In the U.S., competition from indie cafés ought to make coffeehouse giants on the level of Starbucks and Dunkin’ sweat.

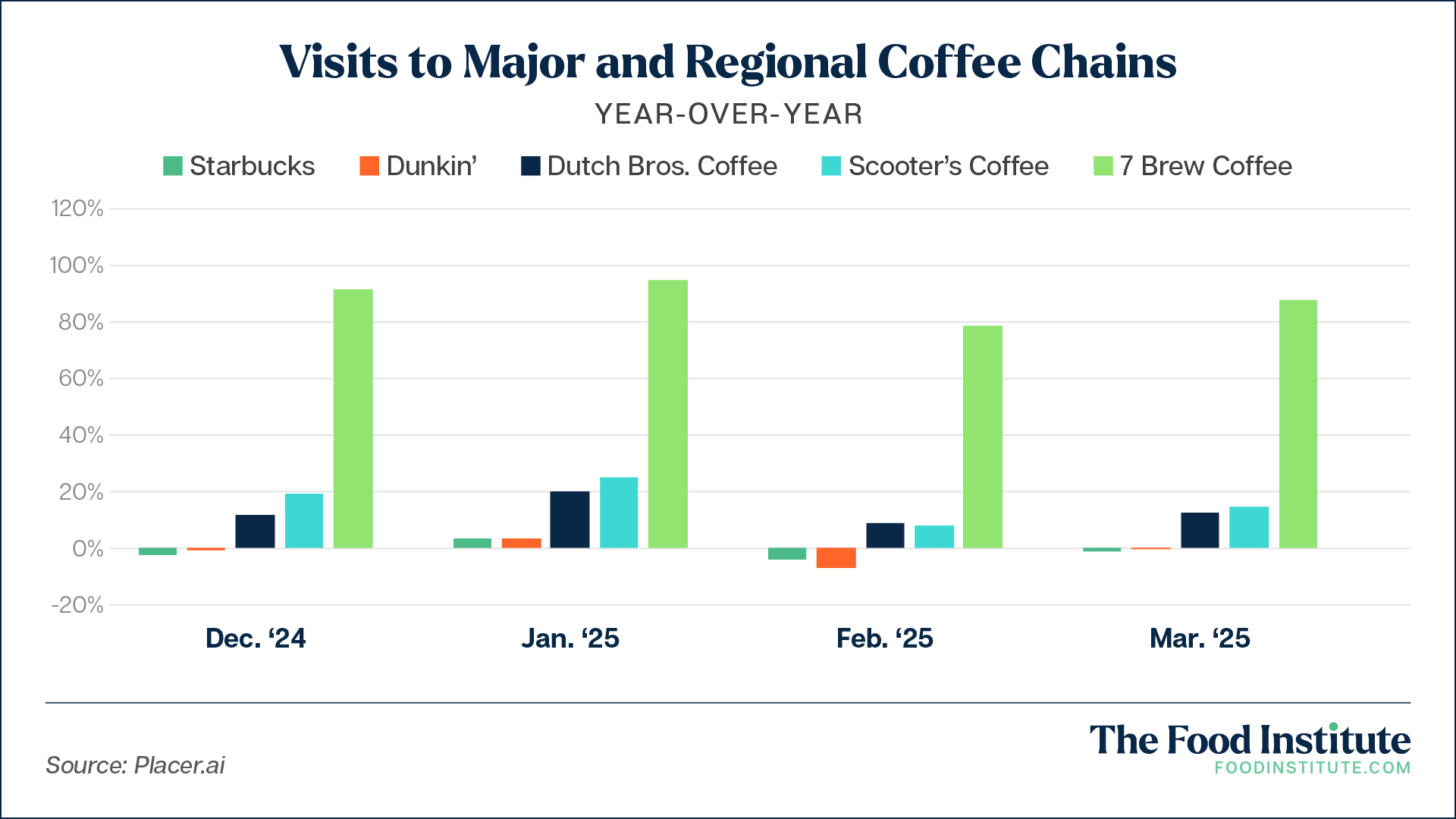

These market leaders have begrudgingly ceded market share to smaller, regional chains, according to a recent report from Placer.ai. Data shows that visits to Starbucks and Dunkin’ fell in Q1 2025 by an estimated 0.9% and 1.7%, respectively, while Oregon-based Dutch Bros, Nebraska’s Scooter’s Coffee, and Arkansas’s 7 Brew sustained double-digit visitation growth.

