Non-alcoholic (NA) beer is American consumer culture’s oldest social responsibility segment. Commercial, branded NA beer made its way into tens of thousands of bars and taverns by the 1990s in part as a soft form of legal defense ‘support’ for their retail and on-premise partners, and also due to pressure from Mothers Against Drunk Driving and the rise of the Designated Driver movement. Beer giants had zero intention of scaling this segment. Alcohol consumption impairs inhibition and often generates rapid repeat purchases – this is a sales advantage the alcohol industry has no interest in torpedoing. Consider that fact when you assess the widely ridiculed ‘poor taste equivalency’ of NA beer offerings from this era.

And so, the half-hearted NA beer segment has barely cracked 1% of U.S. beer market share after a half-century of broad distribution. Yet, you’ll find an NA tap handle almost everywhere. When older Americans (50+) were in college, drinking NA beer at a bar likely led to jokes and ribbing (especially among men). There was no widely diffused set of reasons to stand out from your buddies in this way. Choosing NA beer in public conferred two forms of stigma – a) recovered alcoholic, and b) social loser.

The challenge Athletic Brewing (AB) faces is to find a new positioning for NA beer that makes it a modern, unstigmatized choice and avoid the trap of Beyond Meat. What trap is that?

The trap of:

- not being a delicious alternative

- framing itself purely as an alt-X

- shoving product into distribution before strong repeat and HH retention had been established

- losing symbolic and category focus

- bloating its SG&A (due to lack of product focus)

- not finding a clear outcome that matters in people’s personal lives

- not switching its marketing mix after it hits scale

Performance Review – Skate Ramp Growth

Athletic Brewing has become one of the more impressive Skate Ramp brands of the 2020s due mainly to rigorous early R&D, aggressive social insertion into highly networked, aspirational fitness events (Spartan races, Ironman, etc.), and near-miraculous timing for a DTC CPG launch (i.e., before Apple’s privacy changes and the pandemic-induced ballooning of drop-shipper fees).

PGS projects that the company will be a $150 million trailing business by the end of this year at least (assuming a static UPC mix and current rates of HH penetration growth across all channels). So, let’s see how they got here and what risks they face in maintaining this outstanding performance.

Figure 1. Athletic Brewing Rides the Ramp![1]

Product Mix

- AB has a unique process for brewing non-alcoholic beer, and most of its raised capital has gone toward financing two large breweries near the New York and LA markets that make the business possible. As Forbes noted in a piece last year, “Brewers traditionally make nonalcoholic beer by cooking or filtering standard brews, a process that removes the alcohol—and most of the flavor. Shufelt and Walker took a different tack: Tweak the grains, sugars, temperature, and pH levels to brew a beer with big flavor and little alcohol from the start.”[2]

- AB offers 12+ brews, including seasonal and LTO website-only offerings (e.g., vacation reminder); half the mix is also award-winning.

- Run Wild IPA and Free Wave IPA are the top sellers with the broadest omnichannel distribution.

- AB stays relentlessly focused on beer, a vast universe of flavor and aroma possibilities… and being the craft NA beer.

- Opportunity: AB fans believe it is simply a great-tasting beer. AB is an NA beer that wins elite global beer taste awards (e.g., World Beer Awards), and a lot of them. This is fantastic sensory social proof with which to build a $1 billion+ business.

- Risk: Traditional beer offers a trifecta of broad population reach outcomes (i.e., refreshment, buzz, and flavor). By deleting the critical alcohol outcome – buzz – does AB limit its occasion reach or expand it? How does the competitive struggle alter when beer has to compete purely on an outcome bundle like “refreshing flavor”?

Placement

- AB used DTC incubation to get critical consumer intelligence and to ensure they weren’t shooting themselves in the foot. This is remarkably humble for the finance world. DTC remains a valuable, if unprofitable, channel through which to understand repeat and retention for novel products. It is also a way to build a retail consumer base well before distribution. AB moved quickly into traditional retail after their DTC incubation but not absurdly fast compared to other well-funded brands. As of sometime in 2023, AB is now available in all 50 states.

- Pepper’s minority stake has unlocked a DSD retail partnership of critical value to growing this business exponentially. This is a mode of distributor partnership that Vitaminwater, Bodyarmour, and other novel beverage brands have used to fight the distribution power of the soft drink giants – ally directly with one of them!

- AB is now for sale in elite athletic clubs, tennis clubs, hotel bars, liquor stores, Walmart, Target, natural and specialty channels, grocery, and drugstores. Los Angeles is an excellent example of a market indicative of where the brand is headed nationally as it grows.

- Opportunities: On-premise sales are only 10% or so of overall AB sales and still well below the beer category average of 41%.[3] Additional NA beer upside is found in convenience stores which sell only about $34 million in nonalcoholic beer annually…1/10th of 1% of beer sold in the channel.[4]

- Risk: AB now has to build HH penetration through more scalable out-of-store marketing to keep the company’s sprawling, omnichannel network productive. Easier said than done.

