Despite a season of sweeping tech layoffs and the rise (and concerns) about chatGPT and AI, inflation could be cooling and the mergers and acquisitions outlook remains strong. The Food Institute recently hosted a webinar focused on who’s buying, who’s selling, and who’s innovating, and the foodservice sector remains one of the stronger segments in the economy.

John Carey Siegler is managing director and head of food, consumer, and retail middle market M&A at BMO Capital Markets. Siegler has over 35 years of food industry experience and was joined by David Schoeder – principal at The Food Partners – who also has over three decades of investment banking experience in the food industry. Together, they analyzed the latest M&A activity, updated viewers on contemporary trends in spending, retail, CPG, and more, and offered an outlook on what to expect in the next several years. Here are some of the highlights.

Inflation & Recession are Pebbles in the Pond

Siegler led the webinar with a brief zoom-out of the past several years of M&A with one simple takeaway: the foodservice industry is in pretty good shape. Deal activity has remained steady as the last quarter marked the 10th straight with 70+ deals amid eight federal interest rate increases. Deals peaked in 2021. As inflation loomed, companies rapidly increased prices to combat inflation and credit markets tightened.

Still, food and beverage companies are doing well, particularly those with broad reach and who can act swiftly in the beverage space.

“I like to look at where the action is,” Siegler said, “and there’s healthy activity in almost all sectors, particularly in the better-for-you categories.” Many in the beverage space want to be “all things to all people” between functional, RTD (ready-to-drink), non-alcoholic, and more, and market sentiment remains strong with heavy growth potential.

Inflation is ebbing and the economy is weathering the rate hikes well, Siegler added. Unemployment is at a 50-year low, and though it’s easy to raise the alarm regarding the season of tech company layoffs, they’re minimal compared to the volume of employees hired by those same companies the past several years. Meanwhile, CPG growth has plateaued a bit as pricing on grocery, takeout, and restaurants is starting to coalesce, prompting people to eat out for convenience’s sake instead of spending the same at the grocery store. Despite trade-down in retail, most consumers are still spending similar amounts of cash.

The two-year stock performance of many key food companies offers a more resilient outlook than most may have assumed:

Two-Year Stock Performance (May ‘21 – March ‘23)

See webinar for full company results (15+ results)

There’s a lot of action and opportunity in beverage, and bakery, too. Many companies are looking for minority shares in growth sectors instead of majority shares, spreading their chips broadly. Ingredients companies are experiencing a boon as they allow larger CPG companies to be nimble, relevant, and quick to market.

Other key trends include:

- Major food players can sustain growth by broadening previous investment horizons

- Prioritizing product innovation though process refinement, new capabilities, and digital and e-commerce infrastructure

- Identify efficient go-to-market strategies

- Reprioritize the supply chain network

There’s Health & Wellness and Everything Else

Health and wellness is hot.

“Health and wellness is in front of everything,” Siegler noted. Many brands and products are focusing on health and wellness, including private label, which can distinguish itself with transparent, relatable ingredients that appeal to young shoppers in flavor and nutrition. As prices have skyrocketed in many traditional products, natural-branded product prices have not risen as dramatically.

Across all retail outlets, shoppers continue to buy natural products at an increasing rate, forcing CPG companies to respond with focused innovation. Shoppers trust third-party certifications and labels for sustainability credentials and natural ingredients. Consumers seek functional benefits and natural ingredients that support immunity, mental clarity, reduced cognitive deterioration, stress reduction, and digestive health.

Other trends in this space include clean and recognizable ingredients; development of new foods; trendy ingredients and plant-based proteins; trendy ingredient applications like probiotics and nootropics.