Starbucks’ recent Q1 earnings report confirms the independent data sources. Global and North American same-store sales both fell 1% from the year before. Some of the losses may in part be attributable to high coffee prices and Trump Administration tariffs, CEO Brian Niccol recently told analysts, according to The New York Times.

In the meantime, prominent challenger brands, such as Northeast-based regional chain Gregorys Coffee, are enjoying growth.

“We are seeing slightly positive same-store traffic trends that are contrary to what Starbucks just posted,” Rene Puerta, Gregorys Coffee director of marketing, confirmed to The Food Institute.

Dreaming Big

Rapid expansion is one reason for coffee shop visit growth among regional chains. Placer.ai names Dutch Bros, Scooter’s Coffee, and 7 Brew among chains with footprint-extending plans, but recently, Midwest-based Dunn Brothers announced plans to increase its store count from nearly 50 to 300 by 2029.

From as early as 2019, smaller coffee chains have taken meaningful bites into Starbucks’ and Dunkin’ market share: in 2019, the two giants represented a whopping 85.9% of U.S. visits, which has since dwindled to 77.9% by 2024 YE.

Of the challengers, mid-sized coffee chains are best positioned to reap the benefits, growing by 6.8 percentage points between 2019-24, while small coffee chains grew by just 1.2 percentage points over the period. This stratification makes sense, given, as many smaller chains look to expand to capture market growth, they transition between small- to medium-sized chains.

Over the five-year period, Gregorys grew their store count from 30 to more than 50. In a recent story about specialty coffee experiences, Puerta noted that much of its recent efforts have been to target Gen Z audiences by opening locations in partnership with Simon Malls.

Unique Indulgence

On the other hand, the Placer.ai report suggests Starbucks and Dunkin’ traffic dips may be due to smaller chains winning on innovation.

“Consumers prefer to spend their limited discretionary funds on unique or decadent treats instead of on classic drinks and pastries,” read the report.

Local chains have a more agile operation that allows them to quickly test and implement innovative beverages at a lower cost than chains with thousands of locations. For example, when floral and fruity flavors dominated coffee orders last year, such as lavender or blueberry-infused lattes, regional retailers were already primed to win, as they could more easily bring delights to market.

Additionally, many chains build their platform by providing “riskier” menus than the café giants.

Although Starbucks introduced its lavender offering in March 2024, PJ’s Coffee of New Orleans has been innovating with floral coffee flavors since 2018 with its White Chocolate Lavender Latte. Additionally, the chain launched a Strawberry Rose White Chocolate Latte in 2023. Fewer-location cafés often have the experience of innovation as well as a narrower consumer base that allows them to take more calculated risks.

Dutch Bros, similarly, wowed with its White Chocolate Lavender Cold Brew which was first introduced in 2020, then returned to the market in 2023, and once again this spring, this time with even more innovations incorporating sweet cream cold foam and frozen espresso.

Gregorys’ seasonal menu also includes enticing, unique brews, which Puerta noted have been adept at garnering attention. Most recently, its LTO menu boasts an Iced Cherry Blossom Matcha made with ceremonial grade matcha and vegan cold foam, constructed in layers (milk beverage at the bottom, then matcha, topped with cold foam), to entice shoppers.

“Our LTO and specialty items are drawing in customers, especially matcha, which has grown significantly over the past year,” said Puerta.

Starbucks Still Dominates

The iconic coffeehouse staple that helped transform the domestic coffee scene is not too quick to call it quits. Despite recent bumps, Niccol says it’s just part of the process.

“We’re not just building back our business… We’re building back a better business,” said Niccol on a recent earnings call.

Steep declines, however, shocked the system: visits fell from 55.8% in Q1 2024 to 51.2% in Q1 2025, notes Placer.ai, signaling that Niccol’s drastic “back to the basics” approach has yet to spur an ROI.

In response to the earnings results, the company plans to trim its corporate employee count by as much as 1,100 as a result of profit declines allegedly attributed to costs associated with hiring more workers for its strategy realignment, said the Times.

He highlighted, too, that progress is still being made on its strategy: the brand is piloting a program to allow baristas to easily pick up and trade shifts to meet demand in addition to an initiative that aims to cut café wait times by an average of two minutes. As it figures out how to boost its same-store sales, it’s dialing back its expansion plan, added Niccol.

The Food Institute Podcast

It’s tariff time, and companies the world over are working to better understand how their operations will be impacted. Jodi Ader from RSM US LLP joined The Food Institute Podcast to discuss which products and inputs are currently subject to tariffs, and how to best mitigate supply chain risks.