Global seafood demand per capita is expected to grow through 2050 according to a new Seafood Forecast report from Norwegian risk management firm Det Norske Veritas (DNV). The firm expects annual seafood production to reach 160 million metric tons by the midpoint of the century.

“We forecast an increase in overall marine seafood production of about 20% to 2050,” said Bente Pretlove, Program Director of Ocean Space at DNV Group, in the report. “While capture fisheries output is stagnant, marine aquaculture will double and finfish production almost triple in this period.”

Seafood’s Role in Global Food Demand

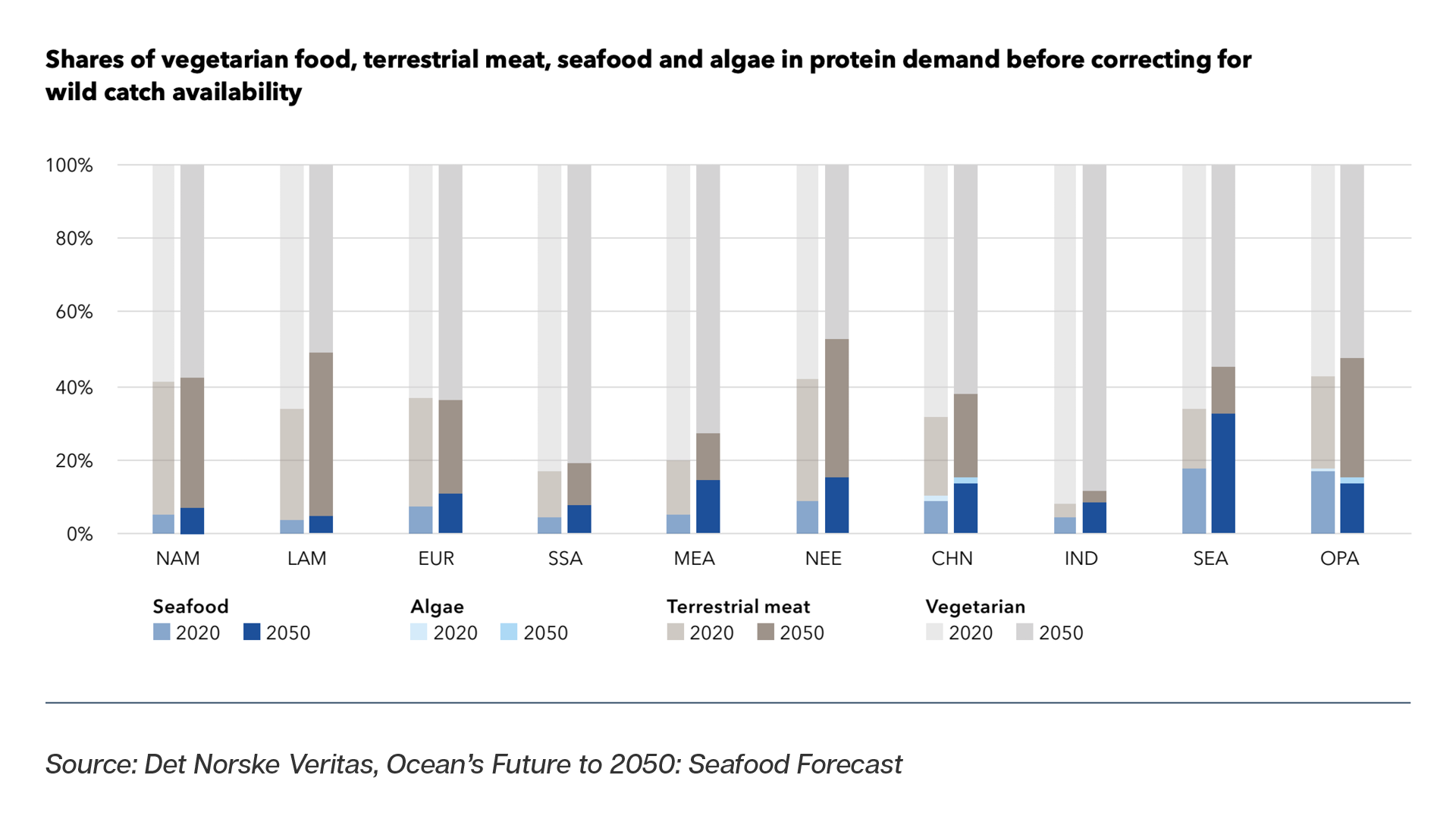

Across the globe, all regions except Latin America and OECD Pacific are predicted to see per-capita seafood demand increase more than the consumption of terrestrial meat and vegetarian foods, such as plants, eggs, and milk. However, this change in consumption patterns will not constitute a large-scale dietary shift towards seafood.

With an estimated 2050 population of just below 1.5 billion, Greater China could be the biggest marine seafood market in absolute numbers.

Furthermore, seaweed production is slated to grow rapidly in Europe and North America. This growth will primarily be driven by demand for industrial and food additives, whereas consumption as direct food will be low.

Marine Aquaculture Outlook

While marine aquaculture production is expected to double by 2050, the forecast for capture fisheries output could remain stagnant, leading to the 20% increase in global production of marine seafood.

