NEW YORK CITY – Brian Choi, CEO of The Food Institute, and Sunny Khamkar, CEO of MenuData, took the Specialty Food Association’s Summer Fancy Food Show main stage recently for a conversation about the current specialty food environment.

The duo discussed the macrotrends shaping consumption patterns and dug into data to show where and how these consumers shop. The verdict: now’s a great time to be in food.

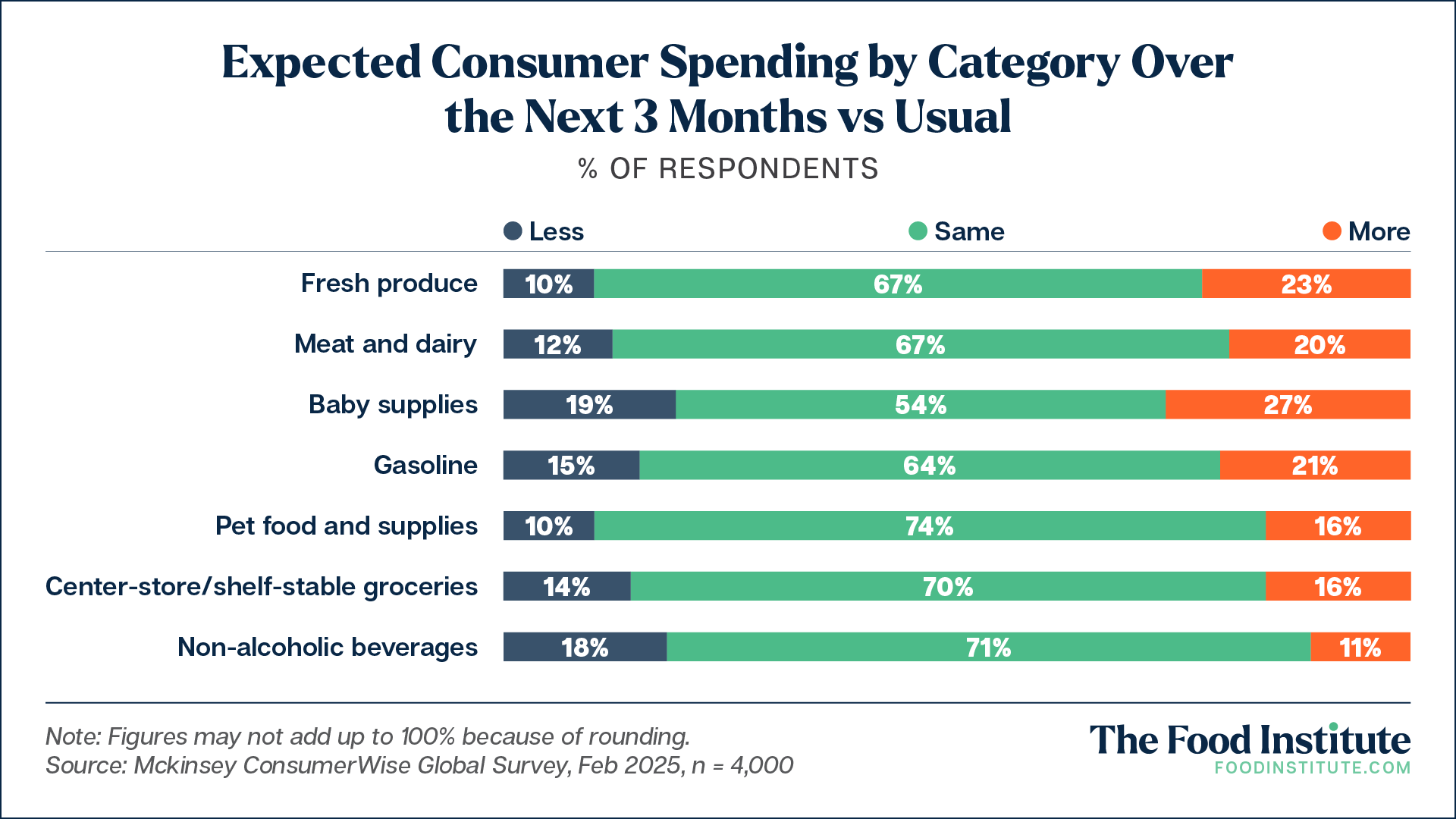

“When you look at how consumers are expected to spend over the next three months … we’re seeing [myriad] categories building up impact,” said Choi.

