Everything looks good, right? Interest rates are bound to come down. Unemployment is low. Food inflation is slowly but surely diminishing despite geopolitical unrest and ongoing piracy problems in the Red Sea.

They don’t care because groceries, medicine, and other bare essentials are still crimping budgets. After 2023 (“the year of private label”), brand loyalty is non-existent and retailers are scrambling to figure out self-checkout, deliver on delivery, and offer more robust and engaging loyalty programs throughout the omnichannel.

According to the 2024 Consumer Outlook Survey from Advantage Solutions, “the surge [of inflation] of the past two years has left a lingering anxiety in the minds – and spending habits – of American consumers.”

“From a grocery perspective, there’s a considerable imperative to keep shelves stocked with sale items since shoppers are no longer dedicated to just one retailer,” said Jill Blanchard, president, enterprise client solutions at Advantage Solutions, citing the fact that 27% of consumers remain committed to their retailer of choice.

For the rest, it’s the wild west. Do what you can to survive.

The Good, The Bad, and the Consumer

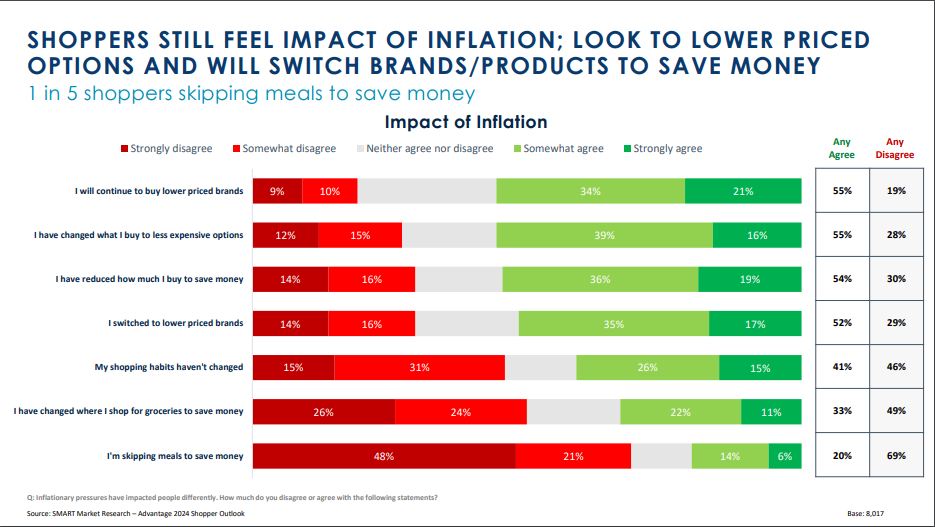

The survey ran from Oct. 31 – Dec. 5 and assessed the retail foodscape with over 8,000 consumers. One of the largest takeaways is that even as prices fell and the future looked brighter at the end of the year, over half (59%) of respondents said their shopping habits had changed; more than half (54%) had reduced the net volume of groceries purchased, and as many as 33% had changed where they shop to save money.

Twenty percent said they’ve skipped meals to save money.

“It’s tough out there for consumers,” Blanchard said in the report.

“Their assessment of their ability to afford everyday essentials has hit a new low – it was close to 60% in 2019, now it’s 40%. And debt is now costing people more to pay off – credit cards, personal loans, auto loans – which exacerbates these daily concerns.”

The market, however, ebbs and flows like the tides – what was hot is now not (plant-based offerings, for many), and what was struggling is now thriving (private-label cereals). When will the pendulum of consumer preference swing back in name brands’ favor? For many consumers, it may remain simply a matter of time.

“Twenty-seven percent of consumers will stick with the new brand when they can’t find the one they want,” Blanchard told The Food Institute. “We can apply this concept to private label and expect a similar percentage of loyalty, but that also means that 73% may switch back – and national brands need to be ready for this by marketing the quality of their brands.”

But it may not be up to the brands alone. It may depend upon a grocer or retailer’s entire suite of offerings to lure once-loyal consumers back on a regular basis. The shift may depend less on brand price and quality and more on the holistic effect of entering a Target, say, or the revamped aesthetic and layout of the nation’s many Walmart stores.

“It’s the fiercest battle for trips that we have ever seen, and everything is on the table,” Blanchard pointed out. “We are seeing stores within a store, a huge emphasis on isolated beauty sections in major retailers, EV charging stations, niche products to differentiate from other retailers, and more.”

