The U.S. government halted imports of new-harvest avocados from Mexico for nearly a week after a U.S. inspector was threatened, months ahead of one of the highest-consumption days for the product.

While the USDA’s Animal and Plant Health Inspection Service (APHIS) announced Feb. 18 that its avocado inspection program in Michoacan, Mexico, had restarted and avocado exports to the U.S. resumed, what could happen if the suspension is reinstated ahead of Cinco de Mayo?

A Look Back

USDA said the suspension was issued Feb. 11 “following a security incident (verbal threat) involving our employees. The market was reopened Feb. 18 after USDA worked with the U.S. Embassy in Mexico’s Regional Security Officer, Mexico’s national plant protection organization (SENASICA), and the Association of Avocado Producers and Packers Exporters of Mexico (APEAM) to enact additional measures to enhance safety for APHIS’ inspectors working in the field.

“The safety of USDA employees simply doing their jobs is of paramount importance. USDA is appreciative of the positive, collaborative relationship between the U.S. and Mexico that made resolution of this issue possible in a timely manner,” the agency said via a press release.

Due to the massive growth of Mexico’s avocado trade, cartels in Michoacan began to fight to control it. In 2017, it was revealed that cartels in the region had extorted avocado farmers for decades, reported Newsweek (Feb. 14).

Suspension of Avocado Imports

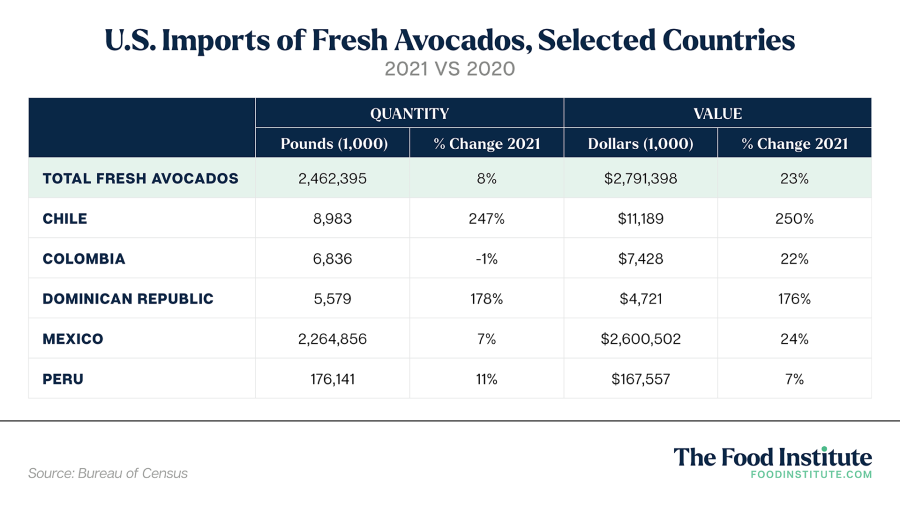

The suspension of imports could disrupt an otherwise lucrative avocado trade between the countries. Imports were up 8% on a volume basis in 2021, reaching nearly 2.5 billion lbs. worth $2.8 billion, according to Food Institute analysis of Census Bureau data

Despite increased import volume from Chile (+247% to nearly 9 million lbs.) and the Dominican Republic (+178% to about 5.6 million lbs.), Mexico represented the lion’s share of imports and accounted for about 92% of the annual total in 2021.

Avocado imports from Mexico are exclusively sourced from the state of Michoacan, although market access was set to open for the state of Jalisco at the start of the new harvest season in April. It remains unclear how the current events will impact the opening of this market.

“This negotiation was going on for several years as U.S. agriculture officials were working with the Mexican agriculture officials to achieve compliance and certification to ship to the U.S. Jalisco is still a young avocado growing region. It is estimated that Jalisco produces export volume at 10-15% of the Michoacan volume. That volume is still equivalent to the average volume of the California crop,” said Brad Rubin, a sector analyst with Wells Fargo, in an e-mail to The Food Institute.

California Production

Although the California Avocado Commission forecast showed an increase over the 2021 season, its harvest would likely not be enough to make up the gap caused by a prolonged import suspension, according to Dr. Michael Swanson, Wells Fargo’s chief agricultural economist.

Per capita consumption of avocados reached 8.9 lbs. per person in 2020, according to Food Institute analysis of USDA data. Just five years earlier, per capita consumption was only 6.9 lbs. per person.

The commission estimated a harvest of 306 million lbs., representing a 15% increase over the final harvest in 2021. Volume was expected to ramp up in earnest in March, with 80% of the seasonal volume expected between April and August.

“California avocado growers welcomed rains in December and January because they moved the region from severe drought to moderate drought conditions, and rain usually has a positive impact on tree health and avocado sizing,” said Jan DeLyser, California Avocado Commission vice president of marketing in a press release.

Demand Still Strong at Retail, Foodservice

Supermarket sales of fresh avocados were down 9.6% on a unit basis to about 1.2 billion units in the 52 weeks ending Feb. 6, according to Food Institute analysis of IRI data. Dollar sales were down 0.9% to $2.5 billion, as well. However, when compared to the pre-pandemic period of February 2020, sales were up on both a dollar (+7.4%) and unit (+10.7%) basis.

210 Analytics principal Anne-Marie Roerink noted avocados were one of the few items to post significant deflation in 2020, and it wasn’t until third quarter 2021 that prices began to rise. During the deflationary period, consumers jumped on the ability to buy many more avocados at a good price, which made unit and volume growth comparisons to 2021 difficult.

“Because of this deflation, the 52-week look for avocados makes it look like America’s love affair with avocados is over, but this is all but true,” she told The Food Institute in an e-mail.

Meanwhile, Chipotle Mexican Grill could face a supply chain nightmare if another suspension were to occur. Known for its guacamole, the company has taken steps in recent years to diversify it’s supply chain, but like most U.S. companies, it relies on Mexican product to fuel its guacamole sales, reported The New York Post (Feb. 15).

Holiday Impact

In 2021, avocado producer Mission Produce estimated 100 million Americans would celebrate Cinco de Mayo, and those consumers would eat about 70 million lbs. of avocados for the holiday.

“Cinco de Mayo is fairly regionalized across the Pacific and Southwest regions of the country. People may look to buy avocados for guacamole, but [the import suspension] shouldn’t be too impactful,” Wells Fargo’s Rubin said before the suspension was lifted. “The prices may go higher as product becomes harder to get or more expensive to import, but the supply should be enough for Americans and Mexican Americans to partake in Cinco De Mayo festivities,” said Rubin.