Pricing

- AB pricing is on par with imported beer such as Heineken and matches Heineken 0.0 pack pricing pretty closely. AB is NOT taking a ‘craft’ or super-premium price positioning within beer, which is wise for its rapid acceleration.

- Opportunity: adding further case pack sizes up the ladder from 12-packs will accelerate the business through strategic price relaxation. Beer has taught all of us to think like this.

- Risk: Selling case packs larger than 12 is rare in the premium beer pricing tier (outside of Club). Making this work requires a) a consumer mix unusually weighted to heavy weekly consumption, or b) successful insertion into home parties (a significant source of retail beer volume). Premium soft drinks have also yet to demonstrate the ability to sell 24-, 30-, or 36-packs.

Promotions

- The trademark brilliantly embeds lifestyle aspiration into every impression in a way that most cult brands require to generate word-of-mouth and usage frequencies weighted toward the heavier end vs. mature brands.

- The de facto slogan “brew without compromise” also took on the most significant source of skepticism for early adopters of the brand, including the athletic ambassadors that lent early, critical social proof.

- The initial marketing toolkit was straight from the soft drink world and worked very well.

- It is time to plan for a very different marketing mix and a newer, broader positioning to take the brand where investors want it to be.

Competitive Situation

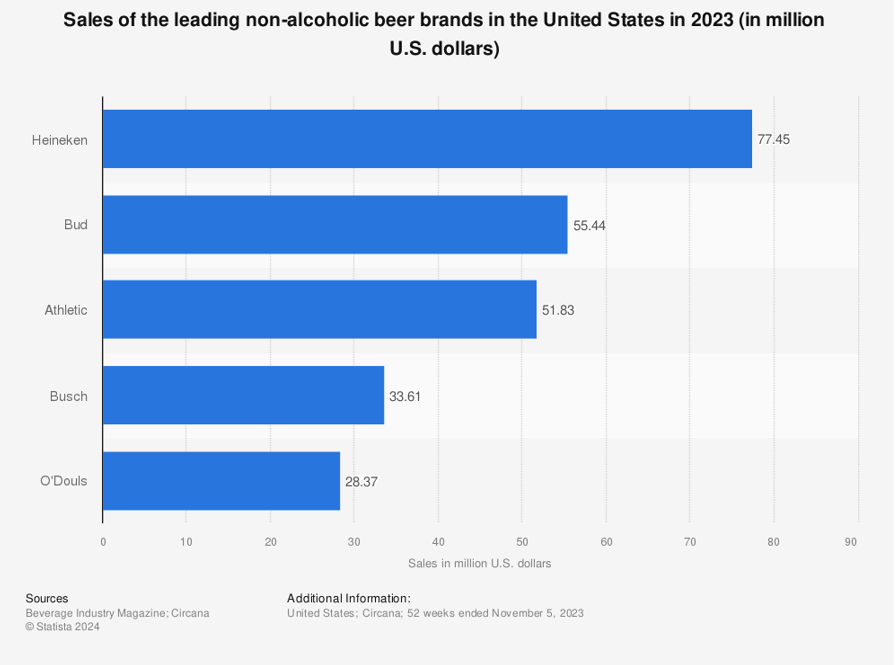

Athletic Brewing is the #3 NA beer in the U.S. retail market based on the most recently available data. AB skated right past O’Doul’s, the ‘iconic’ NA tap handle. Heineken launched its 0.0 in 2017 and has spent tens of millions to advertise and sample its new offering. As of last July, this NA line extension was 7% of Heineken USA revenue, according to Food Dive.[5] These two new lines alone have added over $130 million in retail sales to NA beer. You may have noticed shelf space expanding at your favorite beer pickup spot.

What explains the added demand? And can Athletic Brewing harness a tight competitive strategy to beat Heineken 0.0?

The current explosion in craft NA beers owes itself to different social trends than the anti-drunk driving movement mentioned at the start of this article. The most important modern trend is fitness-intensive weight management ideals among millennials and Gen Z. The next most important is the craft beer trend adjacent to NA beer itself. Probably the least important source of long-term volume is the growing trend toward performance sobriety among educated professionals. Most professionals still drink. And 78% of NA beer drinkers also drink regular alcohol.[6] More importantly, credentialed professionals only amount to about 9-10% of the population anyway.[7] The latter is a great, highly networked niche audience to help reach $100 million quickly through heavy usage and strong repeat-purchase rates. To create a billion-dollar brand within beer, though, AB will have to reach a much larger audience; at least 20-30% of the country based on lighter overall usage.

And this is where occasion-based strategy makes the most sense for AB moving ahead, especially when combined with execution in modern omni-media campaigns. It comes down to how to make craft beer flavor and aroma become credible as a basic refreshment on occasions currently dominated by soft drinks. This is the real NA beverage battle the brand faces.

If AB does not do this, the brand has to stay within the frame of ‘beer occasions when I do not want a buzz.’ This negative framing has never proven to be a great strategy for scaling large CPG brands. None I know of have scaled to $1 billion based on aversion, only based on strong brand or product preference.

