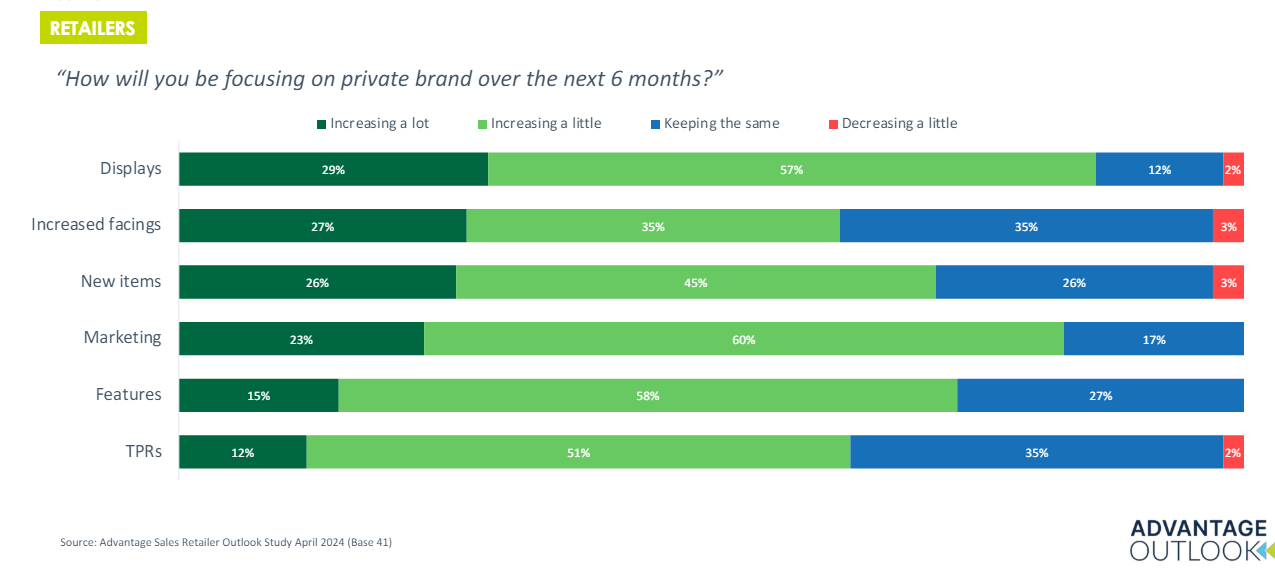

In recent weeks, multiple retailers such as Target, Aldi, Amazon Fresh, and Walgreens have announced significant price discounts to attract cost-conscious shoppers back to their stores. Reflecting this trend, Advantage Solutions’ latest iteration of its quarterly Outlook report found that retailers are focusing on private label strategies over the next six months to address ongoing financial strains by investing in promotional pricing (52%), increasing displays (57%), enhancing marketing (60%), and adding new features (58%).

For many major retailers, the latest quarterly results tell a familiar tale: consumers are fed up with high prices, spending less, and commodifying their loyalty by taking the best deal right now, regardless of whose logo adorns their grocery bag or shopping cart.

Bloomberg reported that the U.S. GDP growth was slower last quarter from reduced consumer spending as the economy expanded at 1.3% pace versus the estimate of 1.6%; these numbers reflect a loss of momentum to start 2024 after several pleasant surprises in 2023 as high interest rates, waning savings, and slower income growth are hampering consumers and businesses. Meanwhile, the Federal Reserve remains tight-lipped about whether or not it will cut interest rates in September as consumer spending increased just 0.2% after a downwardly revised 0.7% rise in March.

Same-store numbers from several notable retail outlets are below:

- Dollar General:+2.4% with visits up 12.6%

- Walmart: +3.8%, noting “upper-income households” helped drive growth

- Costco: +6.5%, with visits up 8.9%

- Target: -3.7%, the fourth straight quarter of sales declines

Shortly after its poor earnings revelation, Target took aim at summer spenders by announcing it would lower everyday prices on approximately 5,000 frequently shopped items, including milk, meat, fresh fruit, coffee, diapers, pet food, and more, including many items from its Good & Gather private-label brand.

