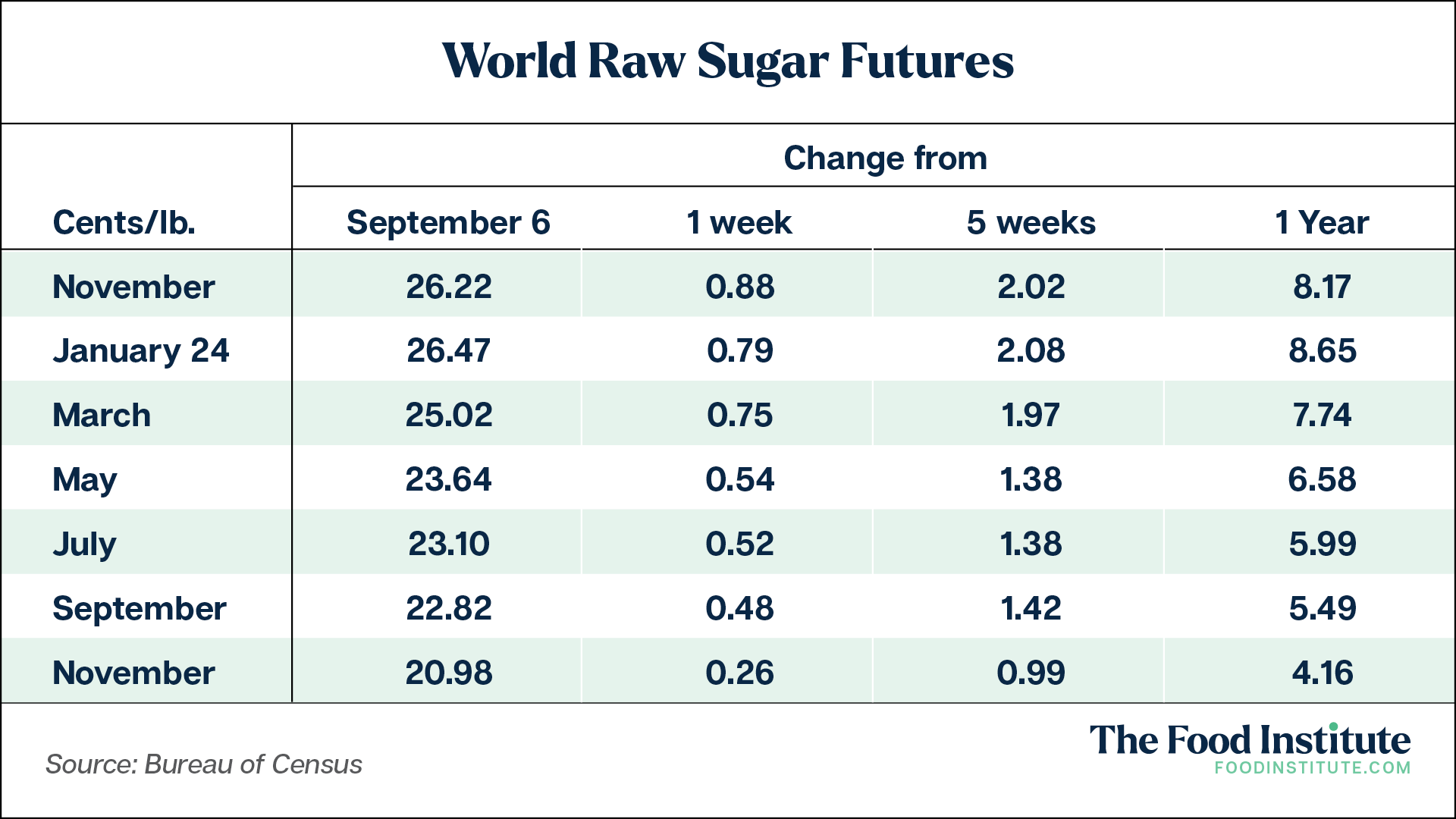

Global sugar prices are up, and sugar production isn’t looking so sweet as we move into a new crop year starting Oct. 1.

