Fifty-two percent of consumers say they value convenience now more than they did in the past, according to a recent report from Deloitte about how grocers can win a greater “share-of-stomach” through fresh and/or convenient offerings. The report, titled “A Fresh (Food) Take on Grocery Convenience,” surveyed 1,000 U.S. retail executives, and 2,000 consumers.

The report found that consumers are demanding fresh food: roughly 90% note that fresh food makes them “happy” and 66% indicate they would pay a premium for fresh foods.

Opportunities in Grocery

“Shoppers love fresh food and crave convenience, finding new ways to provide consumers with ‘fresh convenience,’ by offering fresh choices in approachable ways could help drive more sales,” said Daniel Edsall, grocery leader and principal at Deloitte Consulting.

Edsall highlighted that grocers are well-positioned to capitalize on the shifting consumer landscape. Already some of these changes are happening at retail:

52% of grocery executives expect fresh items to be their most strategically important market in the next one to three years, the report revealed.

Earlier this year, Jonna Parker, principal of fresh foods at research firm Circana discussed the importance of fresh products during a talk at the NGA Show.

“The reality today is that traditional supermarket grocers are losing share in fresh foods at an alarming rate” she said. Panelists, including Dave Holloway, director of produce and floral at Busch’s Fresh Food Market, added that retailers, especially independent retailers, should drive more value for their local communities while maximizing profits by tuning up their fresh departments.

As consumers continue to feel swindled by the unreliability of grocery delivery apps to include fresh produce, the category is a compelling reason for consumers to enter the physical store, which can further promote profits across all aisles. Brian Framson, president of juice equipment company Citrus America, commented on how the category’s “halo effect” can benefit independent grocers.

“Sixty percent of perimeter growth is driven by produce,” said Framson.

Convenience vs Fresh: The Tug of War

Despite consumer interest in fresh foods, the Deloitte report found that, when deciding between fresh or convenience, “ease” tends to win out. Some key findings include:

- 82% of shoppers note that convenience drives their fresh food decisions.

- 62% of shoppers say that, on busy days, they buy more convenient food items, even if they are not healthy or fresh.

- 52% of consumers say they value convenience now more than they did in the past; this view is more common among millennials (57%) and Gen Z (61%).

Grocers are aware of these concerns and are revamping their strategies to win in this area. Some of these changes include the following:

- 85% of grocers indicate that are making investments to increase their convenience offerings; this could look like speedier checkouts, easier-to-navigate floorplans, streamlining return policies, and even bulking up prepared foods sections.

- 84% agree that competing on convenience will also help them energize their volume sales bottom line.

- 65% of grocery executives say their companies are increasing investments in Generative AI (GenAI) technology to offer added convenience, and 73% say their companies will have a major application in place within the next six months.

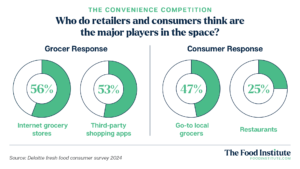

Threats in Convenience

Traditional grocers are concerned about competing in convenience, according to the report. The graphic below outlines some of these worries.

Convenience stores themselves are another area consumers are looking to for quick, easy meals. Research highlighted in Food Institute’s August 2024 report on convenience stores found that 41% of convenience shoppers are purchasing hot prepared foods at least once a week and that 51% rate these offerings as just as good as quick-service restaurants.

To learn more about how convenience stores are changing the retail and foodservice landscape, become a Food Institute member to access all our industry insights. Join now.

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.