Economic pressure continues to put a squeeze on consumers across all income tiers, leaving them vulnerable to further downturns in the year ahead.

In February, Reuters reported that U.S. consumer confidence dropped to 102.9 from 106.0 in January, marking the second straight monthly decline.

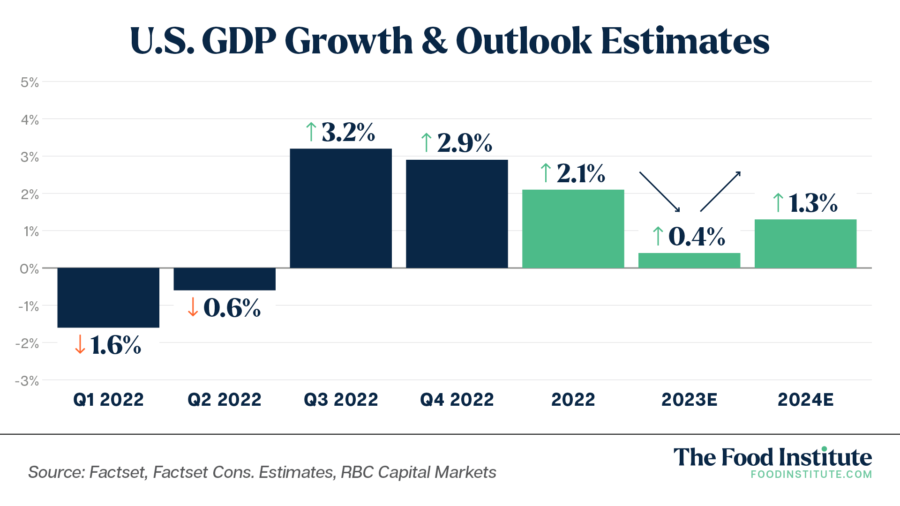

Although consumer and producer inflation are off highs, RBC Capital expects further economic pressure for most of 2023.

“I think we’re right at the cusp of things really starting to devolve in a negative way in the next few months,” said Nik Modi, managing director of RBC Capital Markets, in a recent FI Webinar (available to Food Institute members). “Generally speaking, if we do have a downturn, it’s going to be very shallow, and there is an expectation that we’ll see a rebound either at the end of 2023 or in early 2024.”

Impacts on Purchasing Power

Gas and food inflation has a direct bearing on lower-income consumers. As Modi notes, consumers are currently spending over 11% of their disposable income on food and energy.