The challenge ahead for AB is to make its remarkably tasty line a high-status, modern, and cold refreshment that dislodges sparkling water from a few more occasions per week or month.

And it will do this only if it can convince many (mostly young) men that amazing flavor is the primary reason to do this – that AB is just a great refreshment on occasions when consumers don’t consider alcohol at all (e.g., 2 PM at work). For example, beer offers bitter flavors and aromas perfectly suited to eating salty and savory snacks any time of the day. Beer and chips?

The current positioning statement promoted on the AB website – “Brewing Without Compromise” – still focuses new consumers on what they don’t like about their current craft beers. And that can only be the alcohol. It also betrays the over-achieving ethos of many hard-working founders; one we can’t generalize to most Americans.

So, Is Athletic Brewing Just Another Beyond Meat?

Will AB simply hit a $300-400 million peak and then decline like its famous “alt” cousin – Beyond Meat? Is it being oversold to the original niche, lacking a bridge to a large audience?

Let’s review the signs from the beginning of the piece and cross off the signs of being a less-than-alternative brand that Athletic Brewing has avoided:

- not being a delicious alternative

- framing itself purely as an alt-X

- shoving product into distribution before strong repeat and HH retention had been established

- losing symbolic and category focus

- bloating its SG&A (due to lack of product focus)

- not finding a clear outcome that matters in people’s personal lives

- not switching its marketing mix after it hits scale

Focusing on performative (i.e., occasion-based) sobriety or any kind of sober-living positioning moving ahead would take the brand back to its niche athlete origins. Anyone who drinks AB to be more productive and competitive sounds impressive to most of us but does not represent the vast majority of the much larger addressable soft drinks audience waiting for AB.

About the Author

Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage consumer packaged goods brands. As a professionally trained cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, including brands owned by Coca-Cola Venturing and Emerging Brands, The Hershey Company, General Mills, and Frito-Lay, as well as other emerging brands such as Once Upon a Farm, Rebel creamery, and June Shine kombucha.

Dr. Richardson is the author of Ramping Your Brand: How to Ride the Killer CPG Growth Curve, a #1 Best-seller in Business Consulting on Amazon. He also hosts his podcast—Startup Confidential.

[1] Figure 1 represents publicly disclosed company sales, not retail or food service outlet sales data. 2018 company revenue is estimated assuming a $333 per barrel price inferred from 2019 data publicly released by the company to Bevnet, Inc. – Justin Kendall, “Keurig Dr. Pepper Invests $50 Million in Athletic Brewing Company, Takes Minority Stake in Non-Alc Beer Maker,” Brewbound, November 9, 2022, https://www.brewbound.com/news/keurig-dr-pepper-invests-50-million-in-athletic-brewing-company-takes-minority-stake-in-non-alc-beer-maker/. 2019 and 2020 sales announced in Bloomberg – Kate Krader, “Celebrity Backers Are Making Nonalcoholic Beer a Hot Investment,” Bloomberg, January 12, 2021, https://www.bloomberg.com/news/articles/2021-01-13/athletic-brewing-non-alcoholic-beer-a-hot-celebrity-investment-dry-january. 2021 and 2022 sales announced in – Steven Bertoni, “Inside Athletic Brewing’s Plan to Make Boozeless Beer a Billion-Dollar Business” Forbes, Feb.15, 2023, https://www.forbes.com/sites/stevenbertoni/2023/02/15/inside-athletic-brewings-plan-to-make-boozeless-beer-a-billion-dollar-business/?sh=1bb97fc12814

[2] Steven Bertoni, “Inside Athletic Brewing’s Plan to Make Boozeless Beer a Billion-Dollar Business” Forbes, Feb.15, 2023, https://www.forbes.com/sites/stevenbertoni/2023/02/15/inside-athletic-brewings-plan-to-make-boozeless-beer-a-billion-dollar-business/?sh=1bb97fc12814

[3] Statista.com, “On-premise and off-premise retail dollar sales of alcoholic beverages in the United States in 2022 (in million U.S. dollars)**” https://www.statista.com/statistics/987210/us-on-premise-and-off-premise-retail-dollar-sales-alcoholic-beverages/ and “Athletic Brewing’s Rapid Growth,” Market Watch, August 11, 2022, https://www.marketwatchmag.com/athletic-brewings-rapid-growth/

[4] Statista.com, “Beer sales in United States convenience stores (c-stores) in 2022, by sub-category,” https://www.statista.com/statistics/308956/beer-sales-in-us-convenience-stores-by-sub-category/

[5] Ezra Johnson-Greenough, “Athletic Brewing Partners With Buffalo Wild Wings Nationwide,” May 23, The New School, https://newschoolbeer.com/home/2022/5/athletic-brewing-buffalo-wild-wings-nationwide

[6] NielsenIQ data cited on BevZero.com, “Trends in On-Premise for No-and Low-Alcohol Beverages,” March 25, 2022, https://bevzero.com/trends-in-on-premise-for-no-and-low-alcohol-beverages/

[7] “Professional and related occupations” per 2021 occupational data from the US Census pulled by PGS.