NEW YORK CITY – “There’s a food-as-fuel mentality nowadays and access to more information… It’s a really exciting time to be in the industry,” said Bill Shufelt, CEO of Athletic Brewing Company.

He spoke about the history and growth of the non-alcoholic sector at the UBS Global Consumer and Retail Conference in New York City, March 12-13.

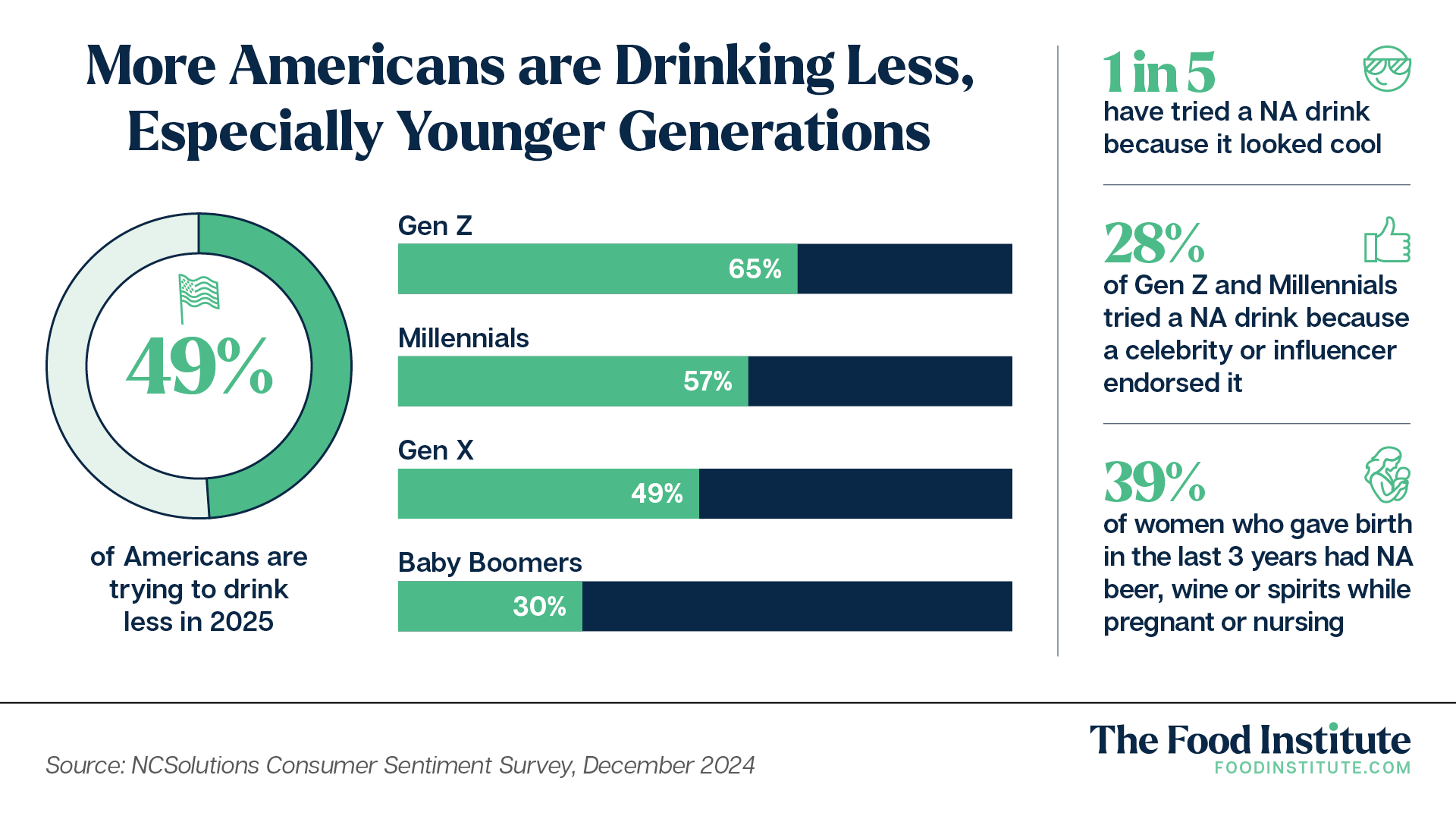

The shift, notably supported by younger generations and better-for-you sentiments, has nearly brought the movement to a breaking point. Nearly 50% of Americans are trying to drink less alcohol in 2025, according to a recent report from NCSolutions, with Gen Z leading the charge with 65% aiming to develop teetotaling lifestyles.