Finfish should remain the most preferred seafood item and overtake mollusks as the leading farmed species type in terms of live weight. The demand for finfish is expected to grow to account for about 70% of the total market for marine seafood.

By 2050, marine finfish production is predicted to expand from sheltered waters to onshore and offshore facilities and reach a global share of 12% and 7%, respectively.

“Scaling up land-based food production to meet global food demand is facing significant challenges,” said Pretlove. “A future shift in demand towards a more seafood-based diet could relieve some of this pressure, but this is a slow-moving process influenced by affordability, food culture, and other consumer preferences.”

“Given a sufficient change in demand, expanding marine aquaculture represents a significant worldwide opportunity in the Blue Economy.”

Change Drivers: Seafood Trade Patterns

Globally, Europe and Latin America are expected to become the leading exporter regions by 2050, accounting for 19% and 18%, respectively. Sub-Saharan Africa, with its declining regional captures and fast-growing population, could face the greatest seafood production deficit and therefore become the biggest importer.

North America’s efforts to upscale offshore and onshore farming of marine finfish are not expected to offset the region’s reliance on seafood imports.

Overall, DNV predicts that supply-demand imbalances will drive a 50% increase in interregional trade by 2050, keeping seafood among the world’s most traded foods.

This is considerably more than the projected 20% increase in global seafood production, which implies that regions will become more dependent on imports.