For many grocers and retailers, wild-card options such as these may be the answer to capture one more family (or even one more consumer) in the short term until economic circumstances change again.

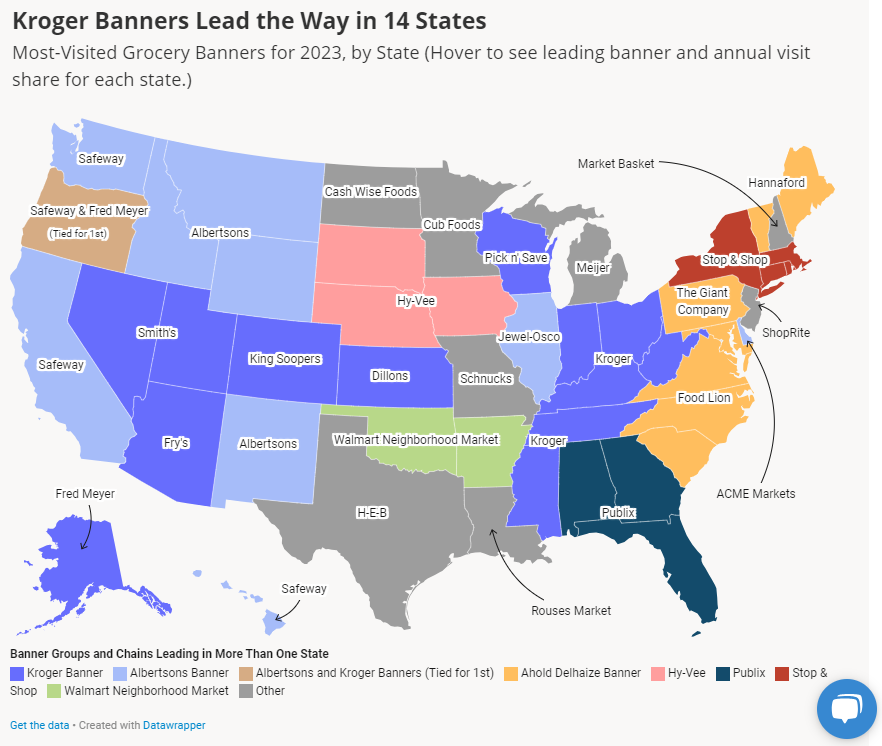

For 2023, however, one grocer ruled as Fastest (or at least Favorite) in the West.

Heavy Lies the Krown

Who did consumers look to in 2023 to keep their pantries stocked and their grocery value secure?

Kroger did, according to recent data from Placer.ai – in terms of sheer visit numbers, Kroger “captured almost 19% of annual foot traffic to the nation’s ten most-frequented grocery chains.”

For Blanchard, data like this further confirms the overall trends in grocery and retail she sees in the greater market.

“The battle to capture the trip can be fought on multiple grounds. The one-stop shop is a big one; consumers want both value and indulgence. For example, a consumer may be paring down from steak to pasta and at the same time seek an affordable indulgence like an upscale body cream or sweet treat. The retailer that offers both ends of the spectrum in the same shopping trip can capture both trips in one.”

Differentiation can also offer a competitive edge. Blanchard said that when a retailer carries a specific product that others don’t have, consumers are more compelled to make the trip, get their coveted items, and then further expand the basket while shopping in-store.

More insights from the Outlook Survey include:

- 33% of shoppers changed where they shop to save money.

- 52% of shoppers have switched to lower-priced brands and 55% of those will continue to buy those lower priced brands moving forward.

- 53% of shoppers choose a retailer based on sales & promotions.

- 55% of shoppers are buying less expensive options to stay on budget.

- 63% of shoppers choose primary retailers based on everyday low prices.

As the year unfolds, will interest rates diminish, inflation continue to abate, and consumers increase their weekly grocery spend? Will foot traffic increase? Or will the (relative) chill of winter keep shoppers in the comfort of their homes, relying on delivery and pick-up to ease their grocery burdens? As retailers tooth and claw for every disposable cent, retailers and grocers must also be prepared to adjust to competitors’ technological innovation – will new products like the Apple Vision Pro upend the omnichannel experience? Will drones continue to proliferate outside of Texas?

Like the wild west, nimble competitors will keep their eyes up, their inventory loaded, and their shelves stocked. A retail windfall may be coming.