As 2022 comes to a close, the vertical farming industry has been hit with a series of high-profile closures. This news came as a shock to many given that, just last year, investments into the industry reached US$ 3.66 billion. While there continued to be an influx of investment in 2022, the challenges to indoor farming rose faster.

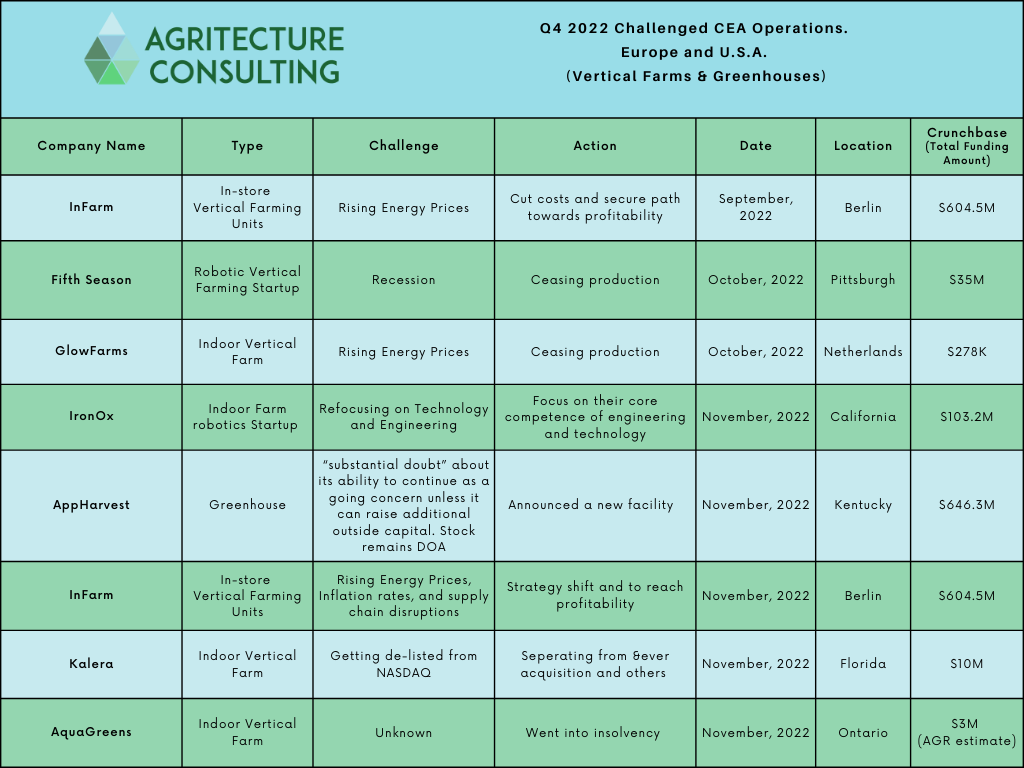

Table 1: List of Q4 2022 Challenged CEA Operations, Europe and U.S.A.

Power is one of the biggest costs associated with running any kind of business, and it’s no secret that indoor farming has an energy problem. Consider:

- iFarm stated that it takes them 182.22 Watts to grow one square meter of leafy greens (the simplest crop to grow in vertical farms), which is approximately 76.55 kWh / month.

- Using these numbers, if we assume a yield for arugula of 3.6 – 5.5 kg per square meter per month, we calculate an energy requirement of 14 – 21 kWh per kg of saleable produce (6.4 – 9.6 kWh of energy per lb).

- According to the 2021 Global CEA Census Report vertical farms use over 7 times more energy per unit of produce than traditional greenhouses do (38.8 kWh per kg of produce compared to 5.4 kWh per kg for GHs). This average is higher than the amount previously mentioned because other crops produced in vertical farms, particularly crops that are slower growing and have less harvestable biomass like basil and strawberries, the energy user per yield can be even higher.

- Within the vertical farming industry, there is great variation in the types of production systems and lighting and hvac technologies that are used. More collaboration in these areas will help the growth and efficiency of the industry.

Why is energy use so high?

In order to produce year-round, vertical farms rely on artificial lighting and humidity control systems which consume energy at high rates. Even before the recent volatility in the energy market, the energy demand of these systems made the sustainability and viability of vertical farming extremely difficult.

How have the worldwide energy crisis and supply chain delays affected the vertical farming industry?

As indicated above, if energy has a standard cost north of a few cents per kwh, it’s easy to see why a vertical farm’s operation costs must be carefully balanced in order to stay afloat. With ongoing supply chain delays for key inputs like fertilizer, labor shortages, recession fears, and the dramatic uptick in energy prices, that balance has been made harder to achieve, and we are seeing reckonings across the world for vertical farms unable to maintain it. Several vertical farms have ceased operations and others are dramatically cutting costs through consolidating operations and layoffs:

- Infarm, the Unicorn of Vertical Farming, is laying off over half their workforce (500) and published a letter to its staff about the pressures of profitability and challenges to their business due to rising energy prices and overall economic slowdown. InFarm says it will aim to become financially self-sustaining within 18 months.

- Kalera is getting de-listed from NASDAQ after their poor performance. Kalera’s shares have been trading under 10 cents a share for 10 consecutive trading days which is against the NASDAQ’S listing rules. Moreover, the third quarter of this year shows that the company made a gross operating loss of $20.7 million in the three months up to the end of September.

