This article is sponsored and written by CohnReznick.

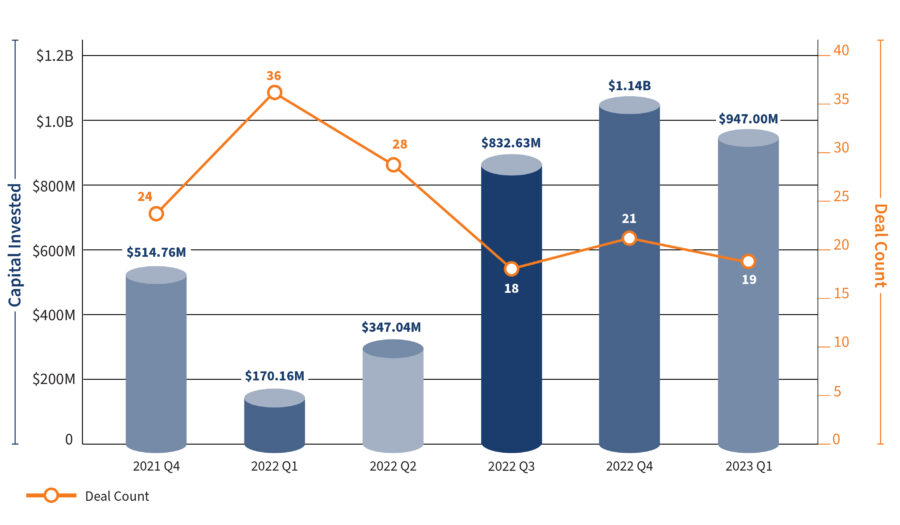

Following broader market trends, food and beverage M&A slowed during Q1 while external forces like inflation, rising interest rates, recessionary fears, and a banking crisis all took center stage. The collapse of Silicon Valley Bank, whose customers included F&B companies like The Better Meat Co. and Equii Foods, cast a shadow over the final weeks of the quarter. Many recent F&B acquisitions were completed by venture firms (e.g., Cercano Management, Female Founders Fund, and New Leaf Invest). This may continue to slow down M&A activity for the sector as venture funds focus on their current portfolio businesses and make sure proper cash management and controls are in place before pursuing further investments.

To continue reading, click here.

About CohnReznick

CohnReznick helps organizations optimize performance, manage risk, and maximize value through associated firms operating under the CohnReznick brand: CohnReznick LLP, a licensed CPA firm providing assurance services; and CohnReznick Advisory LLC (not a licensed firm) providing advisory and tax services. Together, CohnReznick provides leaders with deep industry knowledge and relationships, solutions to address clients’ unique business goals and risks, and insight on how emerging market forces can drive opportunity. With offices nationwide, CohnReznick serves organizations around the world as an independent member of Nexia. For more information, visit www.cohnreznick.com/manufacturing.

Contact:

Helana Robbins Huddleston, CPA, CIRA,

Partner, Manufacturing and Distribution Industry – Co-Leader

Transaction Advisory Services

312.508.5813

helana.robbins@cohnreznick.com

Henrietta Fuchs, CPA,

Partner, Manufacturing and Distribution Industry – Co-Leader

646.762.3432

henrietta.fuchs@cohnreznick.com