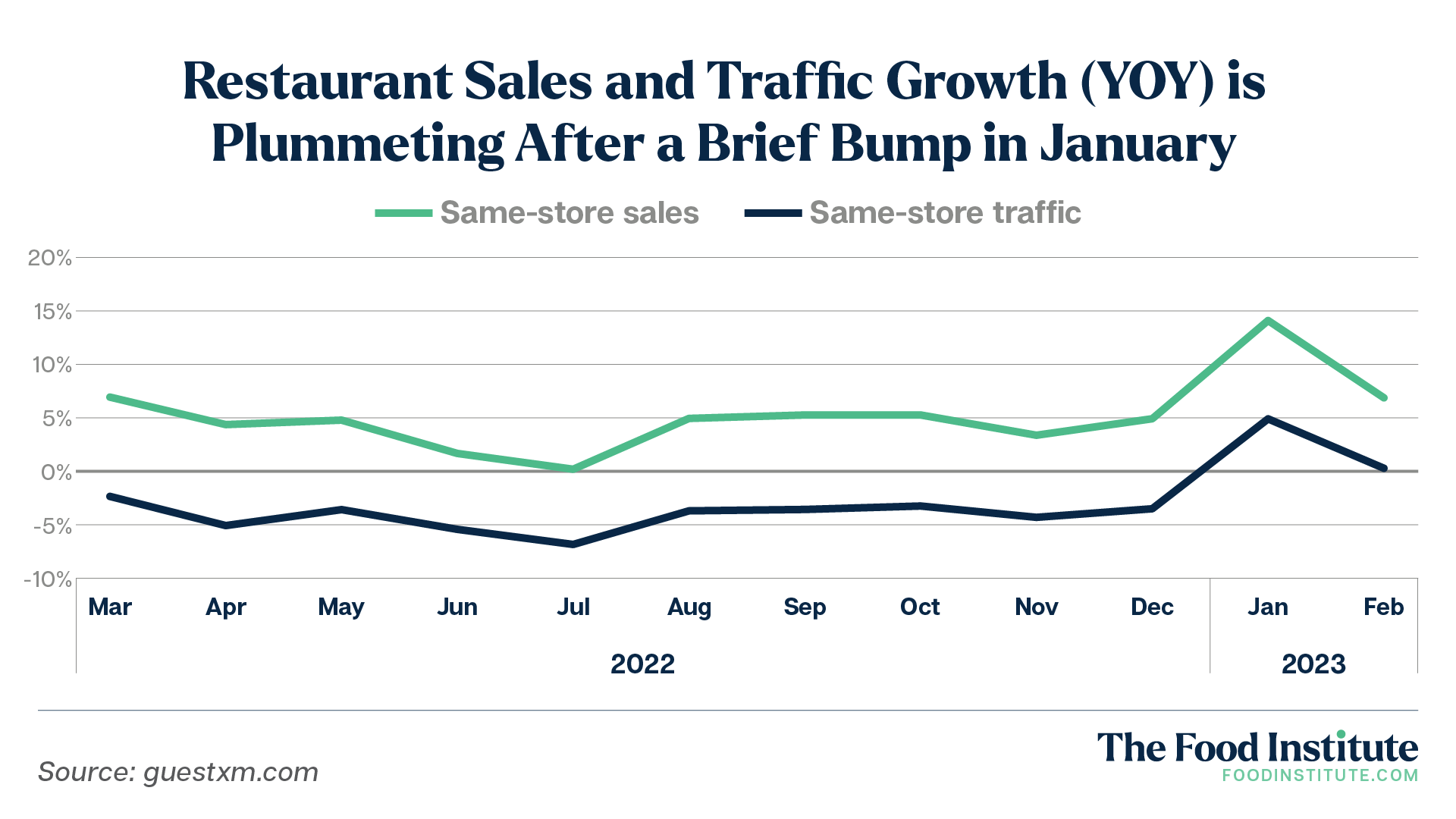

Per guestxm.com, sales and traffic growth is plummeting after a brief bump in January. Average guest checks are down as commodity and labor costs are beginning to ease. The average check grew by only 6.5% year-over-year in February – the lowest since 2021.

checks are down as commodity and labor costs are beginning to ease. The average check grew by only 6.5% year-over-year in February – the lowest since 2021.

KPIs

Malek – The whole country is challenged with labor and staffing. Let’s make sure we’re staffed. What are the team satisfaction scores? What are the customer satisfaction stores? Not only did we hit our sales target, but what could drive that? If there’s a jump in turnover, you’ll see a negative sales impact in a month. We reformatted our bonus program and focused on the work people are doing that we can control. The positive outcomes will follow.

Noveshen – We look at a lot of data. As long as it’s accurate, it’ll fly. We look at sales every day, but we look at guest counts versus average checks; where are sales coming from? What channels? Virtual brands/web apps/walk-in/kiosk? We have so many different ways to order at Starbird. We look at speed-of-service, even on an hourly basis. If something goes over 10 minutes we can identify what went wrong.

Stability among general managers is key and critical; not every GM is going to have a regional or district manager opportunity. We survey them on a quarterly basis. We look at menu mix, social scores, internal monitoring scores, chicken markets and the forecast of chicken. LTO and promotional scores we look at daily. Catering trends, loyalty trends, and controls; we look at comps and assess where our controls are going. We do 2% of transactions in cash; it’s required by law.

Automation

Malek – Automated inventory has saved hours per week. We’re working on other innovations in this space when it comes to product; the ice cream industry is famous for not having any innovation on a scoop-shop level.

Noveshen – Regarding higher food costs and unprecedented rainfall and flooding out west, it’s still TBD on many of the California crops. We promote heavily in the summertime around salads. This year we’re doing a big switch and re-launching the sandwich category; it’s the most competitive part of the chicken business. We’re trying to win the sandwich category, too; when competing against the $5 or $6 sandwich, there’s no salad that cheap. We’ve spent the last 6 months with new breads, new chicken, new saucing techniques, new packaging. We’ll launch new sandwiches – a little less produce-dependent – and the timing should be good this year with the produce market.

This webinar was sponsored by Lazard.