- Aqua Greens Inc., a Rexdale, Ontario-based operator of indoor vertical farming operations, was placed in receivership on February 16, on application by Farm Credit Canada, owed approximately $3.17 million.

- Fifth Season, a Pittsburgh-based indoor vertical farming startup that used advanced robotics to grow a variety of leafy greens for distribution in salad kits sold at hundreds of grocery stores, has shut down. It employed about 100 workers.

- GlowFarms, based in the Netherlands, shut down after 2.5 years. ‘’The problems started this summer with a growing uncertainty regarding the efficient production of crops, mainly due to rising energy prices.’’ as they stated in their latest LinkedIn post

There are other CEA businesses, including equipment providers like Iron Ox, and high-tech, indoor farming companies such as AppHarvest that have seen recent struggles as well.

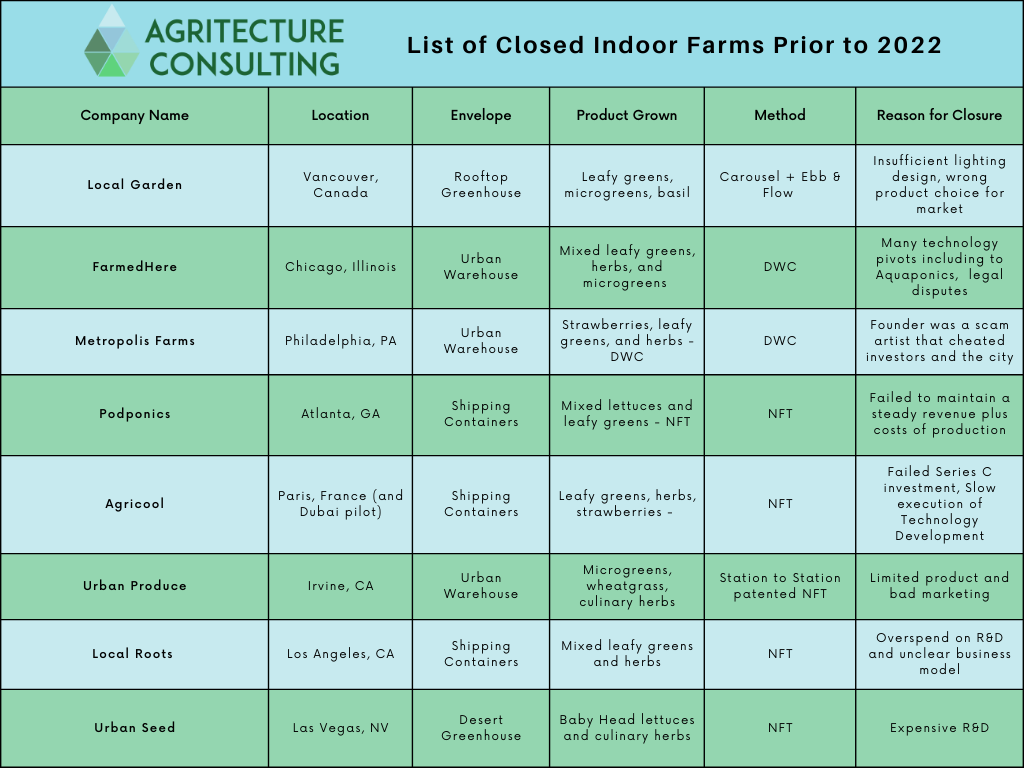

Table 2: List of Closed Indoor Farms Prior to 2022

Experts in the industry initially became concerned about the state of the industry last year after CEA darlings AeroFarms and AppHarvest both experienced setbacks. In December of 2021, Henry Gordon-Smith, Founder and CEO of Agritecture, explained in this AgFunder article that he thought the industry was edging towards the “trough of disillusionment” as defined by the Gartner Hype Cycle.

What is feeding the trough of disillusionment?

Outside of the energy issues (for which the industry is continuing to explore solutions), there are two primary enemies that the sector can combat together. The first enemy is hype.

Hype includes activities like exaggeration, dishonest marketing, and greenwashing. Despite numerous warnings, free resources, and education from experts across the industry, most of the biggest players in vertical farming have engaged in hype without remorse. In the long-term, it’s harmful to them, their investors, and the food system as a whole.

The second enemy is a lack of planning and due diligence.

There is something about vertical farming and the dream that Dr. Dickson Despommier first promoted in 2010 that has seduced many to get involved with vertical farming without proper preparation. We see vertical farms today making the same mistakes that vertical farms did 5 years ago. We also see investors in a feeding frenzy of FOMO rushing to bet on a horse instead of understanding the fundamentals of the race itself. There should be no excuse at this point for repeating these mistakes and this unnecessarily risky behavior at this point. Why? Because the industry has matured and there are numerous free and paid ways to get necessary answers.

Industry experts are still ‘long’ on vertical farming. They believe it has a place in the food system, can be more sustainable than it is today, and can be profitable when planned and operated responsibly. Getting the entire industry to rise to the occasion and reach its objectives will require much collaboration, benchmarking, and elevation of successful suppliers and business models.

Editor’s note: Henry Gordon-Smith is the founder and CEO of Agritecture, an advisory services and technology firm focused on climate-smart agriculture. Niko Simos is a researcher for the firm.