Private-label snacks continue to make major headway through ongoing food inflation and an economy that seems stagnant one moment and buoyant the next. For proof, look no further than the Alpha-Diver consultancy’s latest Snack50 Report, which notes consumer behavior.

For the first time in the report’s history, the top six brands – all of them – are store brands, from retailers like Walmart, Amazon, and Target.

“What we’re seeing is that all the store brands have very high interest,” Alpha-Diver president Hunter Thurman told The Food Institute, “meaning people are exploring them. They’re evaluating them. They’re very engaged looking at them.”

“When I saw this most recent report, it was a bit of a jaw-drop moment – there’s a massive shift looming. Store-brand snacks are poised to basically take over in the coming year or two.”

Alpha-Diver’s Snack50 Report sheds light on why consumers are buying certain brands and what’s driving (or hindering) marketing campaigns in the minds of consumers. The report – which covers brands ranging from Nutri-Grain cereal bars to Sour Patch Kids candy – is based on a sample of the U.S. population and backed by Alpha-Diver’s “Psych Pulse” database of statistical norms.

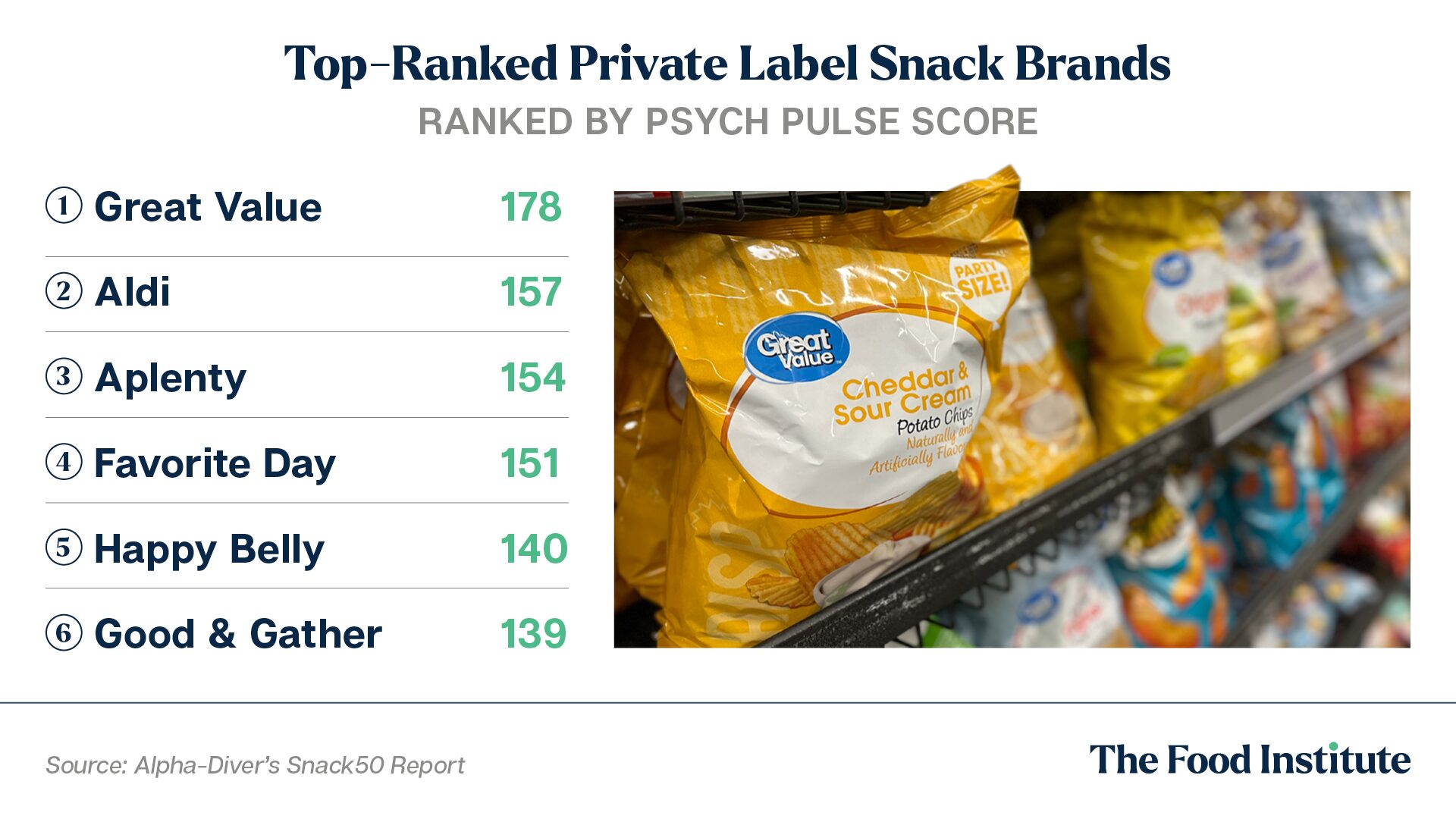

According to Alpha-Diver’s latest report findings (which will be released to the public on May 2), Walmart’s Great Value (with a score of 178) was the top-ranking brand followed by Aldi (157) and Aplenty (154).

At the same time, so-called store brands have made undeniable progress in recent years, with labels like Walmart’s Great Value and Target’s Good & Gather offering products that check most boxes for modern shoppers.

“They’re private labels, but they’re brands,” Thurman told FI. “I mean, you look at Aplenty on Amazon and it does not look generic. It’s not like ‘Oh, here’s knockoff Pringles.’ They’ve got their own unique products.”

According to Alpha-Diver, consumers’ desire to discover new sensory experiences in snacking is up 3.6% versus 2023. Taking data like that into consideration, it appears national brands are at an inflection point and need to demonstrate their value via these consumer-perceived criteria to ward off store brands’ ascension.

“If brands act decisively, they can ward off the private label threat,” Thurman said, “but they’ll have to pull the right levers in strategy and activation – quickly.”

The Food Institute Podcast

How does one jump from aerospace engineering into plant-based chicken nugget production? That’s exactly the leap that Christie Lagally, CEO & Founder of Rebellyous Foods, took in search of producing a healthier chicken nugget. Learn more about her company’s focus on animal welfare, environmental sustainability, and human health in this episode of The Food Institute Podcast.