Global sugar production for the 2022-2023 crop year was estimated at 177.3 million metric tons raw value (MTRV), and current forecasts project a 1.2% decline for the 2023-2024 crop year. The new crop could drop to 174.9 MTRV due to shortfalls connected to El Niño-influenced dry weather.

That’s according to David Branch, a sector manager with the Wells Fargo Agri-Food Institute, who noted that the primary shortfalls were coming from India and Thailand.

El Niño Impacting Asian Sugar Production

In 2023, El Niño degraded growing conditions for the sugar industries in Thailand and India and will continue to affect the global market.

India’s top sugar-producing state, Maharashtra, was estimated to see production fall 14% in the 2023-2024 crop year—its lowest point in four years—due to lower can yields amid the driest August in a century, reported Reuters (Sept. 13).

The state accounts for more than one-third of India’s sugar output. The West Indian Sugar Mills Association predicted the state would produce 9 million metrics tons in the 2023-2024 season, which would begin Oct. 1.

It remains to be seen, but prior reports from Reuters revealed that at least three government sources believed New Delhi would ban mills from exporting sugar in the new crop year, which would be the first halting of shipments in seven years.

Meanwhile, Thailand’s sugar output could drop by 18% to 9 million tons in the coming crop year due to severe drought, according to the Thai Sugar Millers Corp., reported Bloomberg (Sept. 7).

Thailand is the world’s second-largest exporter, so a drop in production will likely fuel higher prices despite them already reaching an 11-year high.

