The steady volume of Silicon Valley unicorns in the past 15 years has buried the fact that growth operates very differently in consumer startups, especially for the manufactured consumer package goods (CPG) that fill Target, Walmart, and your local supermarket. In the last seven years, over four billion dollars of venture capital have surged into early-stage consumer startups, especially into beauty, food, and beverage brands like Flow water, Beyond Meat, Impossible, Bright Farms, among dozens of others.[1] Most of these highly funded consumer ventures began with a level of impatience to scale common to tech startups.

In CPG startups, though, research has shown that exponential growth from a small base of fans is the dominant path to both scale and long-term growth. How a consumer brand forms in the early years matters if it wants to become the next KIND, Chobani or Body Armor. CPG unicorns, though impressively designed in most cases (e.g., Halo Top and Caulipower) tend to overshoot the $100M mark and then collapse backward even to as little as $50M in trailing revenue.

Why?

What did Kind, Chobani, Bark Thins, Body Armor, Vita Coco, SkinnyPop, and dozens of other brands do better than 98% of other early-stage consumer brands, especially their bold unicorn peers?

To understand exponential growth and manage it properly, we first need to understand paths to scale for new CPG brands more generally.

Paths to Scale for CPG Startups

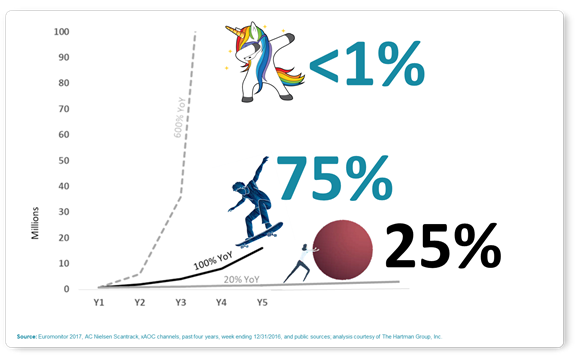

1. The Unicorn Path – Hits $100M in trailing annual sales in 2-3 years

CPG unicorns are slightly slower than the most successful line extensions from public CPG firms, which get to scale in 9-12 months through paid slotting, drafting on iconic brand awareness, and extensive consumer/trade advertising. Because many of the CPG unicorns I‘ve reviewed, like Halo Top, actually launched years earlier and floundered before they hitched a unicorn ride, CPG unicorn growth often looks like the classic Hockey Stick curve, popularized by Bobby Martin and…every venture capitalist out there.

In CPG, this kind of growth for a new brand only occurs once every couple of years and represents less than 1% of launches in any given year, far less than 1% in my experience.

2. The Slow Ramp – low double-digit growth until $100M

Most early-stage CPG brands that get past $500,000 in annual sales grew geometrically in the single or low-double digits. Some of these slow growers end up stagnating as permanent niche businesses before they hit scale. Some ride a roller coaster of ups and downs to get there. Roughly 25% of brands that grow to $100M or beyond take this low-angle geometric path to scale (e.g., Pirate’s Booty). Some slow growers do get acquired by strategics, such as Hormel’s acquisition of Applegate Farms. But, with the market getting ever more competitive, this slow ramp path may get much less common, except for specific technically insulated categories. In the current era, if the innovation has a bridge to at least 5-10% of U.S. households, despite its premium price, someone is likely to come along, copy the innovation, and grow the idea faster.

The question readers may now have is: why doesn’t hitching a unicorn ride lead to lasting growth for consumer brands, since this is the obvious way to beat competitors to scale? I’ll come back to this later, but first we need to understand the final and most common path to scale for CPG brands.

3. The Skate Ramp – exponential growth after $1M up to and beyond $100M

What I call the Skate Ramp is just a modern term for an exponential growth curve, which does look eerily like a quarter-pipe ramp. Astute business strategists will note that the front half of the Sigmoid curve is not really a hockey stick. At all. That’s because the S-curve is pure exponential growth. It feeds on a constant rate of change in annual or monthly growth known in retail CPG as velocity growth at same stores. Most consumer brands that ride the Skate Ramp grow their retail velocities by 50-100% annually from a very low initial base velocity. In the DTC world, this translates to increasing ARPU at the cohort level.

The strategic value of exponential growth in a fast-paced industry ever more subject to fashion-like trends and flush with venture capital is simple: being ignored until it’s too late for anyone to match your scale. When founders couple this approach to scaling a brand with technical insulation through a unique manufacturing process or supply chain (or even temporarily unique), you have the secret behind some of the more famous Skate Ramp brands like Chobani, Bark thins, and KIND bar.

So, what are the management rules behind exponential growth in consumer brands? How can investors spot these brands earlier? And how can entrepreneurs make sure they’re managing a consumer startup for this best-in-class path to scale? My research discussed in a recent book has isolated three behavioral patterns underneath exponential growth.

Repeat-purchase Driven Velocities

Velocity growth for a retail consumer brand has two key sources: 1) additional consumers (in local markets or inside the home itself), and 2) increased consumption by existing consumers (on the same occasion or by adding relevant consumption occasions in their lives). DTC has its equivalent jargon, but the behavioral sources in the real world are identical.

Most CPG startups have three significant barriers to uptake: 1) limited awareness in an ocean of generally well-trusted brands, 2) a limited initial audience tempted by a modern replacement for good enough brands in the category, and 3) most have to go to market at unit premiums of 100-200% above category average because the cost of innovative formulations for small runs is much higher than a public firm would pay for a big launch.

