Last year, consumer sentiment around plant-based products, especially meat-alternatives, cooled significantly in the U.S., while inflation further impeded the industry’s ability to thrive.

“We’ve seen quite a [sales] decline in the last year,” said David Benzaquen of Mission Plant LLC in a recent Food Institute Podcast. “I do expect that we will return to normal within 12 to 18 months, but it certainly is a hard period for the sector.”

“We are currently expecting global retail plant-based food sales to be around $35 billion, with the bulk of that coming from plant-based dairy,” said Jennifer Bartashus, Senior Analyst of Retail Staples & Packaged Food at Bloomberg Intelligence. “This is only slightly up from $33.5 billion we expect in 2023.”

In late January, the Federal Reserve didn’t lower interest rates, but it did signal better times ahead for consumer spending amid an economy that never really experienced the “hard landing” many expected this time one year ago. Will a brighter economic outlook bode well for plant-based in 2024, however?

Industry Hits and Misses in 2023

Along with sales challenges, plant-based witnessed a slowdown in innovation and new products last year, both at retail and in restaurants, as the industry right-sized from an influx of new entrants from 2019-2022, Bartashus told FI.

“Remaining players have had to grapple with fewer investment dollars like venture capital, higher interest rates, and the need to cut costs and focus on profitability,” she said.

However, the industry did have noteworthy pockets of growth and innovation, as Robyn Carter, CEO of Jump Rope Innovation, observed.

“Big players in conventional foods hit their stride here,” Carter told FI.

“[We saw] fast food restaurants such as Taco Bell testing a Vegan Crunchwrap Supreme; plant-based options from Chick-Fil-A; new vegan shakes at Shake Shack; a vegan Reese’s Peanut Butter Cup; and a few plant-based launches from Kraft-Heinz.”

Smaller brands also saw forward momentum, like fast-food restaurant chain Slutty Vegan, which opened several new locations last year.

The Price Equation

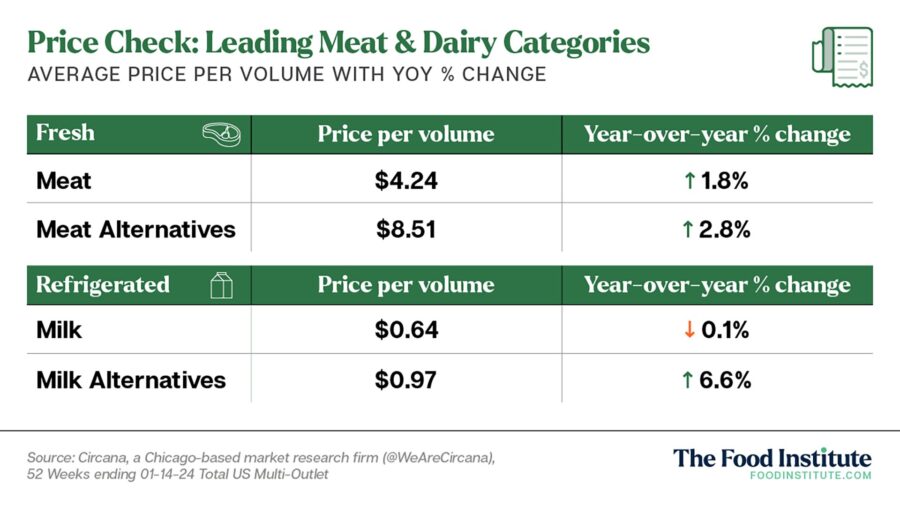

According to Bartashus, a top challenge in the year ahead will be balancing price and volume sold.

“We haven’t seen this yet, but as we slowly start to see deflation, plant-based products need to make sure they bring prices down at a similar pace to conventional products,” she said. “The industry can’t afford for the price-gap to worsen; it needs to stay the same or even shrink.”

In theory, this should help volumes sold improve. As Bartashus observed, however, there is often a lag between when consumers see price changes and when they actually change their behavior. “That can be a tricky period to navigate for food manufacturers,” she added.

Financial Outlook

Elysabeth Alfano, CEO of VegTech Invest, believes plant-based innovation of diversified proteins, including plants, fermentation, and cell cultivation, is slated to become a large-scale financial opportunity. However, “investing in the infrastructure, the picks and shovels of the supply chain remain critical to the growth of the sector.”

Per Bartashus, another top challenge is less funding and higher interest rates — specifically for small companies that are not consistently profitable.

“It makes it harder to raise capital and then higher interest rates on any debt they do have can weigh on financial performance,” said Bartashus.

“Smaller companies like Beyond Meat and Oatly have had multiple rounds of job cuts and expense reduction. This makes investment in innovation and marketing harder, but both are needed to spur growth.”

Alfano predicts that markets will bounce back better this year. “Even though the election will keep things volatile for another three quarters, public markets will come back before venture capital does, thus private market capital and public capital will be funding innovation until venture capital catches up,” she told FI.

Alfano also flagged “blended finance” as the buzz phrase of 2024. “It combines public and private capital to drive innovation and R&D and includies de-risking systems with offtake options, to ensure that entrepreneurs, companies, and farmers won’t lose out in moving to a new system.”

Consumer Adoption Strategies

A final hurdle for the category is re-engaging consumers with the benefits of plant-based products. “Many tried products but have not become repeat purchasers,” said Bartashus. “Promotions haven’t really moved the needle, so a new strategy needs to be found.”

Carter believes the top priority for food manufacturers to improve consumer adoption is to lead with delicious.

“Consumers may pay a bit more for something that aligns with their values or priorities, but they need assurance that plant-based alternatives are going to taste good and that they won’t be wasting their money,” she said. “The parent who is trying to feed their family – and at a time when the grocery bill is so high – needs to know the family will enjoy and eat what they make.”

A leading driver of trial in recent years was major restaurant brands offering limited-time offers on plant-based products. “This made it easy and low-risk for consumers to try something new,” said Bartashus. “We may need something similar to spark widespread interest in the category again, but restaurant operators are facing their own challenges that could make that hard to do.”

Carter sees the most interesting innovations as options that are simply closer to plants. “Brands like Mushroom Angel, Meati, and Superiority Burger that can bring this to people, and bring it deliciously, are really exciting,” she said.

To Bartashus, the top priority for food manufacturers is to take a narrower focus.

“Instead of trying to convert everyone to plant-based products, focus on increasing the frequency of those who already purchase products – delight them and make them brand ambassadors.”

“This can help create organic growth in customers coming to a brand or product. The other area would be to focus on lapsed users, and pulling them back into the ecosystem,” she concluded.