Major salad chains, including Sweetgreen, Just Salad, and Cava, enjoyed sizable growth in 2024 as consumers shifted toward healthier lifestyles; however, competition is heating up, and these brands are looking to diversify their offerings.

Salad chains threaten market share losses from all angles, including grocery, other fast-casual eateries, and quick-serve restaurants.

On the grocery side, recent Food Institute analysis of the Bureau of Labor Statistics CPI data that marks inflation uncovered that, in February, food-away-from-home prices outpaced that of food-at-home, up 0.4% month-over-month compared to 0.1% on an unadjusted basis. The gap widens year-over-year: food away-from-home prices increased 3.7% compared to food-at-home’s modest 1.9% increase.

In an uncertain economic environment, consumer spending will likely continue to pull back, similar to last year.

“Shoppers are cutting back on eating out and are looking to recreate the foodservice experience at home at a lower price,” said Chandler Steele, senior manager of fresh meats innovation at Tyson Foods, in a Supermarket Perimeter story published last August.

Today, experts worry about recession risks related to trade tensions, policy uncertainty, and flatlining consumer confidence, NBC News reported. Financial betting service Polymarket places odds on a recession in 2025 at 40%.

Heading into this financial environment, fast food chains, including Wendy’s and McDonald’s, are getting craftier as they fight for shrinking food dollars. The latter chain, for example, is piloting its next foray into better-for-you center-plate offerings in Canada with the McVeggie following a seemingly unsuccessful domestic test of the McPlant developed with Beyond Meat.

