Washington state apricot growers were anticipating an early start for their crop, but a cold snap may have hurt tree fruit producers in the region by destroying emerging buds.

That’s according to a March 17 report in Capital Press, which found apricot and cherry growers in the state were hurt by temperatures that dropped into the mid-20s March 14 after enjoying an average of 38.3 degrees in January, as stated by AgWeather Net. Generally, temperatures in the region average 33.3 degrees for the month.

Gilbert Orchards co-owner Sean Gilbert said apricot buds in the state’s Tri-Cities region experienced “very slight to very significant” damage, depending on location and exposure. Gilbert noted apricot growers in the lower Yakima Valley reported being three weeks ahead than normal. Washington produces about a half-million boxes of the fruit annually, the second most in the nation.

However, it is much less than the 7 million boxes first-place California produces each year, according to the Washington State Fruit Commission. The group’s president, B.J. Thurlby, noted apricots were typically the first tree fruit to bloom in the region.

“I feel the more fruit we get out before the Fourth of July, the better,” said Thurlby before the freeze. The full extent of the regional damage remains unclear due to the frost damage. Additionally, as with most commodities, markets for the product are in flux as the world adjusts to the growing coronavirus pandemic.

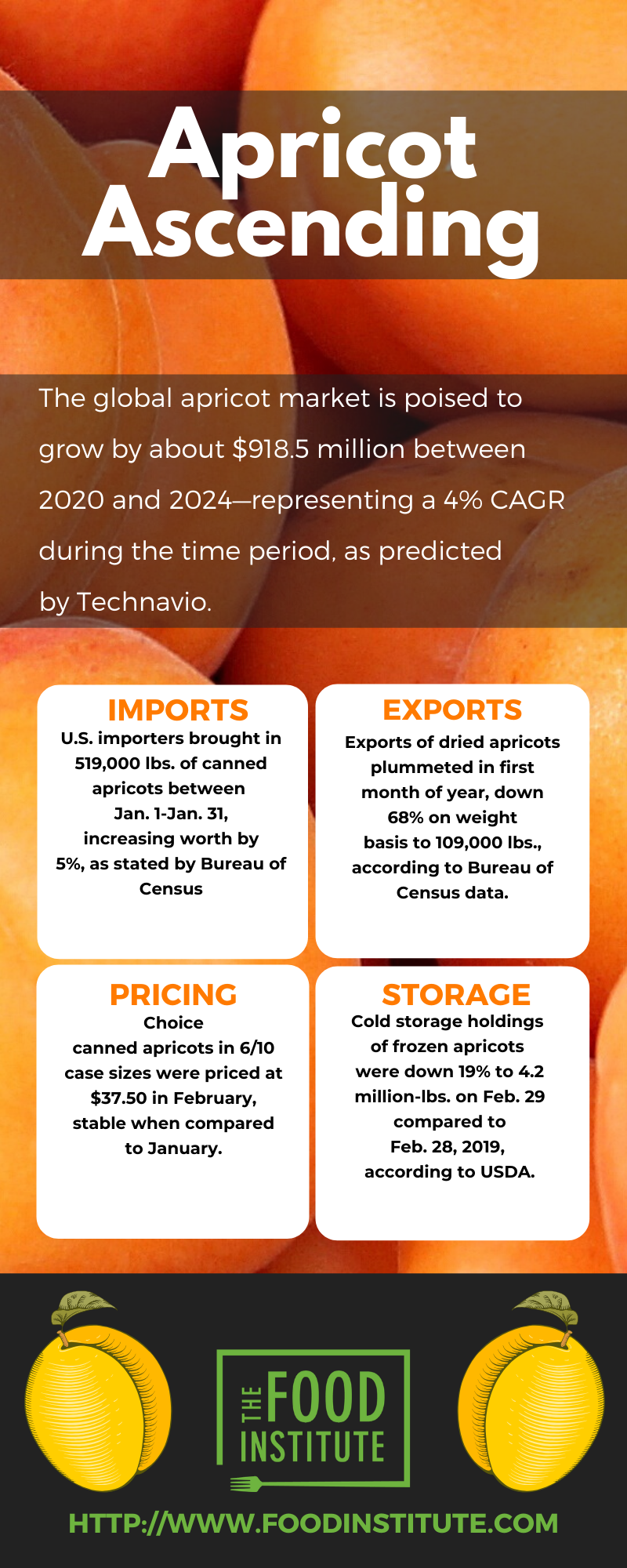

Technavio predicted the global apricot market is poised to grow by about $918.5 million between 2020 and 2024, representing a 4% CAGR during the time period.