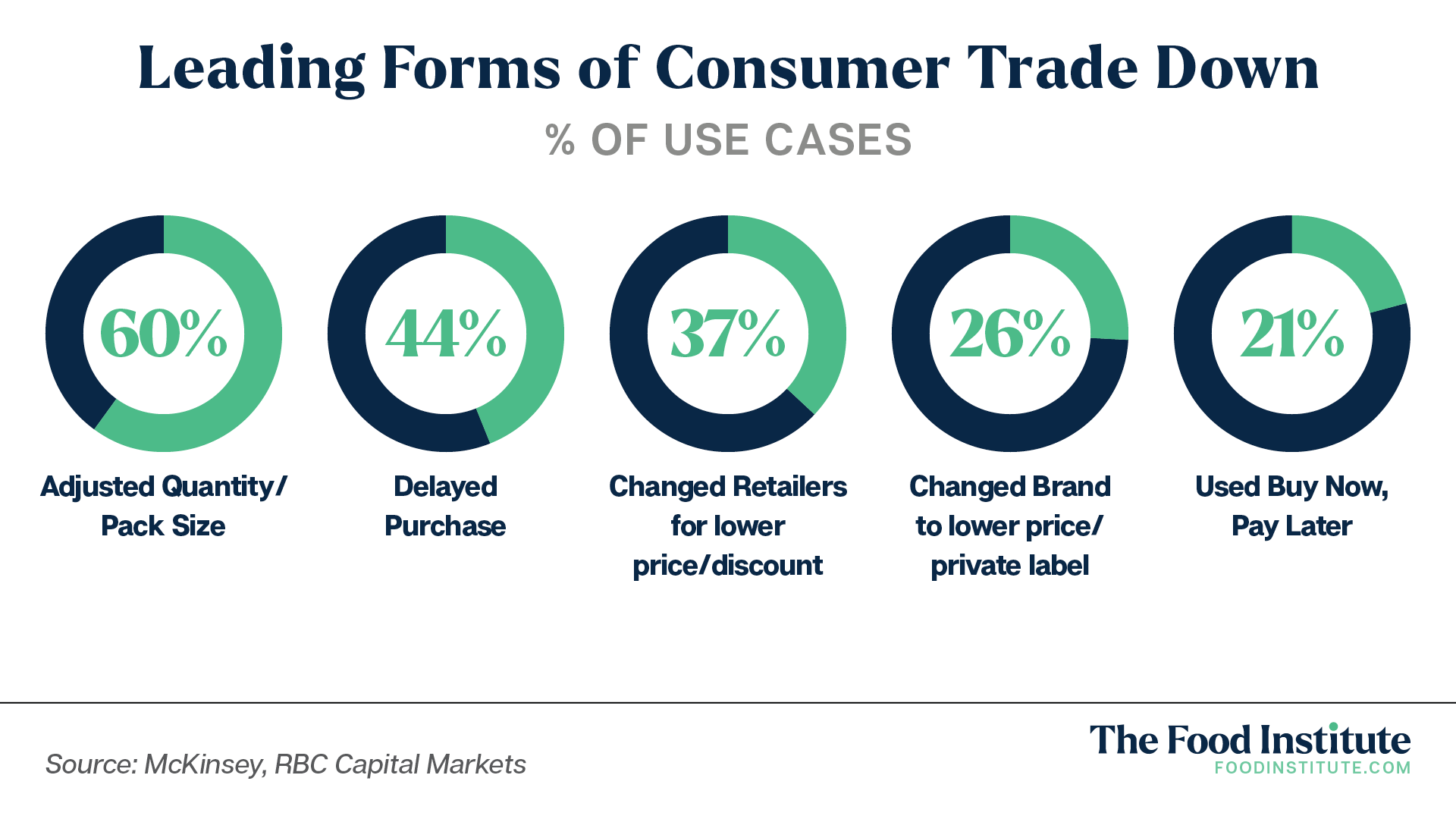

“A lot of the trade-down and private label growth activity that we’ve been seeing has been predominantly driven by lower-income consumers,” said Modi. “Some could say they have been in a quasi-recession.”

RBC Capital also expects to see more pressure on house prices, which have a direct wealth-effect impact on middle-income consumers.

“Typically, someone would spend about 20% of their income in terms of monthly shelter or home payments. Today, that number is 29%,” said Modi. “As the housing market continues to come under pressure, it’s going to have a dramatic impact on consumer psyche, which will then have a carryover impact on consumption behavior.”

Higher-income consumers are also experiencing financial pressure.

“The stock market was down 19% in 2022,” said Modi. “We’re also seeing trade-down within luxury with an increase in mid-tier brands and a decrease in the very high end. That is something that I think people really need to start paying attention to.”

Walmart’s recent guidance reinforces the notion of a softer consumer environment in the months ahead — making incremental price increases very tough for consumers to take. In Q4, the company reported accelerated share gains in private label and across income cohorts with ~50% of gains coming from higher-end consumers.

Target Corp. also reported a marginal 1% year-over-year increase in holiday-quarter sales and warned of continued slowdown, reported CNBC.

Is Inflation in the Rearview?

Although inflation has cooled, rates remain notably higher than historical averages.

In January, the consumer price index (CPI) rose 6.3% from a year ago, decelerating from 6.4% in December but remaining at a level above average since 1986. The producer price index (PPI) was up 6% year-over-year as well, indicating that producer and consumer prices are moving at similar rates.

“[Inflation] is moderating, it’s coming down, so that’s positive. We’re finally getting relief on aluminum, steel, PET, corn, wheat, oil, and freight,” said Modi.

Six percent is still an elevated level, however, and Modi believes that many structural challenges [i.e. wage inflation, housing costs] that happened over the last two years could make it very hard to get back to the federal target of 2%.

Furthermore, international events could cause another spike in costs, particularly the reopening of China’s economy.

“It’s going to take a few more weeks, maybe a month or so for the country’s economy to really start ramping but once it does, we think it’s going to have an impact on the input cost market,” Modi added. “I think people need to be prepared for that.”

Key Points for CPG

According to a recent report by IRI, U.S. CPG omnichannel sales grew 8.4% amid inflation in 2022, while volumes declined 1.5%. Despite the slump in volume, IRI forecasts a 5.5% increase in food and beverage dollar sales through all channels.

Many forms of trade-down are playing a role in this traction.

In 2022, dollar sales for store brands were up 11% and national brands were up 6%. Store brands also outperformed national brands in unit sales.

As Reuters reports, retailers like Target and Dollar Tree have found a new sweet spot in products that cost between $3 and $5.

Per IRI, sports drinks, canned/bottled fruit, and non-chocolate candy sales remain robust, while premium product sales — which drove growth during the height of the pandemic — are easing.

In Q4 of 2022, at-home food spending also remained strong, with center store sales up 11.1% and perimeter dollar sales up 6.3%.

“People are definitely trying to find out of home experiences in home because it’s just cheap,” said Modi. “We’re still dealing in this hybrid living approach. Yes, people are going back to the office, but you’re still spending more time at home than you were prior to closing. I think this is going to be a very long lasting durable structural trend.”

The Food Institute Podcast

How are consumers changing consumption patterns as inflation pushes CPG prices higher? On this episode of The Food Institute Podcast, Ibotta SVP Chris Jensen discusses how consumers are gravitating towards at-home eating, tactics retailers are employing to maintain and grow their customer bases, and how loyalty programs can benefit consumers and retailers alike.