Consumers looking to beef as a primary protein source in their fridges as they hunker down amidst the coronavirus pandemic may be in luck, as production was on the rise in February.

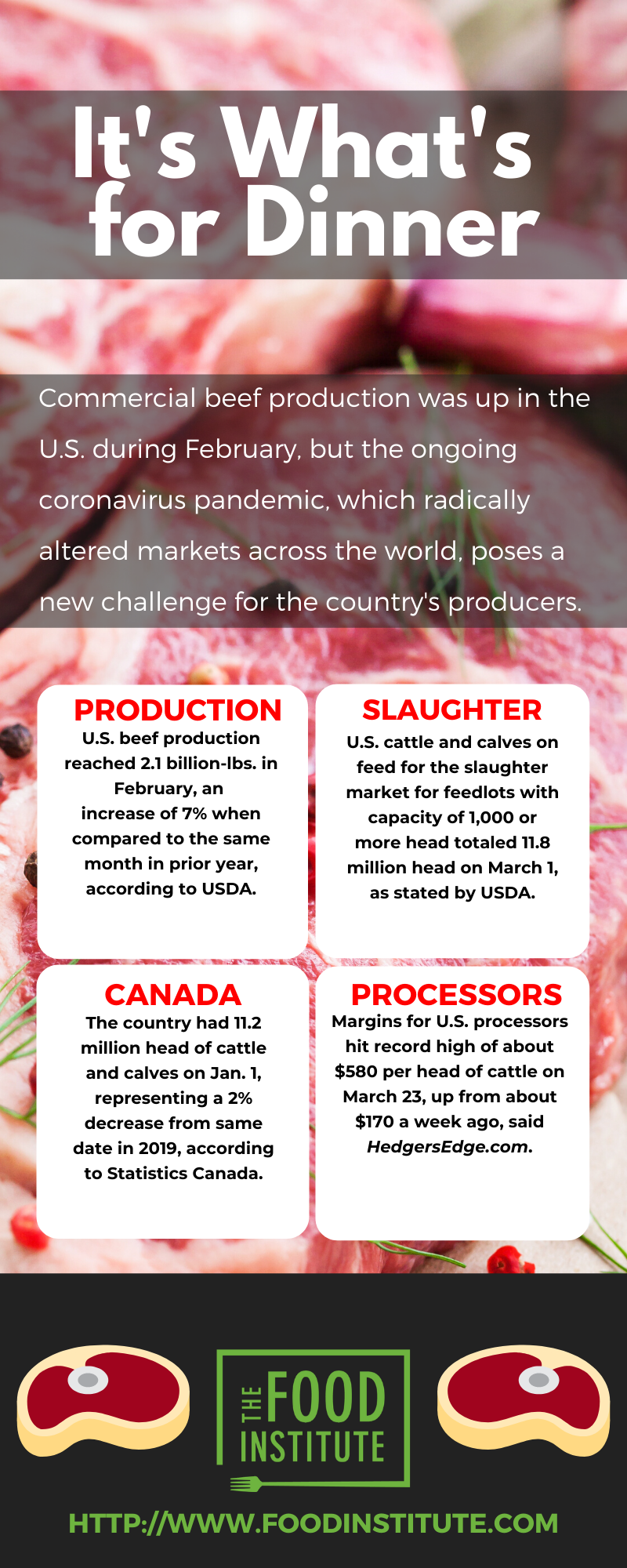

U.S. beef production reached 2.1 billion-lbs. in February, an increase of 7% when compared to the same month in the prior year, according to USDA. Total cattle slaughtered increased 5% year-over-year, reaching nearly 2.6 million head, while the average live weight increased 24 lbs. to 1,376 lbs.

Overall commercial red meat production for the U.S. totaled about 4.5 billion-lbs. in February, representing a 7% increase from the 4.2 billion-lbs. reported in Feb. 2019. Comparatively, commercial pork production totaled 2.3 billion-lbs. during the month.

U.S. cattle and calves on feed for the slaughter market for feedlots with capacity of 1,000 or more head totaled 11.8 million head on March 1, according to USDA, which reported the inventory was slightly above March 1, 2019.

Placements in feedlots during February totaled 1.71 million head, 8% below 2019. Net placements were about 1.7 million head. During February, placements of cattle and calves weighing less than 600 lbs. were 340,000 head; 600-699 lbs. were 315,000 head; 700-799 lbs. were 470,000 head; 800-899 lbs. were 411,000 head; 900-999 lbs. were 115,000 head; and 1,000 lbs. and greater were 60,000 head.