These barriers to uptake create a strong financial incentive for entrepreneurs to find just the right consumers, the ones most predisposed to become heavy users in local geographies. Doing this well vastly reduces the costs to distribute and service demand, including via DTC delivery. Fans, in other words, are essential in consumer startups for top-line and bottom-line reasons.

Yet, the faster a CPG brand grows (i.e., like a unicorn), the less time there is to understand how much of its sales are initial trial vs. repeat purchases and whether the brand is generating highly lucrative heavy usage. The latter matters because repeat purchase is the CPG equivalent of ARPU. Without moderate-to-heavy users in large numbers early on, you have to attract more and more consumers to continue growing quickly, and, very soon, you will run out of them. Why? Because only 10% of consumers are open to paying a price premium for a brand in any given category.[2] If you use capital to ramp up trial only, the decline could be massively swift if the levels of repeat are poor.

Pacing One’s Way to Scale

Entrepreneurs need to manage growth that is slow enough to measure the quality of repeat purchase patterns: whether the behavior behind the brand is indeed scalable (via word-of-mouth or paid promotion). This leads to the second principle behind exponential growth. Founders have to slow the pace to scale without slowing the pace of growth. If that sounds oxymoronic, it is not. It’s just the business world tends to conflate the two variables because it assumes that startups hit an enormous revenue base immediately, which is rarely true for consumer brands.

Exponential growth delays the broad market impact of the business until the back half of the curve, surprising many stakeholders, including brand owners themselves, as revenue mounts and mounts after years of minimal progress (towards scale).

In a world where tech unicorns make many believe the pace to scale can be artificially accelerated, exponentially growing consumer brands belie this illusion again and again by triggering heavy usage inside tiny household population niches. Exponential growth brands do far better in sustaining growth after crossing the $100M mark than those that scale too quickly on weak trial and push techniques commonly deployed by public CPG firms.

Exponential growth gives a new consumer brand enough calendar time to iterate and fine-tune its offering, which often needs to change to market conditions the team didn’t originally anticipate. It also gives the brand time to become embedded in urban social networks.

All this leads me to the third principle underneath exponential growth for consumer brands.

Using Design and Thoughtful Social Placement to Attract Heavy-Using Fans

There is a social science formula to generating heavy-using fans for new consumer brands. The brand’s products must make a critical social claim in urban social networks: our innovation is THE most modern way to achieve X outcome on Y high-stakes social occasion.

The foundation for a new consumer startup to pull off such a bold social claim is to take a mass-market consumer outcome of broad interest like hydration, weight management, energy, and essential nutrition and then deploy a new attribute or set of attributes that is gaining currency among educated urban elites. One of the most potent modern attributes commanding a premium price in food and beverage is low sugar grams per serving in formerly high sugar categories.

With a well-timed, well-designed innovation in hand, the brand needs to insert itself through sampling and awareness-building into the right social niches and social occasions. As early as Red Bull, modern consumer brands have pioneered the art of appearing initially in strategic social locations where early consumers perceive the brand’s outcome quickly (e.g., long-lasting energy to party all night) in real-time. These field marketing techniques have been critical for brands building new categories (e.g., energy drinks) where the reason to try them out is not clear upfront because existing brands are good enough. Brands doing this kind of social insertion focus on social moments where viral word-of-mouth trial will occur instantly within existing social networks that enter the space, be it a nightclub or a mountain trailhead.

Very few Skate Ramp brands grew exponentially off the original product and placement alone, like Chobani and SkinnyPop. Most have used their slow pace to scale to learn which social worlds within which to repeatedly and persistently embed the brand. They can even fine-tune their product lines around specific audiences and ignore others strategically. This iterative dialogue with consumers is something KIND bar perfected early on with its recruitment of yoga studio owners and teachers as brand advocates/samplers. It turns out that yoga fans from the 2000s were particularly attuned to the upscale message of real nutrition in bar form without all the processing and sugar of mainstream bars. There was also an implicit outcome of weight management built into the KIND brand that these early consumers valued because it also drove, in part, their routine practice of yoga.

In sum, neither the fire-hose launch model of public firms nor the slightly slower unicorn path favored by investors allow CPG founders the ability to manage risk appropriately, iterate in the market and build a brand that grows for years and years. And the much slower geometric growth path tends to open CPG innovators up to well-funded copycats in the current market. Exponential growth based on heavy-using (i.e., high ARPU) fans, however, allows financially efficient, even profitable, startups to scale into the next KIND bar.

About the Author

Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage consumer packaged goods brands. As a professionally trained cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, including brands owned by Coca-Cola Venturing and Emerging Brands, The Hershey Company, General Mills, and Frito-Lay, as well as other emerging brands such as Once Upon a Farm, Dr. Squatch Soap, Proven skincare, Rebel creamery, and June Shine kombucha.

James is the author of “Ramping Your Brand: How to Ride the Killer CPG Growth Curve,” a #1 Best-seller in Business Consulting on Amazon.

[1] Source: Nutrition Capital Network via Whipstitch Capital’s 2021 Healthy Nutrition Annual Update; analysis by Premium Growth Solutions

[2] Based on random sample of grocery categories polled nationally and discussed in Ramping Your Brand