Costco Wholesale is one of the great businesses in American history. Costco stock certainly has been one of the great investments — shares have risen more than 300-fold since the company’s 1985 initial public offering; including dividends, a $5,000 investment would have turned into more than $2 million in less than 40 years. Costco is now the 30th most valuable company listed on a U.S. exchange; among legacy retailers, only Walmart and Home Depot have larger market capitalizations.

So when Costco makes a significant change, it’s worth noting. We have four decades’ worth of evidence that this is a company that knows exactly what it’s doing. And what Costco is doing now is cracking down on abuse of its membership, as multiple outlets reported last week. The company is asking for identification even in its self-checkout lanes after rising incidents of abuse in which consumers “borrowed” membership cards to shop at the retailer.

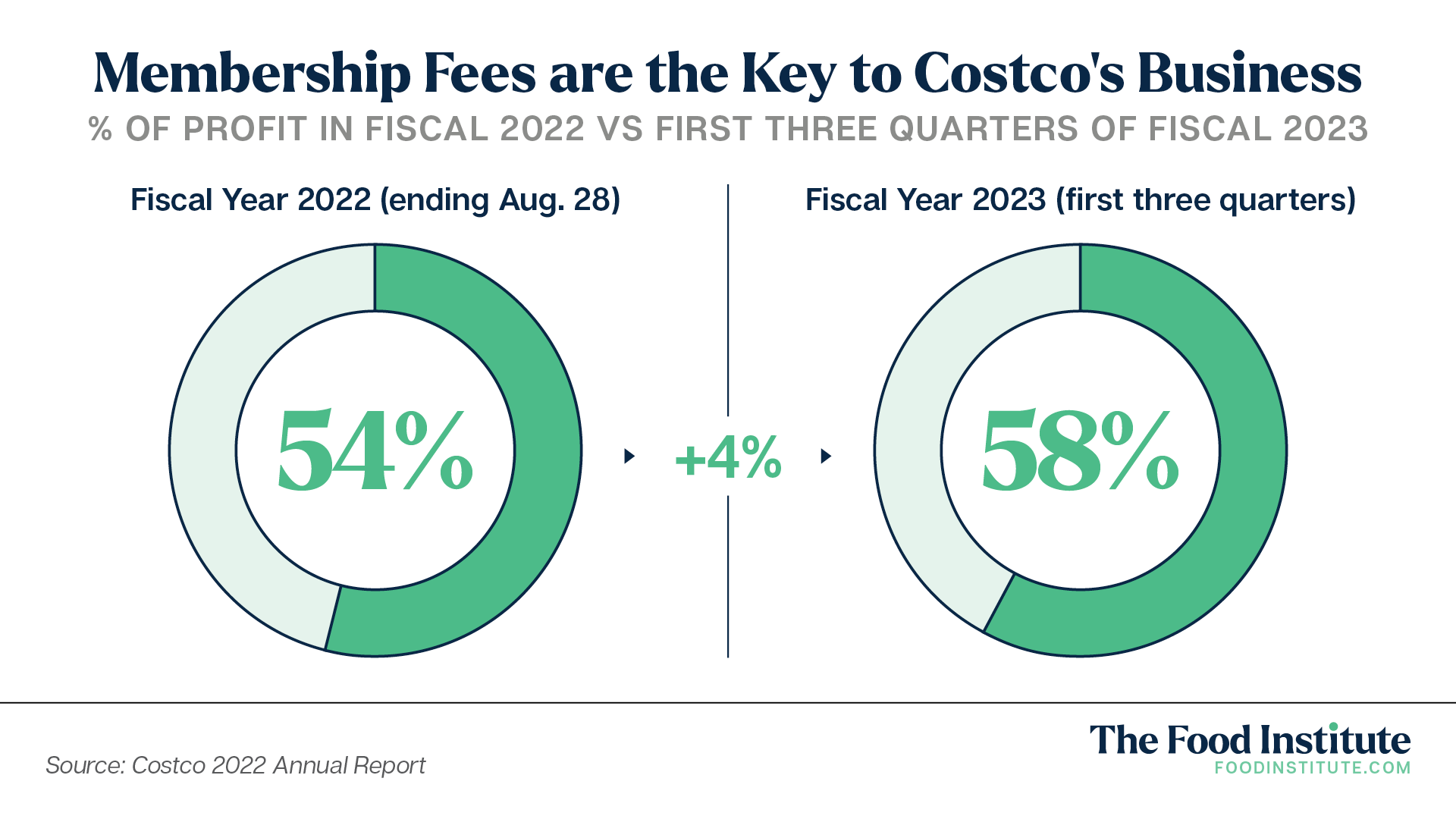

It’s unusual for a retailer to make it more difficult for consumers to shop at its stores. But membership fees are the key to Costco’s business. In fiscal 2022 (ending August 28), membership fees accounted for 54% of the company’s operating profit; the figure has risen to 58% in the first three quarters of fiscal 2023.

In other words, there’s a virtuous circle here between the business and its customers. It’s the membership fees themselves that allow Costco to price its goods at a level that makes paying the fees worthwhile.

That said, Costco’s move is interesting because there’s potentially an argument that a little bit of abuse could be the right amount for the company. Costco does make some profit from selling its goods, after all. In fact, it makes much more than it used to.

Between fiscal 2014 and fiscal 2018, on average membership fees accounted for 71% of operating profit, a notably higher proportion than its fees generate now. During those years, non-fee operating profit was about 0.9% of sales. Over the last seven quarters, the profit margins from product sales have been roughly 1.5% of revenue. On such a massive base — trailing twelve-month revenue is well past $200 billion — that margin expansion is material to overall results.

Management could reasonably argue (though not in public, of course) that if a decent proportion of those using borrowed memberships would not in fact get their own membership then the incremental sales are positive for the business. Those customers perhaps aren’t paying their “fair share” — but what they are paying is better than nothing.

No One Is Immune to Inflation

Of course, trying to strike that balance runs a risk of the problem simply snowballing. But the bigger problem might be inflation.

Even Costco is feeling the impact. Through the first three quarters of fiscal 2023, operating income has risen less than 1%. Profit declined year-over-year in Q3. And Costco has held the line on pricing as gross margins are essentially identical between FY22 and FY23, but labor inflation has contributed to rising operating expenses that erased overall profit growth.

Critically, the multi-year trend of the business generating higher margins on product sales has reversed. That trend mattered; it’s a key reason why COST stock has been a winner of late, providing total returns of 484% over the past decade.

Costco’s move here suggests that membership fees may again return to being 70%-plus of operating costs because still-rising costs are limiting the company’s ability to profit even marginally on product sales. If so, that’s a concern — and not just for Costco. After all, if one of the country’s best retailers is facing challenges from inflation, then no retailer is truly safe.

Vince Martin is an analyst and author whose work has appeared on multiple financial industry websites. He’s the lead writer at (www.overlookedalpha.com) Overlooked Alpha, which offers market-wide and single-stock analysis every week.