In Italy, researchers in Cesena believe they have found apricot varieties that are resistant to the Sharka virus, which causes plum pox. Sharka is a devastating viral disease that affects various stone fruit species including apricots, plums, nectarines, peaches, almonds, and cherries, reported Fresh Plaza (March 19).

“As for apricots, tolerant varieties are Flavor Cot, Lilly Cot, Bora, Spring Blush, Flopria, and Sunny Cot, which have been observed for 10 years,” said Federica Fontana, a researcher at the Astra—Martorano 5 Operative Unit. “Wonder Cot, Anegat, Gilgat, and Bergarouge show no symptoms after three years. Although they do have the virus, as we inoculated it, leaves and fruits show no symptoms.”

The researchers monitor stone fruit flowers to detect symptoms of the virus, looking for specks on the flowers. Researchers will continue to work on the project to determine other stone fruit varieties that were inoculated against the disease.

Meanwhile, imports of canned apricots increased 19% on relatively light value in the first month of 2020. U.S. importers brought in 519,000 lbs. of the fruit between Jan. 1-Jan. 31, as state by the Bureau of Census. The product’s worth increased 5% to $243,000 during the time frame. Interestingly, imports from China were up 140% during the time frame by weight, totaling 287,000 lbs. Worth soared 149% to $112,000. It remained unclear how the coronavirus pandemic would impact canned apricot supplies originating in China, but in the early going, it appeared the country’s output was up significantly.

Exports of canned apricots were primarily sent to remaining members of North America. Overall, the U.S. exported 86,000 lbs. of canned apricots between Jan. 1-Jan. 31, according to Bureau of Census Data, representing a 30% decline when compared to the time period in 2019.

Declining exports of the products to Canada drove the decrease. While U.S. exporters shipped only 11,000 lbs. of the product into Canada during the period, representing a 71% fall from the prior year, exports to Mexico jumped 30% to 68,000 lbs.

Regarding prices, choice canned apricots in 6/10 case sizes were priced at $37.50 in February, according to Food Institute Report sources. The pricing was unchanged from January, with earlier expectations pricing would remain stable through the summer.

Sales of canned apricots contracted 24.6% on a dollar sale basis during the 52-weeks ending Dec. 1, 2019, as indicated by data from IRI. In total, IRI tracked $6.1 million in purchases for the category during the period, with $3.1 million assigned to private label producers. However, this was a 30.2% reduction in dollar sales when compared to the prior year, despite maintaining a 50.5% dollar share of the category.

It wasn’t immediately clear how pricing would change due to the ongoing coronavirus pandemic. With consumers shifting their purchasing habits to focus on canned and preserved goods, and an evolving shipping situation, fluctuations could be expected in the months to come.

In the dried sector, exports of dried apricots plummeted in the first month of the year, down 68% on weight basis to 109,000 lbs., according to Bureau of Census data. Worth likewise fell 64% to $342,000. Exports to Israel remained relatively stable by weight, totaling 84,000 lbs. Worth increased 23% to $270,000.

Imports of dried apricots jumped significantly, up 46% to 3.5 million-lbs. during January, as indicated by the Bureau of Census. The value of all exported dried apricots increased 42% to $4.6 million. Turkey was the leading exporter to the U.S., posting a 44% increase in pounds shipped to 3.4 million-lbs. and 41% rise in value to $4.5 million.

Supermarket sales of dried apricot products declined 4% in dollar sales during the 52-week period ending Dec. 1, 2019, according to data from IRI. The category grabbed $49.2 million in total sales, with private label products representing the bulk of sales with $16.6 million. Dollar share increased 5.4% during the period for private label sales. Mariani was the largest single brand in sales, with $11.3 million.

USDA indicated cold storage holdings of frozen apricots were down 19% on Feb. 29 with compared to Feb. 28, 2019. The agency recorded about 4.2 million-lbs. of frozen product in storage on the date, which was also down about 19% from Jan. 31.