Alternative, or dairy free, milk is a key growth driver for the plant-based industry, so what keeps shoppers coming back for more? Here’s the latest consumer pulse from Brightfield Group’s Q3 2023 survey.

Numbers of Note

In the past six months, 60.3% of females purchased milk alternatives compared to 39.3% of males. Females also lead consumption — 73.8% of respondents indicated that they buy these products for themselves rather than for a spouse or partner.

When it comes to brand recognition, Silk is the most familiar name in alt-milk with a hefty 68.6% of consumers referencing it by name in a fill-in-the-blank survey prompt. Oatly (14.3%), Califia Farms (7.9%), Blue Diamond (6.1%), and Planet Oat (5.5%) round out the top five.

Leading Motivations for Purchase

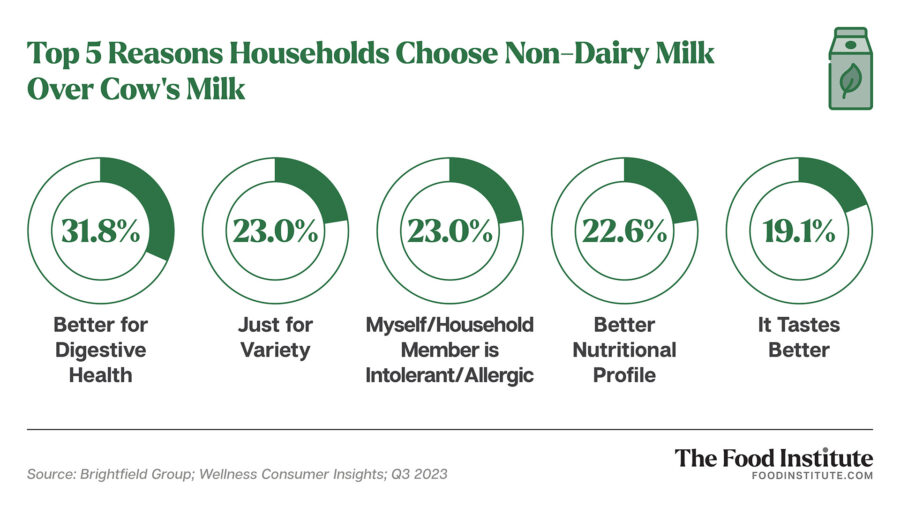

Across the board, digestive health is the primary reason that consumers incorporate milk alternatives into their diet, with Gen X and Baby Boomers being the strongest drivers behind this sentiment.

Both Gen X and Gen Z are most likely to have lactose intolerance concerns, while Millennials predominantly seek variety. Different use cases and specific recipe needs also boost interest in having multiple dairy products on hand — including traditional cow’s milk.

“Overall, we find that there’s a significant overlap between plant-based dairy and regular dairy purchasing, which contextualizes the large proportion of plant-based milk purchasers choosing the product for variety, nutritional profile, and taste,” Julie Murphy, Consumer Insights Manager at Brightfield Group, told The Food Institute.

Dietary Insights

What’s not a significant motivation for purchase? Identifying as vegan or plant-based. Only 4.8% of total respondents made this claim, placing it lowest on the scale. By generation, 7.2% of Millennials took this position, followed by Gen Z (6.3%), Baby Boomers (4.3%) and Gen X (2.7%).

Similarly, 44.5% of alt-milk consumers do not conform to a specific diet. Low sugar led the dietary practices (27.2%), followed by low carb (21.0%), high protein (16.6%), and intermittent fasting (16.1%).

“Many people nowadays have minor stomach issues that are causing them to reevaluate their eating habits but not necessarily follow a specific diet,” said Murphy. “It makes sense why we’d even see ‘for other medical reasons’ (9.1%) being a bigger driver than being plant-based.”