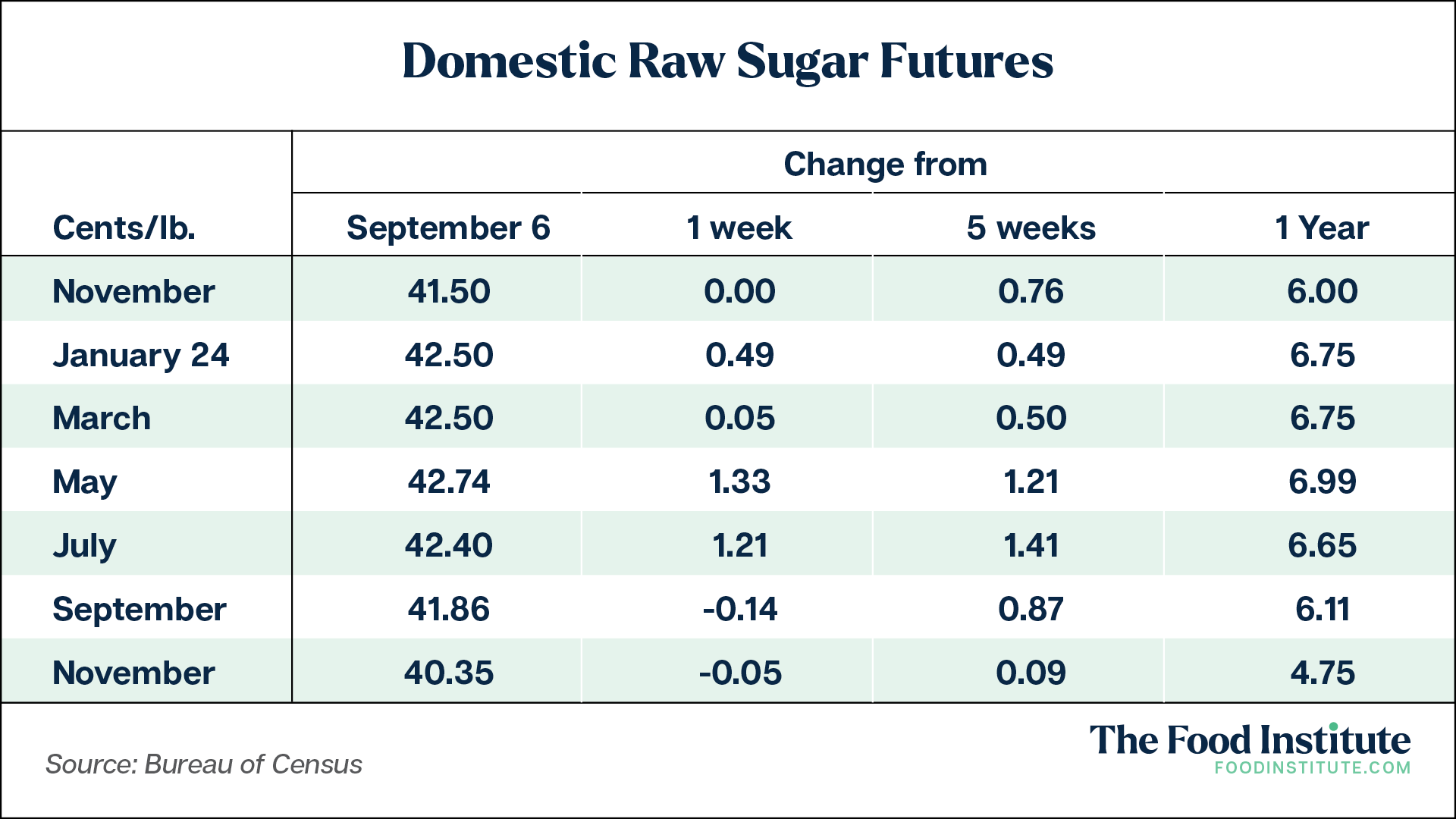

Domestic Sugar Production Appears on Track

When it comes to domestic sugar market, many would be surprised to see how highly subsidized the sector is, according to Branch. The U.S. and most foreign governments subsidize the sector.

“As a result, the U.S. sugar industry is highly regulated under provisions of the current 2018 U.S. Farm Bill (renewed by congress every 5 years), which provides for domestic marketing allotments and tariff rate quotas that determine the amount of sugar available to the U.S.,” he said.

“As a result, ‘world prices’ are heavily distorted by the fact that sugar is one of the most highly subsidized industries in the world,” he added.

Branch said about 45% of domestic sugar production was sourced from sugar cane, while 55% came from sugar beets. In general, the U.S. averaged about 9 million short tons, raw value (STRV) annually.

Sugar beets are grown in five regions across 11 northern states, as the long and cold winters typically aid in the storage of beets harvested starting in October.

“While sugar beet producers have had their weather issues the past few crop years which negatively impacted production, so far reports are that harvesting is on schedule, yields are at or above average, and sucrose levels in the beets are higher than the past few years which should provide for better recovery levels,” said Branch in an e-mail to The Food Institute.

Meanwhile, sugar cane requires tropical and subtropical climates. The U.S. produces sugar from cane in Florida, Louisiana, and Texas.

“Weather issues for this year are having a negative impact on Louisiana, as current drought conditions have lowered estimated production for this crop by 371,403 STRV to 1.68 mm STRV,” added Branch.

Can Brazil Make Up for Sugar Production Gap?

Branch noted that Unica projections showed Brazil’s sugar production could reach a record high of 42.7 MTRV in the 2023-2024 crop year, representing a 15% increase from the prior year.

Unica also reported that Brazil’s sugar exports could account for about 50% of the global sugar trade this year as domestic mills focus cane for sugar production at the expense of ethanol production.

Branch said the current market situation would take a few years to settle due to several factors, including potential export bans from India and Thailand.

Additionally, he highlighted the fact that Brazil had not made significant investments in mill infrastructure since the 2009-2010 season.

“Thus, annual production has been relatively flat and driven primarily by weather patterns. Annual sugar exports are determined primarily based on price of sugar vs. ethanol, with the sugar that exceeds domestic consumption utilized for whatever product can bring the highest price,” he said.

The Food Institute Podcast

Food waste is already a global problem, and it could morph into an even larger issue as the world’s population grows. Flashfood founder and CEO Josh Domingues highlights how important collaboration is to fighting food waste, and how Flashfood aims to divert food from landfills.