The trend of pure play grocers struggling has flipped since 2020, with supermarket stocks for grocers like Albertsons holding their own.

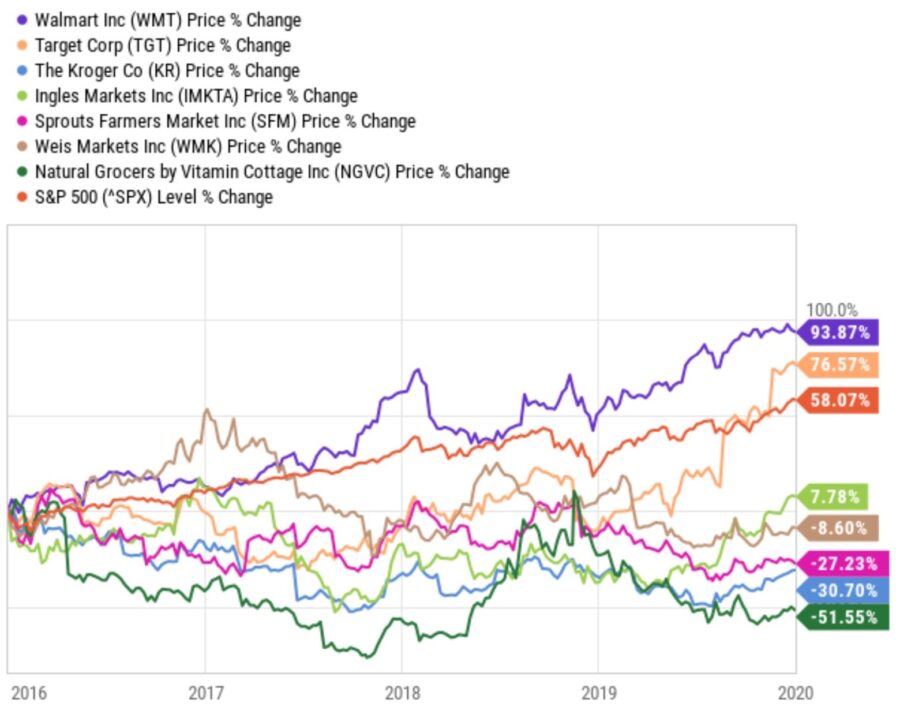

Before the pandemic struck in earnest in 2020, the conventional wisdom was that pure-play grocers were in trouble. Certainly, the stock market believed as much.

From the beginning of 2016 to the beginning of 2020, shares of both Walmart and Target nicely outperformed the market as a whole, as measured by the Standard & Poor’s 500 Index. During the period, supermarket stocks did not just underperform, but declined:

Source: YCharts

Amazon’s 2017 acquisition of Whole Foods — and its subsequent price cuts — clearly played a role in investor sentiment. That purchase highlighted the existing fear surrounding the sector: that over time pure-play grocers simply wouldn’t be able to compete. That fear was not created, only amplified, by Amazon’s entry into the industry.

Indeed, as The Motley Fool noted in late 2019, even Kroger was ceding market share to Walmart. In that context, less-scaled supermarkets seemed to have little chance of competing.

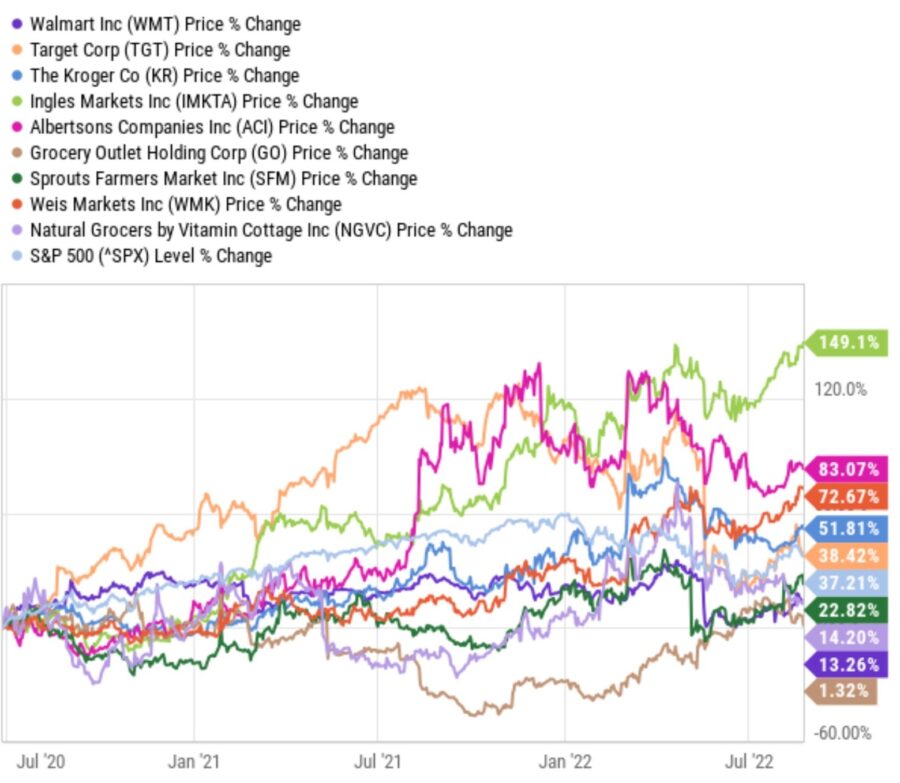

But a funny thing has happened since June 2020, when Albertsons went public, the trend has flipped:

Source: YCharts

To be sure, factors outside the grocery business are at play for Walmart and Target. The two companies are dealing with billions of dollars in excess inventory in apparel, electronics and other categories; clearing out that inventory has led to sharply lower profits beyond grocery.

Still, grocery stocks — and particularly the larger grocery stocks — have done exceptionally well. They’re outperforming not just Walmart and Target (and Amazon — whose shares are flat over this period), but the market as a whole.

Several factors explain the rally. Obviously, the damage inflicted by the pandemic on the restaurant space proved a benefit for grocers. More recently, inflation has provided a similar boost, pressuring smaller restaurants and leading to greater share for supermarkets.

But the sector also has responded well to existing challenges. Digital offerings now are essentially standard across the industry, minimizing the early technological edge held by the likes of Walmart and Amazon.

Careful cost controls have allowed grocers to keep much of the inflationary increase in prices. Recent financial results do show modest compression in gross margin percentage for supermarket operators, but gross margin dollars have risen nicely and helped drive underlying profit growth.

For the time being, these trends should hold. Consumers already are switching to private label brands, a potential tailwind for supermarket profit margins. Inflation has moderated this summer but remains an ongoing threat to restaurants and third-party delivery services.

But risks still loom. Perhaps lost in the disappointing results from Walmart this year has been the fact that its grocery business is performing exceptionally well. The retail giant said after both first and second quarter results that it had taken market share in grocery.

So, while independent grocers are performing well now, their work isn’t done just yet.

Vince Martin is an analyst and author whose work has appeared on multiple financial industry websites for more than a decade. He is the lead writer at Overlooked Alpha, which offers market-wide and single-stock analysis every week. He has no positions in any securities mentioned.