In many ways, the pandemic has been a boom time for third-party delivery platforms, which have benefited from consumers largely hunkering down at home and summoning dinners to their doorstep.

But business is rapidly changing in several ways for such delivery apps. The third-party platforms are consolidating and diversifying, as noted by The Chicago Tribune (March 1). For example, DoorDash has expanded its business model to add deliveries of toiletries.

All told, restaurant delivery sales more than doubled to $40.8 billion at the end of 2020, up from $19.6 billion a year prior, according to NPD Group.

Yet, it’s natural to wonder if delivery platforms can possibly maintain that momentum. So, what’s next for these third-party delivery platforms? Once the pandemic is over, will consumers still demand such delivery services, or did COVID-19-related lockdowns simply prop these businesses up temporarily?

RESTAURANTS SEEKING CONTROL

The pandemic has made food delivery a staple of consumers’ lives, but many restaurants are now searching for alternative delivery models that aren’t fraught with the fees that delivery platforms charge.

While some restaurants are hiring their own drivers, others are attempting to drive customers to their own websites for online orders. Meanwhile, some restaurants are partnering exclusively with a single third-party platform, so they can have more control.

For now, restaurants are partnering with third-party delivery platforms en masse, since it’s the surest way to get their food to customers, according to Cara Rasch, a food industry analyst with Packaged Facts who spoke with The Chicago Tribune.

That said, Rasch doesn’t expect third-party delivery companies to dominate forever, due in part to the fact that delivery platforms are continually offering discounts to draw customers who are in search of the best deals.

EFFORTS TO EVOLVE

As if reading the writing on the wall, delivery platforms have taken several steps in recent months to help ensure business sustainability. Examples include:

- DoorDash purchased robotics company Chowbotics, a tech company that uses robotics to assemble custom meals like salads in under 2 minutes, in a setup similar to a standard vending machine, as reported by Yahoo Finance (Feb. 8). That type of automation could help partner restaurants expand to new categories.

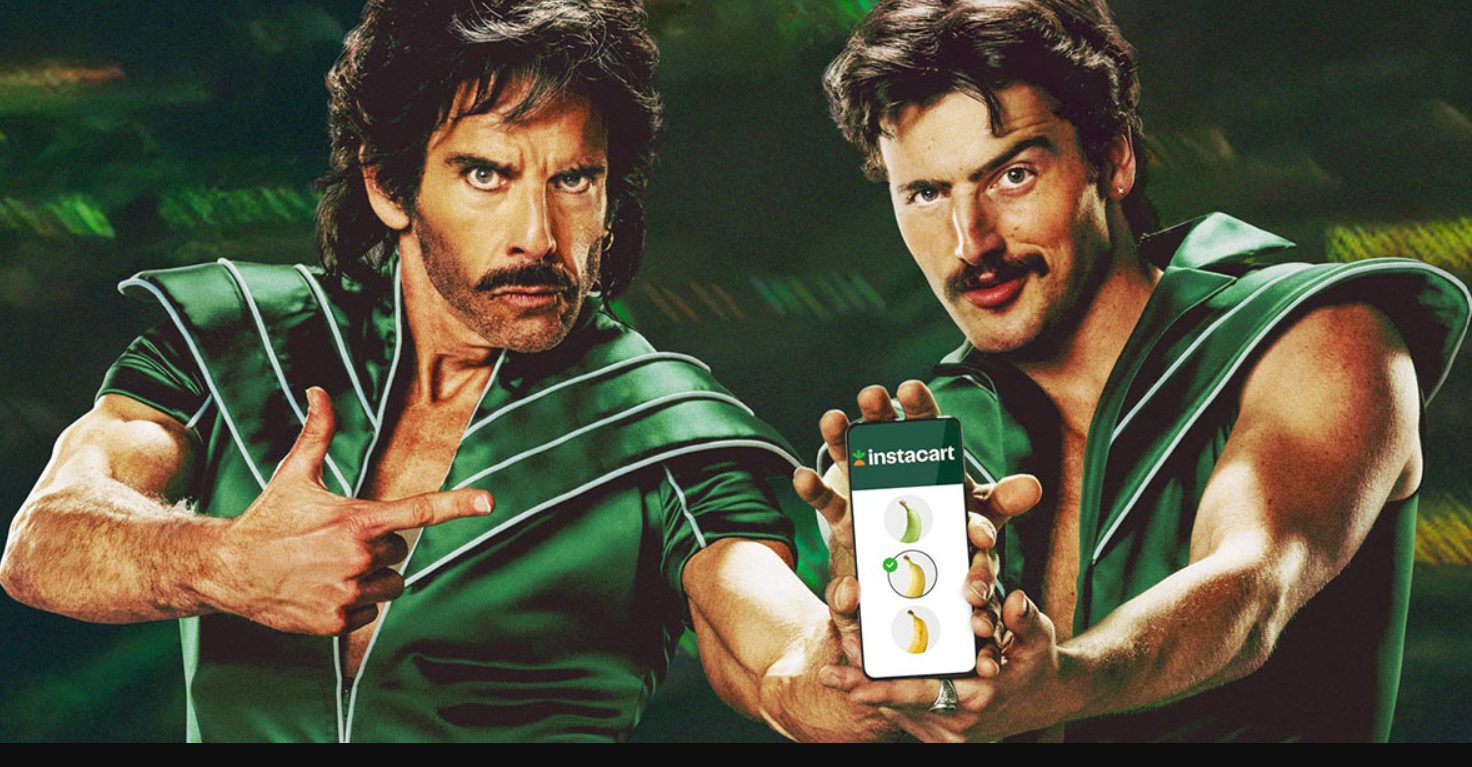

- Instacart, the prominent grocery delivery service, recently partnered with arts and crafts retailer Michaels to deliver from nearly 100 stores in Chicago, Dallas, and Washington D.C. The partnership is part of Instacart’s shift to more of an all-encompassing e-commerce platform.

- Additionally, DoorDash and Instacart reportedly plan to launch credit cards. JPMorgan Chase & Co. will issue Instacart’s card and is reportedly bidding to partner with DoorDash. The Instacart credit card will likely launch next year, with cardholders earning 5% cash back on their purchases, reported Yahoo (April 7).

Meanwhile, Rasch expects further consolidation that leaves just one or two big players among the major delivery platforms. Last year, for instance, Uber Eats bought Postmates for $2.65 billion.

Ultimately, for some restaurants, the future of “delivery” may be pickup, which is far cheaper and easier to control. Plus, carryout is typically a much larger revenue stream for restaurants than delivery. Delivery represented 11% of off-premises restaurant sales in 2020, while carryout accounted for 46% and drive-thru 44%, according to NPD Group.