When it comes to consumers, the alt-meat category has more than its fair share of challenges — and supporters. Who’s buying meat alternatives today and why? Here are the latest stats from Brightfield Group’s quarterly shopper survey.

Numbers of Note

In terms of dietary association, 13% of respondents who bought meat alternatives in the first half of 2023 followed a plant-based diet; 12.4% were vegetarians, and 6.9% were vegans.

Upper-income households accounted for most cross-generational alt-meat purchases, with Gen X (45.3%) and baby boomers (38.2%) tipping the scales. Middle-income shoppers led by a slight margin among millennials, while Gen Z’s majority (41.4%) fell in the lowest income bracket.

Traditional grocery stores were the primary purchase channel for baby boomers (57.9%) and Gen X (46.9%). Comparatively, millennials opted for mass merchandisers first (38.1%), and their buying patterns over-indexed at dollar stores. Gen Z made more plant-based meat purchases at natural food stores (35.9%) and over-indexed at pharmacies.

When it comes to brand recognition, Beyond Meat was the most familiar name in alt-meat, with 51.3% of consumers referencing the company in a fill-in-the-blank survey. Impossible Foods (33.7%), MorningStar Farms (28.3%), Gardein (12.7%), and Boca Burger (8.5%) rounded out the top five.

Why Do They Buy?

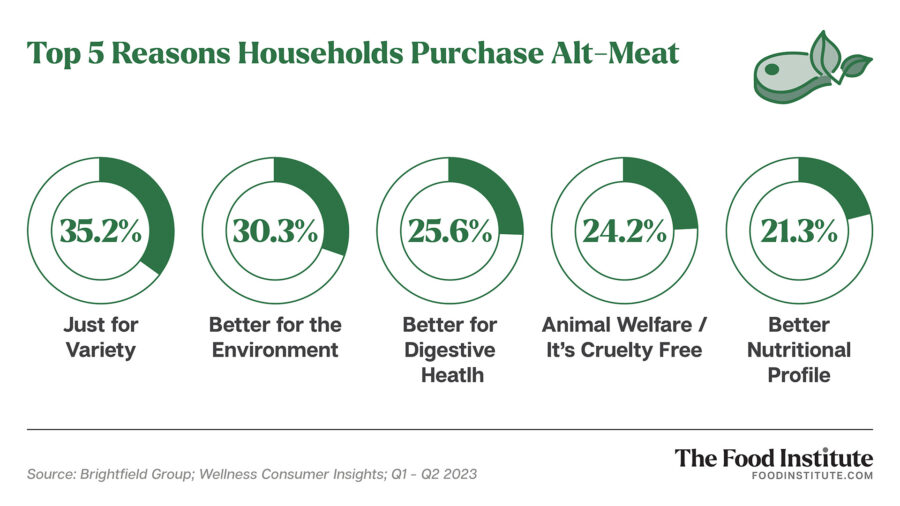

Across all generations, variety was the standout motivation for purchase. A similar trend was observed among alternative dairy consumers. This consensus highlights a notable evolution of purchase drivers as initial industry momentum largely revolved around perceived health and environmental benefits of plant-based versus traditional meat.

“Consumers are choosing plant-based or alt-meat for several reasons including perceived health benefits, environmental mindfulness, and variety of flavor profile,” Andy Keenan, EVP and GM at Advantage Solutions told The Food Institute. “As today’s consumers are more health conscious and ingredient aware, they have learnt over time that most plant-based meat products are processed – and in some cases more processed – than animal meat.”

On the lower side of the scale, only 7.2% of respondents claimed they “never liked meat,” with Gen Z (13.1%) and millennials (8.9%) both over-indexing on this response.

“While still a small part of the consumer landscape, flexitarianism promotes the inclusion of plant-based foods as part of a diet that also includes the consumption of red meat,” said Keenan. “However limited, this is also contributing to a variety of consumer choice.”

Flexitarian Takeaways

Variety was also king when consumers were asked why they buy alt-meat in addition to traditional meat, but only 1.3% of respondents claimed they do so to help the environment.

Reducing meat consumption (3.1%) and trying to switch to plant-based only (1.3%) were also among the lowest-ranking purchase motivators.

As Keenan notes, manufacturers should consider strategic in-store merchandising strategies as they strive to bring new shoppers to the alt-meat category.

“One way to drive new consumer trial – and consumer volume – is to work with retailers and consider placing plant-based items into the mainstream product sets within a store [as opposed to] a natural or plant-based section,” he concluded.