Not to be outdone, Walmart announced a competing private-label brand – BetterGoods – throwing down the gauntlet with even a similar name to one of its primary rivals. Perhaps unsurprisingly, private-label products continue to compel consumers as store-brand goods are taking more and more market share away from national brands, which comprise about 78% of overall foodbev sales. Millennials and Gen Z favor store brands the most, though 68% of high-income shoppers also view them favorably, according to a recent story from The Wall Street Journal.

“Both stores have stepped up their innovation and quality with private brands,” said Jim Griffin, president of Daymon North America. “These strategic and beneficial builds to mass channel assortment portfolio’s better position them to target both younger and specialty grocery shoppers with private brands that capture their hearts, and wallets.”

Griffin also added that both Gen Z and millennials over-index for delicious, unique, and on-trend culinary flavor profiles – “the wilder, the better!” – alongside their desire for CPG brands with better-for-you ingredients but without the hefty price tags.

“Unique, on-trend products from exclusive private brands help to build loyalty and help position retailers to drive traffic,” Griffin added. “The mass channel as a whole is a compelling one-stop-shop for shoppers, and private brands are a secret-sauce advantage to drive traffic, innovation, and loyalty.”

Private-label goods have become so dominant, in fact, that more than half of retailers expect private-label goods to be their top driver of growth this year, according to a recent survey by NielsenIQ. Per the story, Campbell Soup reported that competition from store brands is pressuring its pretzel business, while food juggernaut Mondelez reported the same for its struggling Chips Ahoy brand.

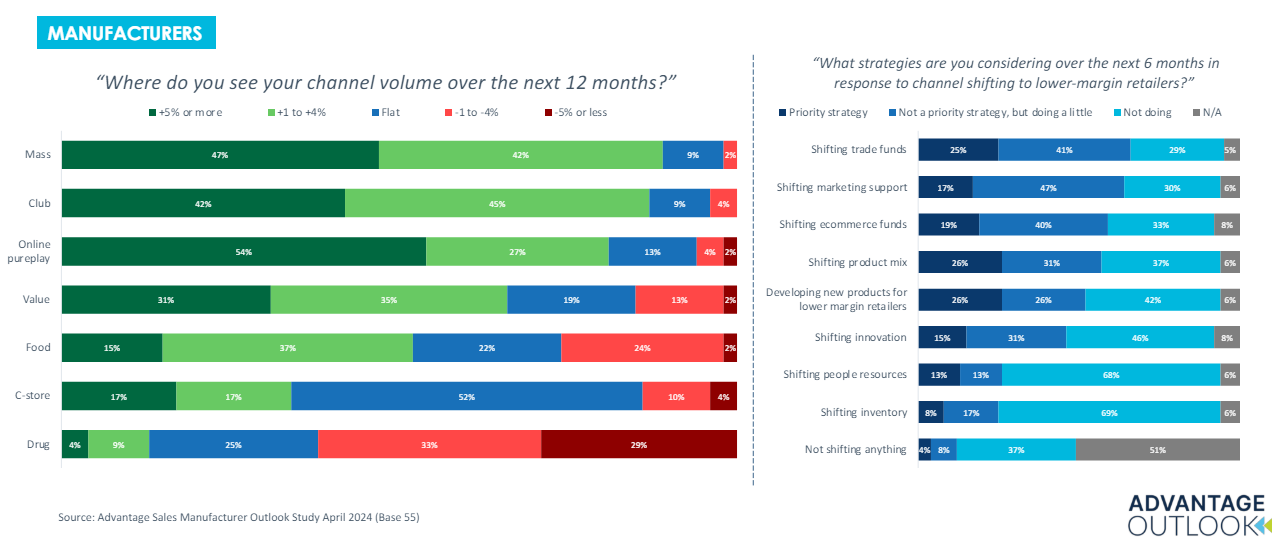

And according to the latest Advantage Outlook report from Advantage Solutions, manufacturers see channel volume in the next 12 months in mass market, club, and online pureplay sectors. “Shifting product mix” and “developing new products for lower-margin retailers” are the primary strategies manufacturers reported as consumers trade down and scrimp, save, and bundle all they can to feed their families and themselves:

Long story short, manufacturers are developing robust private-label lines (a la BetterGoods) to bolster their revenue, increase foot traffic, and offer real value (and competing flavor!) to consumers across every demographic.