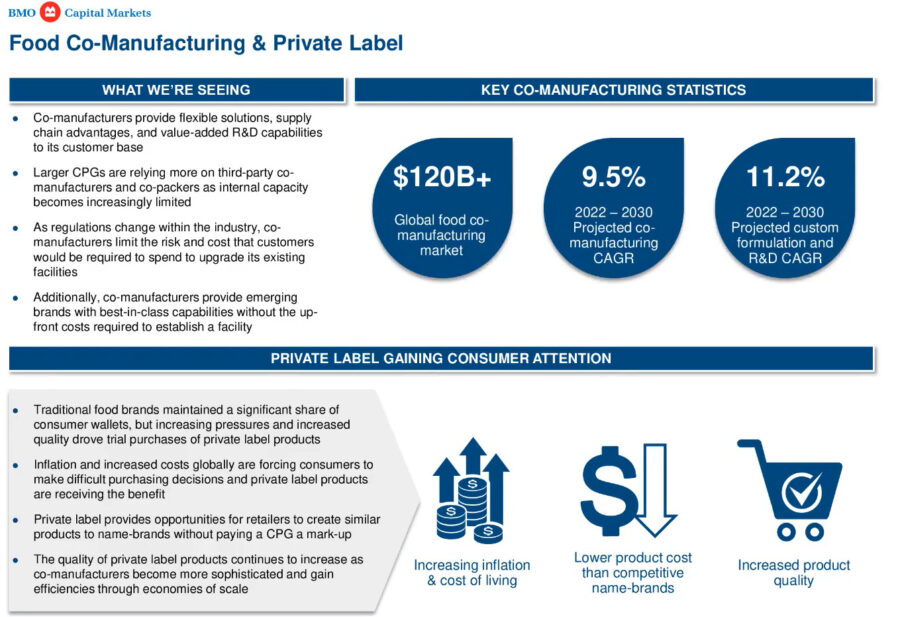

Co-manufacturing and private labels are seeing a lot of activity. There’s not much brand risk for larger companies – Siegler noted that brands come and go, and from a private equity perspective this is a good bet.

“Private label used to be Trader Joe’s and a few other specialty stores; now it’s a key strategy for major players such as Target, Sam’s Club, and other grocers and retailers,” Siegler said.

One reason private label is doing well is that omnichannel is ascendant; as people have returned to stores, they can compare products to private label, and private label’s value gets enhanced during an in-store comparison – it’s much harder and less convenient to do the same online.

Other strong sectors include bakery, frozen, and pet food. Frozen sees many international flavors and textures on the rise as consumers want to experience something different but not at the cost of going out, and many frozen products can match the quality of fresh equivalents. The pet sector is also exploding as many consumers refuse to trade down for their pets’ dietary and nutrition needs.

“The humanization of pets,” Siegler noted, “has built a huge mergers and acquisition business.”

To conclude his section, Siegler noted to always be critical of scale and how to achieve it; good, functional skill sets of people who can do a number of things are more important to help rationalize the growth of the business. Data remains essential to interpret what customers are doing and why.

More than anything, the mergers and acquisitions market should not radically change in the near future; “Today’s market is not going to stop the capital that’s out there to buy companies, and private equity firms are still flush with cash.”

The Pandemic Was Bad for People (and Good for Business)

David Schoeder described the perfect storm of events that led to high revenues for those poised to take advantage of them. Retailers and wholesalers benefited via the opportunity to curtail or eliminate advertising and other promotional efforts during the onset of the pandemic. The labor shortage benefited retailers who could operate at 60-70% capacity with 10-20% increases of top-line products. Consumers accepted out-of-stock, poor store conditions, long lines, and more with high brand loyalty and the incremental cash flow generated was unprecedented in the history of grocery – liquidity was at an all-time high in December 2021 and retailers used surplus cash to pay off debt while the cost of capital reached a historic low point.

Today, a new perfect storm has arisen between the war in Ukraine, rising interest rates, lingering supply chain issues, the maybe-not-over banking crisis, and, in Schoeder’s eyes, a quiet but possible real estate crisis on the horizon.

“We’re in chapter 4 of a 25-chapter Stephen King novel,” Schoeder said.

During the pandemic, retailers altered their operating procedures and merchandising strategies to further increase the bottom line:

- If a product didn’t fly off the shelf it was likely discontinued

- Retailers which limited or stopped paper ads are now rethinking their strategy

- Specialty food and variety for cooking-at-home contributed to greater sales

- No more limiting hours of operation

- Self-checkout lanes have increased

- Retailers with labor shortages are realizing they don’t need pre-pandemic levels of employee hours

Schoeder said consolidation is the name of the game in store sales/acquisitions. “We’ll probably see 250-350 stores sold for the next several years unless Kroger/Albertsons merges with another one,” he noted. The number of stores sold annually since 2011 has fluctuated between 300 and 1,000, and the average number of stores moving during each transaction is about 30.

“The KA merger does not create a monopoly nationally,” he said, “though the proposed business combination does create a monopoly in some markets; the question is whether the stores being spun off will be viable in the eyes of the FTC.”

He also noted it’s almost impossible to judge the actual value of today’s grocery stores using a five-year projection; 2020 – 22 “isn’t really valid,” he noted. Inflation is a wild card. SNAP is going away, which will really impact many stores’ revenues.

“ The good news is minimum wages in most states will be stable,” Schoeder added. Another harbinger of the future may be rising oil prices, he said. “That’s bad news for everyone, farmer to consumer. Few will benefit from store closures.”

Schoeder concluded by quoting Charles Darwin: “It is not the strongest of the species that survives, nor the most intelligent. It is the one most adaptable to change.”

Still, Schoeder expects the global economy to take a softer landing than many expect.

“If I were to name this Stephen King book, I might just re-use The Stand,” he said. “Most grocers, retailers, and employers are doing all right.”