On the surface, the appearance of highly pathogenic avian influenza (HPAI) in 2022 should have pushed prices up for both chicken and eggs at an equal level. But anyone keeping an eye on supermarket shelves knows this is not the case.

In its Livestock, Dairy, and Poultry Outlook: January 2023 report, USDA noted prices for eggs had risen by 32% in 2022 when compared to 2021, which was the highest in the data set; poultry posted the second highest increase, but the increase was less than half of that exhibited in the egg industry at 14.6%.

Why were the prices increases for eggs and chicken so vastly different? The Food Institute spoke with Wells Fargo Agri-Food Institute Sector Manager Kevin Bergquist to help answer that question.

Different Chickens but Similar Vulnerability

It’s worth noting that most of the chicken consumed in the U.S. comes from the broiler chicken variety, which is distinct from chickens used in the egg-laying industry. Those birds are commonly referred to as “layers.”

“Broilers and egg-laying hens are actually different species of birds, but both are very susceptible to infection from HPAI,” said Bergquist. “Whether a broiler or an egg operation, the HPAI protection measures directly undertaken are very similar.”

HPAI Impacted Each Industry Differently

Bergquist noted the broiler chicken industry had been less impacted by HPAI in 2022 as fewer birds and operations were hit by the outbreak. This industry was still in a long-term operational recovery from COVID-19-related factors.

When broiler chicken production increased in mid-2022, basic supply and demand dynamics took over, leading to lower chicken prices. Meanwhile, the national egg supply was constrained as HPAI hit this sector harder.

“It comes down to basic supply and demand, although there are multiple underlying issues. The current supply of eggs is constrained, which supports a higher price environment. Chicken prices, conversely, moderated in 2022 essentially due to increased availability,” he said in an e-mail to The Food Institute.

Flock Size Matters

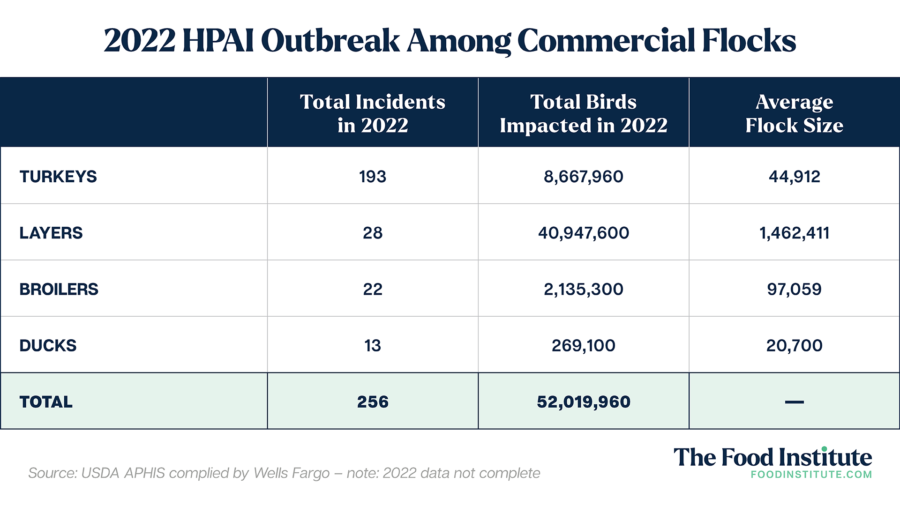

Bergquist noted the physical configuration of the egg-layer industry and the broiler chicken industry could help explain some of the disparity. In 2022, USDA reported 28 incidences of HPAI on an egg-laying flock, while 22 were reported for broiler chicken operations.

“Layers only had six more incidents of an HPAI infection, but the average flock size is 15 times larger than that of broilers. Therefore, when HPAI hits an egg-laying operation, many more birds are impacted compared to an infection at a broiler grower site,” he said.

This was evident in the turkey industry, too: although USDA reported 193 incidents of HPAI on turkey operations during the year, only 8.7 million turkeys were culled.

“Broiler companies most often have numerous independent contract growers who raise the broiler chickens from baby chicks to grow out to market size (5-7 lbs.). Most of these individual grower operations are relatively small and are widely dispersed for miles all around the central processing facility…if one grower’s flock gets infected, it doesn’t necessarily impact any of the other growers in the region because of the physical separation between growers,” Berguist said.

On the other hand, eggs are produced and processed daily, and the most cost-effective physical configuration is to design layer houses that are directly connected to a processing and packaging plant. A particular layer house may contain thousands or even hundreds of thousands of hens or more.

“If HPAI hits an egg-laying operation, all of the hens at the site are destroyed because of the close proximity of the houses. It is inevitable that if HPAI is detected in one egg layer house, within a day or two it will be in all of the houses on site. Since the average egg-laying flock size is 1.46 million infected birds, that’s a lot of hens taken out of egg production in just one unfortunate HPAI circumstance,” Berguist added.

Potential for Disruptions in 2023

Egg-laying flocks were hit especially hard in 2023, with 42 million egg-laying chickens culled since February 2022 in efforts to stem the outbreak. The broiler chicken industry dodged the worst of the outbreak, but Bergquist said that may not be the case in 2023.

“As to the broiler market, whatever the 2022 HPAI impact on price was, it was short-lived at best, and the market has found a new point of equilibrium between production and price. Unless HPAI directly and more significantly infects broiler growers in 2023, the broiler market overall will likely not see any additional impacts,” he said.

The Food Institute Podcast

Click the play button above to listen to the episode.

Recent cyberattacks have shown the business and reputational impacts of a breach, but what technologies can be used to protect your organization? SmartLedger’s Bryan Daugherty and Gregory Ward explain how CERTIHASH Sentinel Node can help a company detect a cyber intrusion more quickly, while IBM’s Patryk Walaszczyk shares how the technology could redefine cybersecurity.