“Consumers are still spending, but they are increasingly savvy about how, where, and on what they spend,” said Jill Blanchard, president of enterprise client solutions at Advantage Solutions. “It’s all about deals and details. For instance, more consumers are looking at the economic value – the price-per-ounce or count. More consumers are price shopping across channels and retailers, and more consumers are limiting their spending to necessities versus discretionary items.”

On top of that, retailers’ top private-label strategies include emphasizing displays (29% “increasing a lot”); increasing facings (27% “increasing a lot”); and adding new items (26%) and marketing (23%):

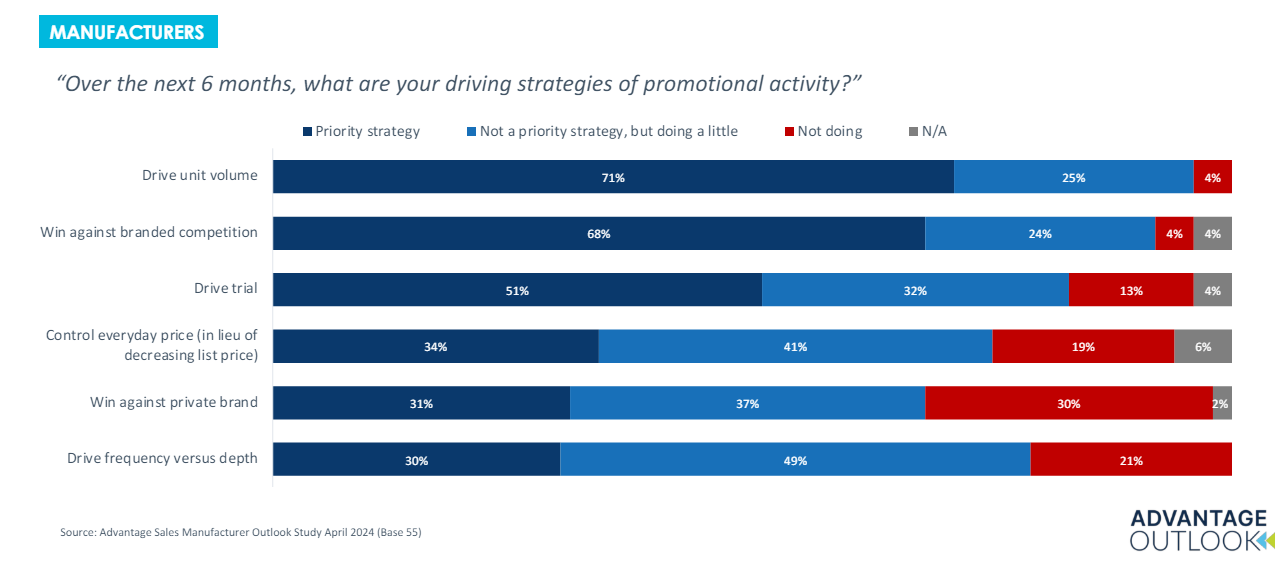

Last, retailers reported that summer promotional strategies to drive unit volume and compete against branded competition are far and away the top priority for providing value and moving product:

In short, retailers are scrambling to push value in a product-and-promotional blitz not seen since before the pandemic. As the economy teeters on the verge of an election year, consumers are battening down the hatches (and food budgets) to keep their families solvent, sated, and satisfied.

Will interest rates come down this fall? Probably not.

Will Target be able to right the ship amid summer spending and inch toward higher comp sales and revenue? Probably – the market rewards innovation, even if it’s a smokescreen to simply open doors and invite the shopping public in.

Most importantly – and perhaps most telling – will Costco increase the price of its $1.50 all-beef hot dog and soda combo? Unless the sky falls in, no – this week, Costco vowed to keep its most sacred offering the same price as it was in 1985.

Same as it ever was, as David Byrne once said. Unfortunately that steady drumbeat of commercial reliability occurs less than once in a lifetime for most brands, products, and services, and this summer, outsize value will help conquer unstable market volatility.

The Food Institute Podcast

Funding sources are drying up and inflation is making it harder and harder for higher-priced food brands to compete – what’s an early-stage food company to do? Dr. James Richardson, owner of Premium Growth Solutions and author of Ramping Your Brand, joined The Food Institute Podcast to discuss what types of food companies are succeeding under current industry dynamics.