Much has been made of McDonald’s CosMc’s concept in the months since its debut. Social media is rife with brand-happy consumers checking it out for the first time, documenting their journeys via TikTok and YouTube and allowing themselves the rare opportunity to be surprised in the QSR world.

@nick.digiovanni @CosMcs rating #CosMcs #rating ♬ original sound – nick.digiovanni

As the calendar turns to 2024 – and as McDonald’s targets the likes of Starbucks, Caribou Coffee, Panera, and other afternoon daypart and snack/bev-forward establishments in its galactic crosshairs – other competitors are vying for market share, trying to wrest precious dollars away from the Golden Arches and into their own coffee-stained coffers.

The Food Institute recently sat down with Sam Vise, CEO at Optimum Retailing, to discuss the emergent CosMcVerse and today’s QSR foodscape.

The Grimace Shake was one of the top Google searches all year, helped fuel McDonald’s Q3 numbers, and was a marketing boon for the Golden Arches. Is this return to previous brand ambassadors a passing fad or a way forward?

CosMc’s is playing into the nostalgia theme that McDonald’s has been teasing all year with the Grimace Shake and the re-introduction of the Nug Buddies. Even looking at the drive-thru-only style of service, it’s reminiscent of carhop service popularized in the 50s when servers would rollerskate food out. McDonald’s is bringing out a lot of historical themes in its marketing strategy and it’s a brilliant way to revitalize the brand to a new audience.

McDonald’s is calling CosMc’s a “beverage-forward” establishment for a quick bite or pick-me-up. Do you see this as a viable competitor to Starbucks and other coffee shops?

CosMc’s will be a viable competitor to beverage shops with comparable price points and service such as Dunkin’ Donuts and specialty beverage shops, which are growing in popularity. The soda industry isn’t as strong as it used to be, prompting brands to create alternative beverages and shops that are still fun to drink – bubble tea shops, for example.

CosMc’s has strong potential to take a share of customers looking to enjoy a refreshing, sweet beverage, especially given its ability to offer value and convenience among competitors. Despite talk of CosMc’s competing with Starbucks, CosMc’s pricing and business model structure are very different, which makes them unlikely competitors in the long-run.

We also read recently that Taco Bell is debuting two frozen beverage menu options called Chillers. Are these direct challenges to one another as both brands plan for explosive growth in the next few years?

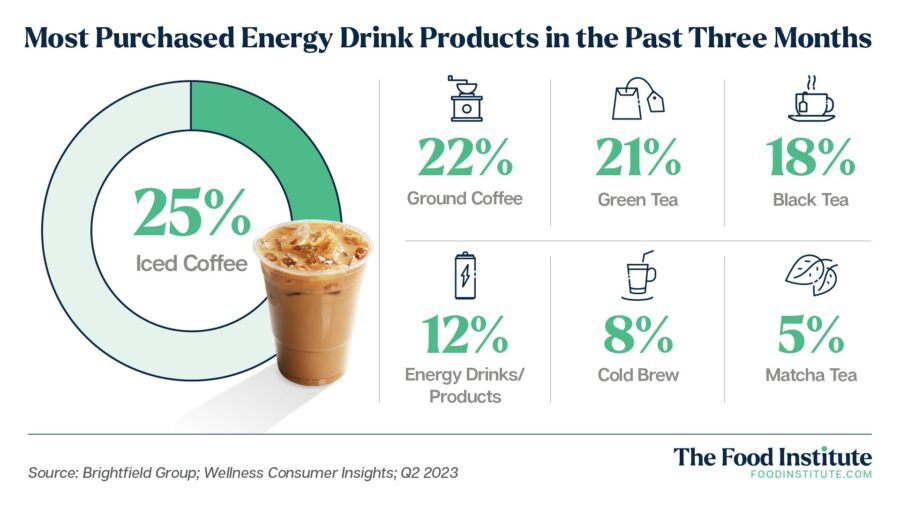

The popularity of iced coffees and beverages overall are increasing and QSR brands are adapting their offerings in response to the change. Cold beverages made up 75 percent of Starbucks’s total drink sales in the company’s fiscal third-quarter results, which is telling about consumers’ preferences for cold drinks. Gen Z is drinking more cold beverages and making less coffee at home compared to previous generations. Brands are focused on what’s popular now, which is cold and enticing-looking beverages. While the release of Taco Bell’s new Chiller may not be a direct response to CosMc’s, the beverage industry is changing.

What can Optimum Retailing tell us about the Illinois and Texas sites? How do you see those differing?

Being that CosMc’s Illinois location is a pilot site, it’s hard to say exactly how the Texas locations will look. McDonald’s leadership will keep a close eye on what’s working during the trial phase and make adjustments based on successes and failures. Their purpose in choosing Texas is likely because the region is so different from Illinois; the format and menu offerings will probably be identical initially to see how Texas-based customers respond, and McDonald’s might experiment with localization further down the line when the baseline concept proves to be successful.

The average American store is shrinking; many fast-food restaurants are smaller and leaning on digital orders, delivery, and pickup instead of sit-down, and consumers are more brand-agnostic than ever. Where will CosMc’s fit on this spectrum between inviting people into one of the most familiar brands in the world, and catering to today’s convenience- and value-oriented consumer?

McDonald’s is creating an environment that is experience-forward, convenient, and fits into the lifestyle needs of modern consumers. The concept has bold, fun elements that create memorable experiences, all while being quick and convenient to visit. We’re seeing people move away from strictly dining in at restaurants, and many brands are embracing the “phygital” experience of blending in-person interaction with digital touchpoints. McDonald’s is noting these shifts in consumer behavior and creating a separate, forward-looking brand that is meeting diners where they are.

Do you see any other market responses from McDonald’s competitors, or is it too early in the game for that?

McDonald’s competitors are paying attention and will likely introduce variations of their own creative concepts. Competitors probably won’t mimic CosMc’s strategy directly, but brands will be thinking strategically about store formatting and menu offerings. QSR brands have already been innovating tremendously this year alone when it comes to store formats and in the drive-thru. Chick-fil-A is piloting its drive-thru only locations in 2024 and Taco Bell is focused on cantina and digital-forward location expansion, to name a few. CosMc’s is another example of what strategic brands that know their customers’ needs and preferences are doing to adapt. Competitors who want to stay relevant will follow suit.

Does anything else bear mentioning McDonald’s, CosMc’s, the snacking/coffee crowd, and what’s in store next in this wild sector of restaurant/foodbev?

For CosMc’s to be successful with this concept, it’s important McDonald’s is willing to pivot to support customers’ needs. They’re starting off with big, bold branding, but it’ll be critical for them to carefully assess the market response early on and make changes based on that.

In terms of the beverage industry overall, this is a very smart play for McDonald’s and other brands will follow. Cold drinks overall don’t travel well so by offering them, brands are forcing consumers to come to the restaurants and drink them soon afterward. Restaurants benefit more by getting consumers in-store, but third-party delivery apps and an increased standard of convenience have made that more difficult. Offering cold, quick service and fun beverages checks all the boxes of what customers want – making it a win-win for both parties.