Common sense wins the day in most respects, and a little data goes a long way toward verifying collective gut-checks, especially during inflationary years. And though the U.S. has landed a little softer than feared – thus far – prices are still up and the Federal Reserve is still increasing interest rates, as it did in late July. The 5.5% interest rate is the highest in 22 years.

So how are shoppers responding? It’s not rocket science – budgets are tightening. Tradedown is happening as brands like Aldi, Dollar General, and big-brand private labels have experienced skyrocketing sales. And for many, convenience in the food/bev retail space trumps almost everything else when there are bills to pay.

That’s why the latest whitepaper from 84.51°, Kroger Co.’s data science company, is so telling. “Winning with the Omnichannel Shopper in the Face of Disruption” has some keen insights for today’s market and consumer drawn from first-party retail data from over 62 million American households.

The Omnichannel Shopper in 2023

Omnichannel shoppers, of course, are “those who make purchases in-store and online.” In other words, almost everybody. What the data reveals, however, are all the curious strata of shopper within that set. Those shopping online, for instance, are more likely to:

- Identify as millennials

- Have households with children

- Be part of a larger household

- Value convenience items such as pre-made meals and frozen items

- Be more engaged with Natural and Organic designations within the store

Nonetheless, there are outliers to every rule and the economic realities for today’s consumer show some overarching patterns.

“Rising prices at the grocery store remain a top concern for most customers and have encouraged them to find ways to combat inflation to stretch their dollars further,” said Kelli Fulton, an insights consultant with 84.51°.

Fulton remarked that 70% of shoppers are looking for sales, deals, and coupons more frequently, and that more than 50% of shoppers are cutting back on items, both per trip and as overall grocery customers. They’re also switching to cheaper brands, she said, denoting less reliable repeat sales within brands and putting increasing pressure on CPG companies to foster brand loyalty.

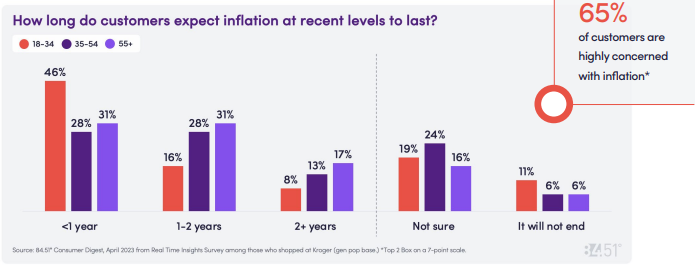

What’s more, with age comes experience. As the graph below shows, while 65% of customers are highly concerned about inflation, almost 50% of younger consumers aged 18-34 believe inflation will pass us by within one calendar year. Over 50% of shoppers aged 35+ believe it will take 1-2 years, and 40% of shoppers aged the same believe inflation will last well into the next electoral cycle.

Convenience is the primary reason why consumers shop pickup or delivery opposed to in-store for their groceries. Saving money, however, is the second reason for prioritizing pickup/delivery, as it’s hard to spend money from outside the automatic doors of big-box retailers and grocers.

Despite its convenience, even the most loyal ecommerce shoppers still find ways to venture into stores; the data shows that even the most dedicated ecommerce shoppers still complete almost 40% of their grocery trips in-store. For those who are less loyal to ecommerce (and often more price-sensitive), that number rises to in-store grocery shopping almost 90% of the time. Just 7% of consumers report that they prefer all in-store shopping.

How to Succeed in the Omnichannel

Per the report, the key to ensuring a positive online experience for omnichannel shoppers “is to provide a seamless experience between their in-store and online shopping.”

What does that mean to the consumer? It means the same coupons. It means the same prices. It means the same quality of products and brands offered.

There’s a reason consumers hardly ever win when trying to price-match from one retailer or grocer to another—it’s because the world of all data (and omnipresent access to it!) from the corporate side means companies must lean on the shopping experience itself to drive loyalty as most consumers know what they want and at which price point they want it.

Still, the whitepaper data puts numbers to common sense about how to attract, retain, and return consumers to a particular brand’s omnichannel. The three most important aspects to online shoppers are:

- Accuracy of order (88%)

- Availability of items on the shopping list (81%)

- Ability to apply coupons or offers (76%)

The data is telling; the next two aspects are quality of substitutions (74%) and ease of navigating the website and/or app (71%). In other words, the top reasons people shop in the omnichannel have everything to do with the experience (comfort and convenience) and the yield opposed to the pre- and post-purchase aspects (navigation ease and quality substitutes, respectively).

From a retailer’s perspective, there are simple and effective ways to meet these needs. The whitepaper lists adequate supply both online and in-store to increase customer satisfaction; online accuracy to ensure shoppers can find in-store what’s listed online; relevant coupons online that reflect the economy, the meteorological and economic seasons, and more; and quality substitutions available at a moment’s notice if an item is out.

Of this list, accuracy and availability are crucial. The report states that if an online item is unavailable, 75% of omnichannel shoppers will try to get it again at the same retailer next time or by going in-store. The other 25%, however, value accuracy so much they’ll look elsewhere. And 6% will simply switch their entire cart to another retailer that has the item in stock.

Perhaps most telling from the data was how shoppers learn about new grocery and household items given the sheer spectacle and smorgasbord of ads and options the average consumer is exposed to on a daily basis. Survey says:

20-25% find new items via:

- Word-of-mouth

- TV commercial

- “New items” section of site

- Pop-up advertisement

18% find new items via:

- Search bar to look for new items

- Social media (29% for 25-34 year-olds

Meanwhile, 10% aren’t sure items they see online are even considered “new” and 22% don’t seek out new items when shopping online, which makes sense given the tunnel vision aspect of purchasing anything online – people don’t browse so much as hunt and peck for what they need.