Compared to 2023, overall sober-curious sentiments increased by 44%, signaling the cross-channel impact of this shift.

Nevertheless, the alcohol sector is far from death. Major industry forces still have key growth levers and may even benefit from the growth of non-alcoholic, as it has the potential to bring more people into the category.

At the recent event Ab InBev CEO Michel Doukeris noted that digitalization and organic growth will be core to the company’s playbook in the year to come. Through acquisitions, the brand has over 500 portfolio brands worldwide in the sector, which allows them to scale opportunities across myriad operations.

“We can leverage insights from one area of our business and apply them to other brands at the global scale,” said Doukeris.

Alcohol-Free. Friend or Foe?

“In a modern, busy world, alcohol doesn’t make sense for most occasions. I saw a world where essentially 50% of the world was shut out of adult beverages,” said Shufelt.

When the company began, nearly a decade ago, it anticipated and helped spearhead a movement where social drinking didn’t have to come at the expense of personal goals. Shufelt explained how his decision to stop drinking alcohol in 2013 while training for an ultramarathon felt surprisingly common — his generation wanted to achieve more and alcohol could get in the way of that, he explained.

Despite eating into beverage alcohol market sales, Shufelt doesn’t see Athletic in opposition to mainstream alcohol brands.

“We are an additive to the adult beverage industry. We are not prohibitionists. We do not have an issue with alcohol in general,” he said.

Instead, he noted non-alcoholic brews inspire additional use cases that bring more people into the alcohol industry, such as when driving home from work, when delegated a “designated driver” from friends or family, or more on-the-nose, when giving a presentation at 11 in the morning.

Surprisingly Doukeris agreed, noting how 60% of the recent overall 20% volume growth in non-alcoholic beer comes from new drinking occasions, rather than former beer drinkers switching over.

“Beer drinkers are now drinking [non-alcoholic beer] with lunch and drinking [it] more during the week then driving home.”

On the other hand, Shufelt noted that alcohol use cases still abound, with plenty of market share for legacy brands to enjoy. Instead, the industries can come together to further promote these beverages as a companion to group activities. Shufelt poignantly contended that when consumers socialize less often, it hurts everyone.

Growing Together, Beverage Industry’s Future

When asked if the non-alcoholic movement was a fad or here to stay, Doukeris noted how the COVID pandemic shaped Gen Z behaviors. As many couldn’t gather in social settings conducive for alcohol consumption, many didn’t associate the two as strongly as previous generations.

However, the CEO contended that the Gen Z post-pandemic environment has stabilized, with drinking-age consumers once again participating in these social activities. On the beer category, he added that a recent report found that this modified drinking behavior would have an impact of less than one percent on the beer category. In a word, Doukeris is unfazed.

On the other hand, AB InBev is also set to grow with its non-alcoholic business with portfolio companies such as Michelob Ultra Zero. Doukeris cited the segment as a powerful innovation for the general drinker, signaling these brews’ importance in a healthy portfolio.

Athletic anticipates a more disruptive environment for the industry. Shufelt noted how domestically, many markets have a non-alcoholic beer penetration of less than 5% while some are upwards of 50%. Nevertheless, social acceptance toward this lifestyle and availability of high-quality, easily accessible innovations are driving growth.

He also discussed a democratization of social drinking across ethnicities, genders, ages, and socioeconomic status, which is key to their marketing initiative.

“Legacy have had to bear the decisions of their previous marketing initiatives,” he explained.

These brands often marketed beer toward the male, creating a masculine fanbase. On the other hand, Athletic strives to be evenly distributed between genders while making people of all backgrounds feel included.

Learn more about the future of the non-alcoholic beverage market when FI hosts a free webinar about the topic on Tuesday, April 8 at 2 p.m. EDT. Register here.

The Food Institute Podcast

This Episode is Sponsored by: City National Bank

How are macro-economic factors and changing consumer preferences impacting the natural grocery sector? City National Bank’s Justin D’Affronte steps in as guest host as he speaks with Mother’s Market CEO Dorothy Carlow about inflation, tariffs, consumer preferences, and more.