Inflation is affecting prices across the food continuum, and meat is no exception.

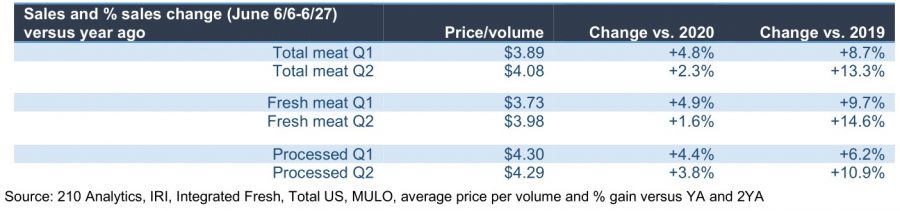

Meat prices were up in the first two quarters of the year when compared to both 2020 and 2019, according to analysis of IRI data from 210 Analytics.

Across all measured meat and poultry items (both fixed and random weight), the average price per lb. stood at $3.89 in the first quarter of 2021 and jumped to $4.08 in the second quarter, representing gains of 4.8% and 2.3% over the same periods last year. Compared to the first and second quarters of 2019, the increases were 8.7% and 13.3%, respectively.

“Beef has re-emerged as the king of the castle, in large part driven by ground beef. People started buying for meal occasions in one swoop and that favored cuts that can be used in a variety of meals. Ground beef benefits from being versatile, cost-effective and kid friendly. But beef dollar sales are also boosted by inflation, like most items around the store from fruit to cleaning supplies. The meat and poultry supply chains also remain out of balance, worsened by the labor woes in processing plants and retail alike,” said Anne-Marie Roerink, principal at 210 Analytics.

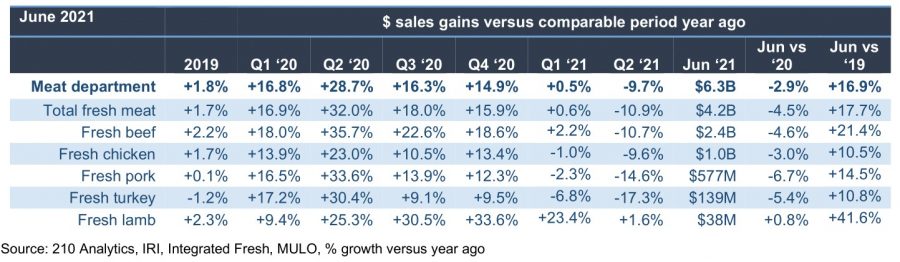

Meat sales broke record after record in March, April, and May of 2020, so it should be no surprise that meat department sales could not keep pace. However, they were not as far off as one might think: total meat department sales reached $19.5 billion in the first quarter of 2021, up 0.4% from last year. Meat sales in the second quarter dropped 9.7% to $20.1 billion.

Taken together, meat sales were down 5% in the first half of 2021 when compared to the same period in 2020. However, when compared to the pre-pandemic 2019 normal, sales were up 16.7%.

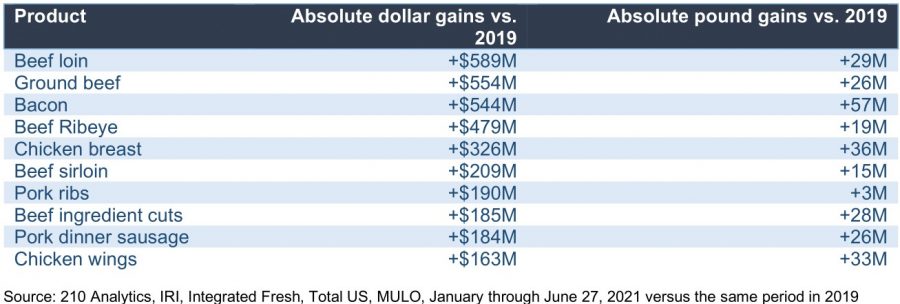

Beef Loin, Ground Beef, and Bacon Help Propel Sales

The top three product categories that contributed to growth in the first half include beef loin, ground beef, and bacon, which posted absolute dollar gains of $589 million, $554 million, and $544 million, respectively, according to 210 Analytics. Bacon sales saw the biggest growth in terms of volume, with an additional 57 million-lbs. sold.

Of the top ten, only two poultry items made the cut: chicken breast (+$326 million) and chicken wings (+$163 million) were in the fourth and tenth spots, respectively. The remainder included beef ribeye, beef sirloin, pork ribs, beef ingredient cuts, and pork dinner sausage.

Lamb Leads in June Sales

When compared to June 2020, the only meat category tracked by 210 Analytics to show positive sales growth on a value basis was fresh lamb, which increased 0.8% to $38 million.

Total meat department sales dropped 2.9% to $6.3 billion during the month, with fresh meat dropping 4.5% to $4.2 billion. Fresh beef (-4.6% to $2.4 billion), fresh chicken (-3% to $1 billion), and fresh pork (-6.7% to $577 million) were all down year-over-year, but were up 21.4%, 10.5%, and 14.5% when compared to 2019, respectively.

“Pre-pandemic, restaurants had the bigger portion of lamb sales, certainly in dollars. But it was exactly those white tablecloth restaurants that were heavily affected by the lockdowns. So people started to experiment with different meats and the lamb enthusiast banked on their ever-growing meat IQ to include lamb in their regular meal lineup instead of this being something made during the holidays only. The sustained strength in lamb sales demonstrates that this may be a trend with staying power. We see the same kind of experimentation with other niche meats, like venison, that nearly doubled over the past year, albeit it off a very small base,” said Roerink.

210 Analytics reporting is made possible by Marriner Marketing.