Marketings of fed cattle during February totaled 1.8 million head, 5% above 2019. Other disappearance totaled 58,000 head during February, 12% below 2019.

However, the National Cattlemen’s Beef Association (NBCA) noted that while it was working tirelessly on protecting the nation’s beef supply, it would require the help of state governments and federal officials. They stressed that highly volatile markets could force ranching operations out of business when the public needs them most.

“In order to combat this staggering burden, NCBA has been actively engaged with leaders in both the U.S. Senate and House of Representatives to ensure that relief funds from any aid package reach these struggling cattle producers directly,” said Ethan Lane, VP of government affairs, NCBA. “It is important that any such relief avoids the lasting market-altering effects of a price support program, such as those that have been proposed by some members of the Senate. Instead, we must keep the focus on providing quick, targeted relief to struggling producers.”

In a letter sent to Senate Leader Mitch McConnell, Speaker of the House Nancy Peolosi, and House Republic Leader Kevin McCarthy, NCBA noted cattle production was the largest segment of the U.S. agricultural industry, representing 18% of total farm receipts in 2018.

“As retail beef demand continues to soar in the wake of temporary restaurant closures, it is critical that cattle producers are empowered to maintain operational certainty as they work to ensure our nation’s food security during this crisis,” the group wrote in the letter. “To that end, as Congress considers additional measures to combat the effects of COVID-19, it is imperative that a future funding package include a meaningful safeguard for our nation’s farm and ranch families during this public health emergency.”

Additionally, the Cattleman’s Beef Board (CBB) noted the coronavirus was causing unexpected shifts for the cattle markets. The group’s contractors, including NCBA, pivoted strategies to better address current and future effects stemming from the pandemic.

“The COVID-19 situation is extremely fluid, and none of us knows what next month, next week, or even tomorrow may bring. That’s why Beef Checkoff contractors will continue adjusting their plans accordingly over time,” said CBB chairman Jared Brackett in a message to constituents. “Knowledge is power, and it’s our job to ensure you are aware of how your checkoff dollars are being spent to help the beef industry adapt to this changing world.”

Meanwhile, North American producers tallied their herds for the beginning of 2020. Combined cattle and calves in the U.S. and Canada totaled 105.6 million head on Jan. 1, down 1% from the 106.2 million head reported Jan. 1, 2019, according to USDA and Statistics Canada. The combined cows and heifers that calved totaled 45.2 million head, also down 1% from 2019.

U.S. cattle and calves accounted for 94.4 million head during the month, down slightly from the 94.8 million head reported Jan. 1, 2019.

In Canada, 11.2 million head of cattle and calves on the date represented a 2% decrease from the same date in 2019. Inventory of U.S. and Canadian cows and heifers that calved totaled 40.7 million head and 4.5 million head, representing decreases of 1% and 2%, respectively.

North American meat processors in both countries are preparing to increase payments for workers during the coronavirus outbreak as they seek ways to meet surging demand. Tyson will pay farmers a onetime premium on cattle slaughtered, while Cargill will pay U.S. and Canadian slaughterhouse workers a premium of $2 an hour until May 3. Margins for U.S. beef processors hit a record high of about $580 per head of cattle on March 23, up from about $170 a week ago, according to HedgersEdge.com, reported Reuters (March 23).

“This is an unprecedented time and the intent of our response is to show our support in an effort to help our supply partners weather this extraordinary situation,” Tyson said in a statement.

Some beef farmers are saying the coronavirus pandemic pushed down prices so low for the product that even these increases won’t help. South Dakota farmers like Walt Bones are seeing losses of hundreds of dollars per cow at auction, right when shoppers are increasingly stocking up on groceries and home goods, including beef, reported Argus Leader (March 24).

“Now we’ve got to look at a different strategy,” Bones said. “I can’t keep feeding them day after day after day and wait for the market to get better.”

South Dakota farmers in general raised the alarm when a report from Fort Pierre Livestock Auction accused the nation’s four top beef packers of conspiring to fix prices. Tyson, JBS, National Beef, and Cargill control 81% of the nation’s beef packing market, according to a federal antitrust lawsuit filed by industry representatives last year against the companies in a separate matter. Sen. Mike Rounds urged the Department of Justice to investigate the claim.

“This is a multi-billion dollar problem for South Dakota,” Rounds said in an interview with South Dakota News Watch. “This is not new, but it has been enhanced and brought into the spotlight because at a time of national crisis, we have seen the problems with this existing market be highlighted.”