Diversification of Aquaculture Feed

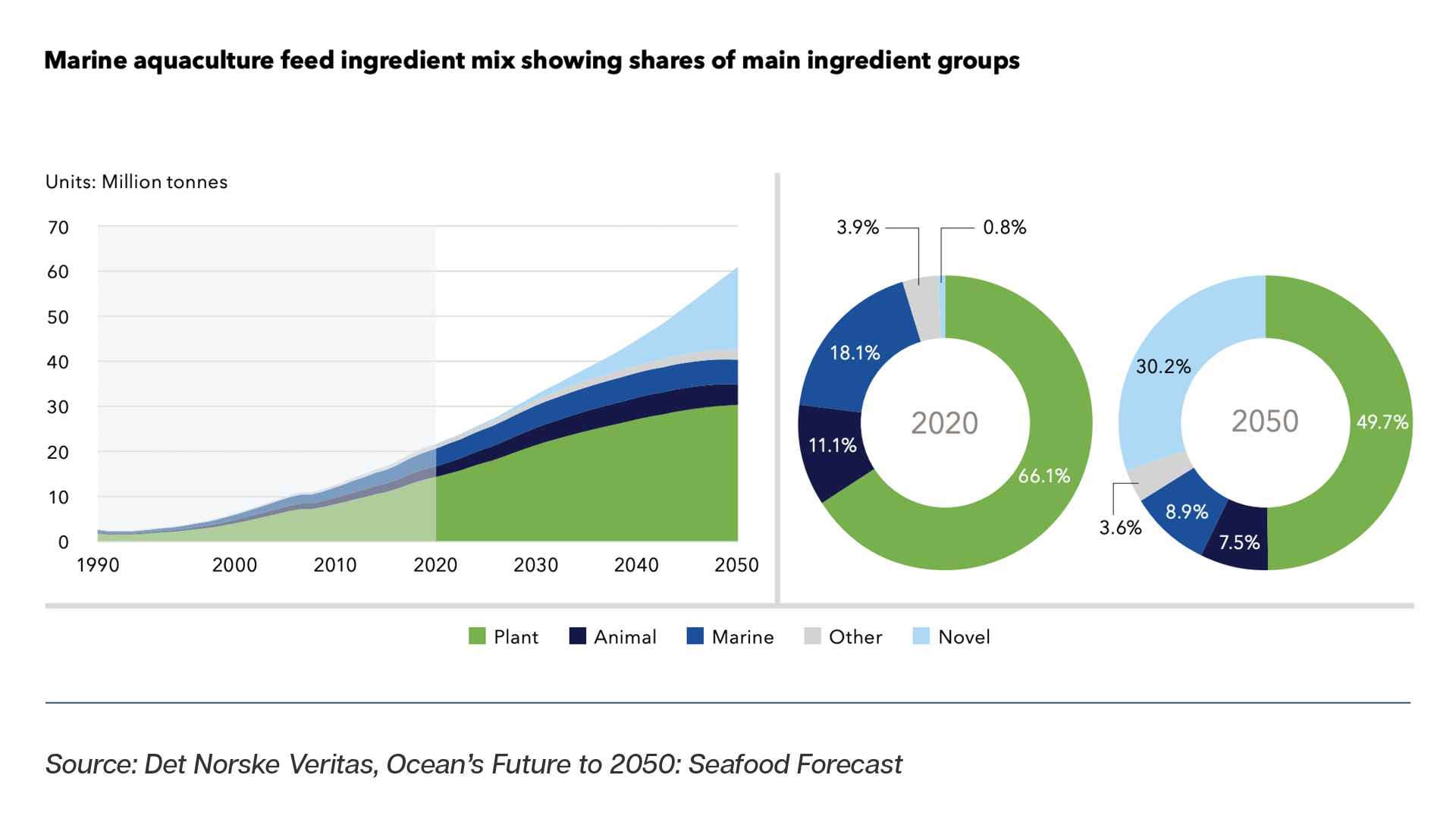

Aquaculture feed supplies are expected to diversify further in the years ahead, reducing the dependence on marine and agriculture-based ingredients.

“Marine aquaculture must maintain an intense focus on fish health and welfare, technological innovation, and sustainability measures to meet future growth,” said Pretlove. “One key priority will be to meet the demand for feed ingredients by decoupling it from sources of food for human consumption.”

Plants are expected to remain the largest source of ingredients by volume in 2050, while combined share of fish meal and fish oil could decrease. Inclusion of novel ingredients such as single-cell proteins, insect meal, and algal oil present significant growth potential.

“We forecast that feed supplies will improve on sustainability by transitioning to novel ingredients,” Pretlove added. “These developments are crucial for the long-term sustainability of fed aquaculture in our seafood mix.”

The Food Institute Podcast

It’s been a rough four years for the modern grocery consumer – first, the pandemic shifted many consumer habits and subsequent inflation challenged their budgets. Alex Trott, director of insights with 84.51°, helps break down current pain points and opportunities that consumers are facing, including increased anxiety, stretched finances, and a need for omnichannel solutions.