Fear of Peak Salad

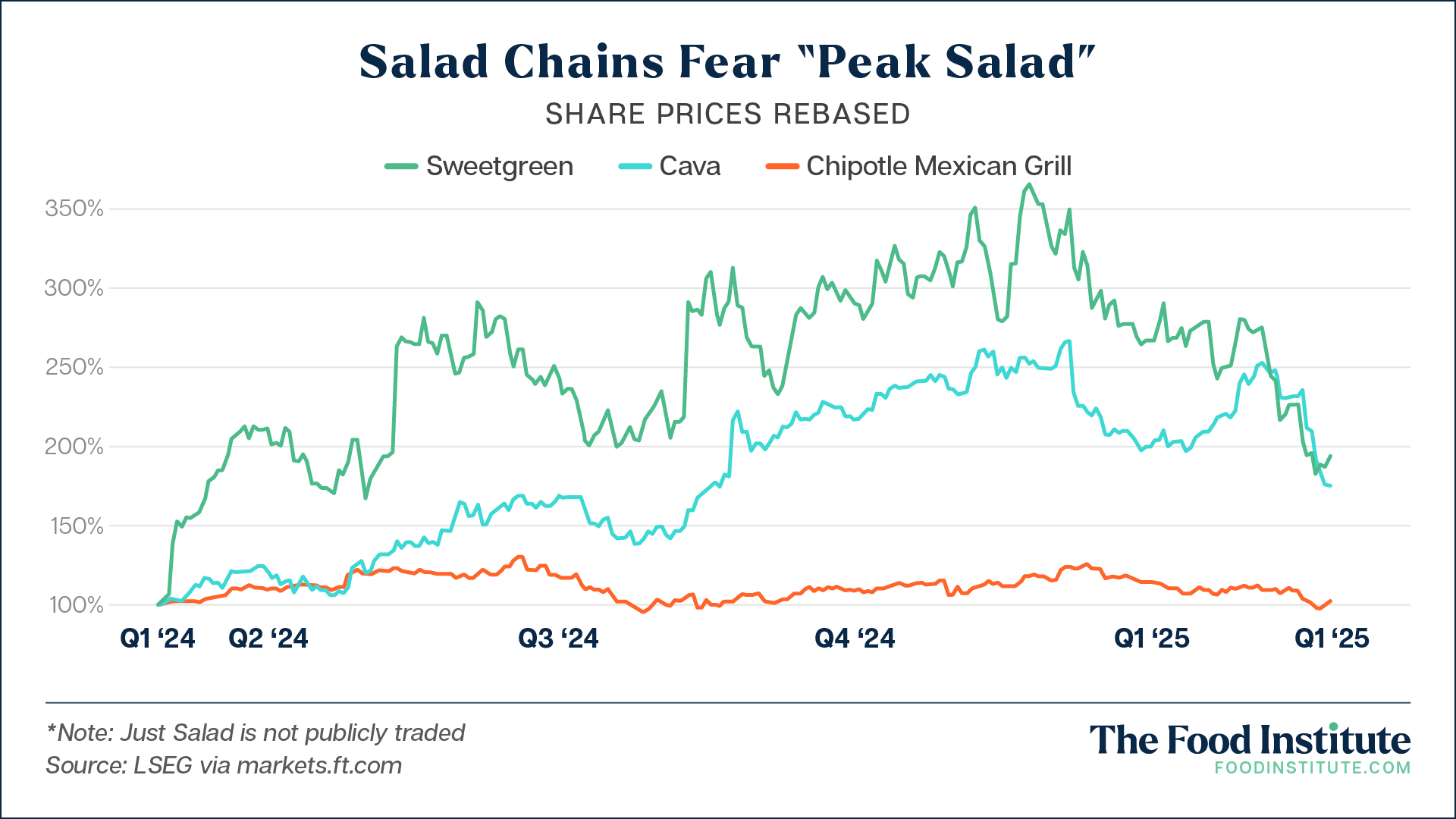

Q1 2025 market stagnation, however, begs the question, “Have we hit peak salad?” Financial Times data suggests maybe.

According to the report, Sweetgreen and Cava report a slowdown in their metrics. The former salad staple expects sales growth to slow to between 1-3% for 2025 after hitting 6% in 2024, and the latter Mediterranean-inspired chain projects same-store sales to expand 6-8%, down from last year’s 13.4% growth.

The latest data is a far cry from their historic success. Last year alone Sweetgreen and Cava shares tripled. Investors are still holding out hope for the segment: Just Salad hit “unicorn” status in February having secured a $200 million investment that brought its valuation to $1 billion.

Just Salad is also a unicorn for other reasons—the chain boasts “impressive same-store sales growth … outpacing others in the fast-casual category … driven by increased consumer traffic during the past year,” said Michael Carmen, co-head of private investments at Wellington Management, the investment group responsible for the recent capital raise milestone.

Nevertheless, competition in the sector has pushed companies to think outside of the box as they look to expand their footprints.

The Path Ahead—Leveraging New Levers

As businesses look to recoup their former glory, their strategies target new markets while appealing to additional day parts.

Just Salad, for example, recently launched an entrée optimized for dinner time.

The Market Plates offer a “dinner-friendly” option for consumers looking for healthy choices. Additionally, the brand notes it caters to evolving consumer needs as it expands.

Chicken + Tzatziki Harvest Market Plate

“This launch reflects our understanding that today’s consumers seek quick and convenient options that deliver healthful, protein-forward meals, whether that’s for lunch or dinner,” said Just Salad founder and CEO Nick Kenner in a statement.

“By expanding our menu to include these chef-crafted plates, we’re answering the call from our customers who want to enjoy Just Salad in a variety of ways and beyond their traditional salad at lunch as we scale across the country.”

The offerings come in three core options: Chicken + Tzatziki Harvest, Braised Chicken + Pesto, and Chicken Fajita. Additionally, seasonal offerings will be made available for a limited time. The additions also complement the chain’s self-proclaimed “rapid expansion” strategy backed by the recent capital investment.

While the entrée endeavors to bring customers in for late-night dining, Sweetgreen’s latest creation prioritizes an indulgent experience akin to QSRs to complement a dinner or a light snack between meals.

The wavy-cut russet potato fry is designed for use with Sweetgreen salad dressing or the new Garlic Aioli and Pickle Ketchup dipping sauces.

Kelly Roddy, CEO of WOWorks, told FI in a story published late last year that savory indulgence may be a common growth lever for these health-focused brands.

“Salad chains seem to recognize that, while the core of their customer base will always want healthier options, a bit of indulgence … makes the dining experience feel less niche,” he said.

The fries coincided with Sweetgreen’s Richmond debut, targeting a new metropolitan market as it deepens its commitment to menu diversification. The Ripple Fries are expected to roll out to all other locations throughout the year.

Cava, on the other hand, is mobilizing its recently introduced a Pita Chip offering with a marketing campaign featuring a new brand character “Peter Chip” in celebration of National Pita Day on March 29.

The chain is also finding success in its permissible indulgence and is targeting younger audiences with its recent advertising campaign.

Last year, the chain and Sweetgreen both dipped their toes into the dinner market, introducing steak to their menus which Financial Times asserts boosted traffic during the evening, but Placer.ai data suggests left both chains struggling to connect with consumers.

While Cava outpaced fast-casual lunch sales by 6% in Q4 2024, their dinner visits only topped traditional eateries by 0.7%. On the other hand, Sweetgreen sat behind fast-casual dining with traffic down 0.9% over the same period.

Undoubtedly, these metrics signal the segments’ growth potential for around-the-clock dining.

The Food Institute Podcast

This Episode is Sponsored by: City National Bank

How are macro-economic factors and changing consumer preferences impacting the natural grocery sector? City National Bank’s Justin D’Affronte steps in as guest host as he speaks with Mother’s Market CEO Dorothy Carlow about inflation, tariffs, consumer preferences, and more.