“In a nutshell, it’s good to be in food and beverage. People always have to eat. People always have to drink.”

Despite economic uncertainty and tariff concerns, specialty food category consumption, on the whole, is either maintaining or increasing market share at a rate that outpaces consumers’ expected decreasing tendencies.

This insight challenges consumer sentiments, where only 35% of Americans feel the economic situation is at least “somewhat good.” Choi said that bifurcated consumer characteristics is responsible for much of this disconnect. He noted how lower-income shoppers are more likely to step back on their specialty food consumption while higher-income consumers continue to purchase specialty products with a meaningful value proposition.

Moreover, government data reveals food and wage inflation has begun to stabilize after peaking in Q1 2023. This means that, although food prices continue to outpace average wage growth, the difference between the two continues to narrow. This allows cash-strapped consumers to afford more of their necessities.

Experimentation is Mainstream

Nestled into the prevailing microtrend which Choi and Khamkar dub “sensorial and global flavor experiences,” is the notion that consumers crave originality, and are willing to pay a premium for it.

Nearly 50% of consumers enjoy experimenting at home while 75% of consumers describe themselves as low to moderately price sensitive when buying specialty foods, meaning they either don’t worry too much about prices or will compare prices and still indulge on occasion, according to recent MenuData research.

These factors provide an opportunity for specialty food brands to offer the experimentation that their shoppers crave without becoming too preoccupied with eking out the thinnest profit margin – welcome news in an industry already operating under such constraint.

Consumer retailer preferences solidify this point. Although, price/value is the top consideration, product uniqueness, convenience, store experience, and ethical sourcing patterns also factor into the conversation. Moreover, when asked where consumers have purchased specialty foods in the past three months, farmers markets came out on top. This shows that not only are shoppers going to these places, but they’re seeking out specialty items from there.

“We were shocked to find the top response to be farmers markets. It signals that the consumer cares about fresh, minimally handled, artisan products,” said Khamkar. “It reinforced that storytelling piece around sourcing and [third-party] certifications.”

Clean Label Gets Cleaner

Strong industry forces, including the gradual growing interest in personal well-being, recent Biden and Trump administration action against synthetic food dyes, and the recent “Make America Healthy Again” (MAHA) movement mean specialty food retailers endeavoring to offer healthy products need to take a close look at their ingredients.

“Consumers don’t want 20 ingredients they can’t pronounce on their labels,” said Choi.

This coincides with attributes like grass-fed and ingredients such as avocado oil and ghee growing in usage.

The American Heart Association found that 77% of consumers actively seek a healthy diet; however separate research from ResearchAmerica notes that lack of time and lack of knowledge are among the barriers to a healthy diet. This gap highlights the need for these aligned brands to simplify the process with clear, consistent messaging.

MenuData found that, in assessing the entire retail landscape, the usage of overall health terms are up by nearly 15%. Additionally, healthy ingredient categories across major retailers dramatically increased their portfolio of products with healthy ingredients over the period.

This health movement has arrived to dominate the market and is here to stay. It’s up to specialty makers and grocery-industry stakeholders to meet these better-for-you-curious consumers where they are, and give them an easy solution to their unique need state.

The Food Institute Podcast

Several economic headwinds indicate the consumer is being financially stretched, but we all need to eat – so what are consumers actually buying at the grocery store? Nik Modi of RBC returns to The Food Institute Podcast to discuss channel differentiation, consumer product selection, and other macro trends.