Grocery delivery services such as DoorDash, Grubhub, Uber Eats, and Instacart are off to a rocky year as persistent high prices threaten consumer purchasing behaviors.

These inflated costs have led over 55% of consumers to reduce their grocery delivery order frequency due to concerns over price, according to a recent report from delivery driver assistant platform Gridwise. The Annual Gig Mobility Report 2025 found that the perceived value is becoming a hindrance to delivery capabilities, with only 46.6% outright agreeing that grocery delivery services offer a good value for the price.

As a result, the industry has hit an inflection point: 58.2% of consumers report that they would switch to in-store shopping if grocery delivery fees were to continue increasing. The report noted that, to these price-sensitive customers, added value propositions such as discounts or subscription plans could help keep them in the ecosystem.

Instacart recently posted its fourth-quarter earnings call, showing that its revenue rose 10% to $883 million, missing the $891 million analyst estimate and causing the company’s stocks to fall 12% on Feb 26, its worst day on record according to CNBC.

It’s clear the delivery darling is struggling to sustain growth, a likely issue consistent across platforms. Consistently elevated prices at both grocery and food-away-from-home spending underlie much of these concerns.

Grocery Delivery Competition Heats Up

So, what’s ahead for Instacart? CEO Fidji Simo wrote in a letter to investors that it will double down on its omnichannel commitment.

“Our deep integrations with retailers position us well to win in omnichannel,” wrote Simo.

“More of our retail partners are adopting our connected store solutions like AI-powered Caper Carts, electronic shelf label software Carrot Tags, and catering management system FoodStorm, which are all showing signs of strong product-market fit.”

Where restaurant delivery began the food delivery wars, grocery delivery will be its next battleground. Instacart partners with over 1,800 retail banners and can leverage these relationships to forge deeper connections that can facilitate omnichannel experiences and advertising opportunities to generate growth.

“And research shows that omnichannel customers are more valuable, with higher purchasing power and more annual shopping trips than brick-and-mortar-only customers,” continued Simo.

“Our deep integrations with retailers position us well to win in omnichannel.”

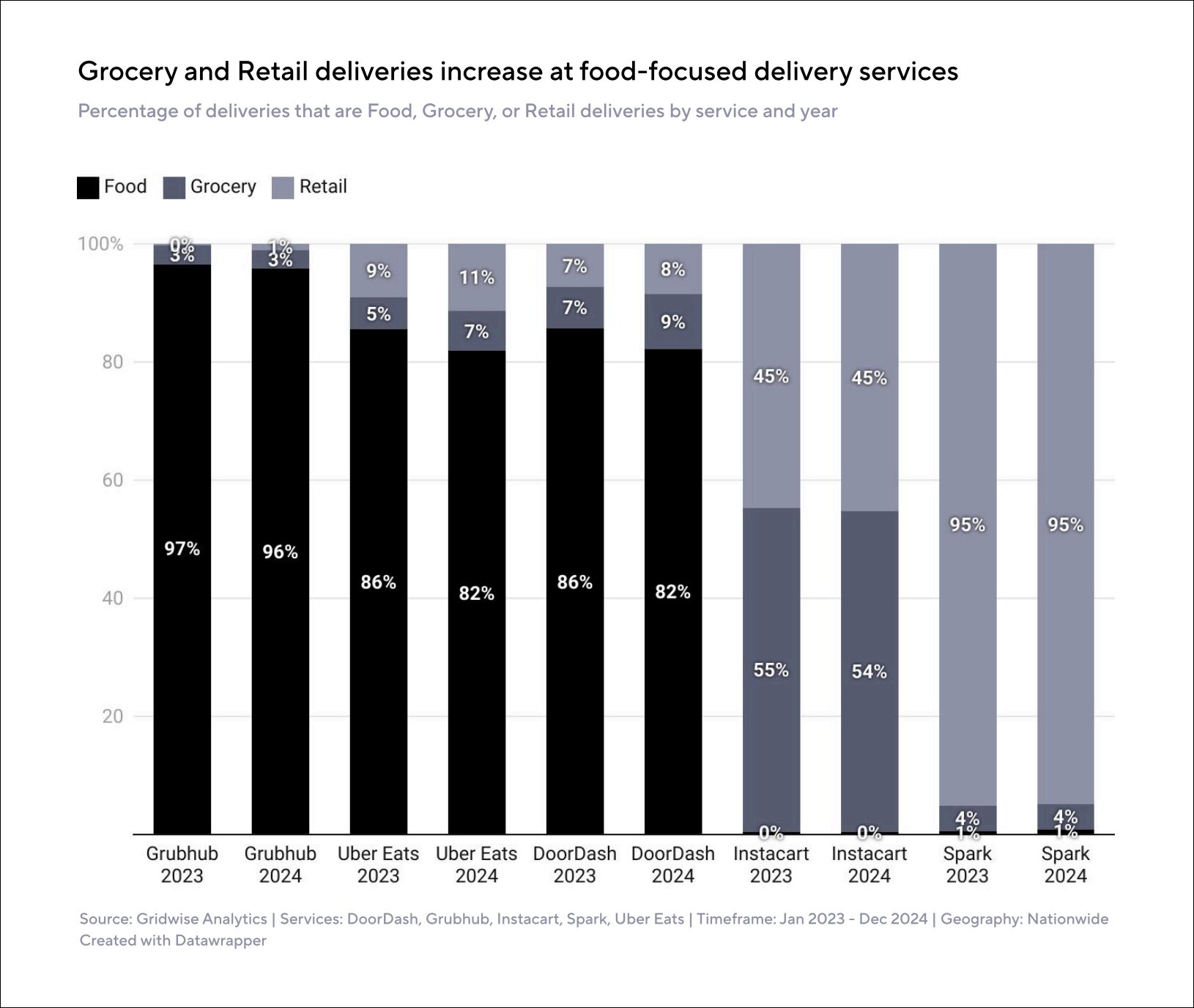

Overall, grocery delivery is a small, but meaningful aspect of the online delivery market, but Instacart is a clear leader, having invested on pure grocery since its inception.

Other services, however, are catching up. DoorDash, for example, recently solidified its commitment to regional grocers with the introduction of four retail banners to its platform. Angelo Caputo’s Fresh Markets, Festival Foods, Marc’s, and Woodman’s Food Markets, are the latest in a recent strategy to bulk out its grocery vertical.

This strategy is recent, with many coming on in 2024, including all Ahold Delhaize USA’s banners, H Mart, and all Wakefern Food Corp banners, according to the platform. As such, the company ended last year with 9% of sales coming from grocery.

Analyzing this data, one thing is clear: 2025 is shaping up to be a pivotal year for delivery services.

The Food Institute Podcast

How does one ride the skate ramp in CPG? Dr. James Richardson, author of Ramping Your Brand and owner of Premium Growth Solutions, shares some of the pitfalls many early-stage CPG brands make, and highlights some of the pathways to success.