A growing number of food tech companies are using precision fermentation to create animal-free proteins in pursuit of a more sustainable future. Although still in its infancy, the market shows strong potential for future growth across multiple categories.

The global precision fermentation market is predicted to grow at a compound annual rate (CAGR) of 40.5% between 2022 – 2031, per Research Dive, with the North American market predicted to be the most profitable by the close of the forecast period.

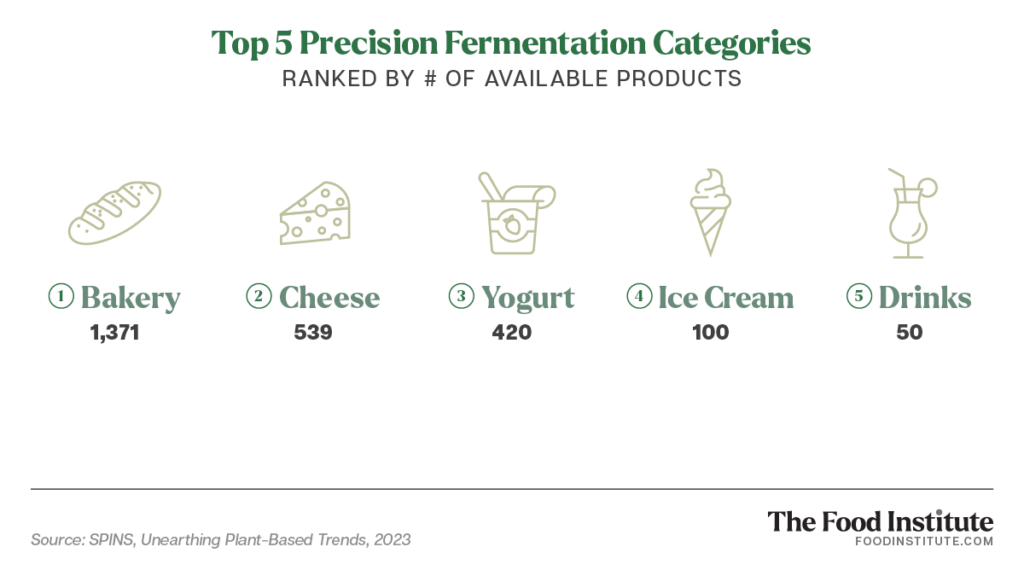

The dairy sub-segment is expected to be the most dominant, due to growing utilization by the dairy sector for producing cheese products. The industry is also making significant strides in animal-free egg substitutes — a noteworthy trend at this year’s IFT First expo — while increasing consumer preference for plant-based meat is anticipated to fuel growth over the long-term.

A Dairy Revolution?

In August, precision fermentation company New Culture reached a manufacturing milestone for its animal-free casein, enabling it to reach price parity on factory-farmed cheese within three years, reported The Spoon.

New research published in International Food and Agribusiness Management Review Journal suggests that even with a 25% price premium, a sizable number of consumers will adopt animal-free cheese, accounting for an initial 22% market share.

“The question of whether society will embrace the next generation of food has loomed over the cell-ag space for quite some time,” Associate Prof. Peter Slade of the University of Saskatchewan told Green Queen. “As long as precision-fermentation dairy can achieve competitive prices, it is poised to revolutionize markets.”

Key Challenges to Price Parity

At present, scale is the major limiting factor for precision fermentation.

According to Jack Ellis, Senior Associate of Agriculture & Food at Cleantech Group, many existing precision fermentation facilities have been designed with pharmaceutical production as a template.

“While such facilities can work for early-stage exploratory work and pilot-scale food production, they do not fit the cost structure for commercially manufacturing food products at mass scale,” Ellis told The Food Institute.

Furthermore, contract manufacturing facilities that are optimized for food production are limited in number, “meaning that precision fermentation startups often have to compete for limited capacity.”

Another key barrier to entry from the food industry side is cost of goods sold, says Monica Bhatia, a biochemistry PhD and co-CEO of food technology company EQUII.

“Precision fermentation-derived products would have a hard time creating ingredients at less than $25/kg in the next several years, whereas traditional food is for the most part using extremely cheap ingredients,” Bhatia told The Food Institute.

Solutions and Outlook

To overcome scalability hurdles, Ellis notes that contract manufacturers have begun tailoring offerings for the industry, and in some cases, building structures into contracts to help startups with financing along the way.

Collaborative industry efforts and government support initiatives are also helping to create strategic partnerships and shore up funding. For instance, in February 2023, nine precision fermentation leaders across the globe united to from the Precision Fermentation Alliance, a trade organization created to serve as a voice and global convener for the industry.

But will precision fermentation technologies ever become accessible enough to curb escalating demand for animal-based protein across the globe?

Bhatia believes that the precision fermentation-derived products will most likely remain confined to highly niche or specialty ingredient categories due to overall cost of goods. “For EQUII, we have reduced cost of our protein to <10$/kg yet we face an enormous cost burden to navigate traditional retail.”

To Ellis, reaching a level in which precision fermentation becomes more sustainable and economically efficient depends upon multiple factors.“Expansion and modernization of manufacturing capacity is one part of this; feedstock availability and sustainability is another,” said Ellis. “If all of this comes together then precision fermentation can certainly become a major part of the future food system alongside plant proteins and cellular agriculture.”