Editor’s note: The following represents the opinions of the author, Dr. James Richardson, and doesn’t necessarily reflect the opinions of The Food Institute and its staff.

We don’t see Ethan Brown in the news much anymore. The plant-based meat hype cycle is over, the easy money gathered. Beyond Meat didn’t raise nearly as much capital as Impossible – only $122M in 13 rounds.[1] Twitter co-founder Evan Williams, Bill Gates, Leonardo DiCaprio, former McDonald’s president Don Thompson, and Kleiner Perkins came on early in what was billed as a killer food-tech investment. The final ‘raise’ was from the 2019 IPO, which yielded $250M.

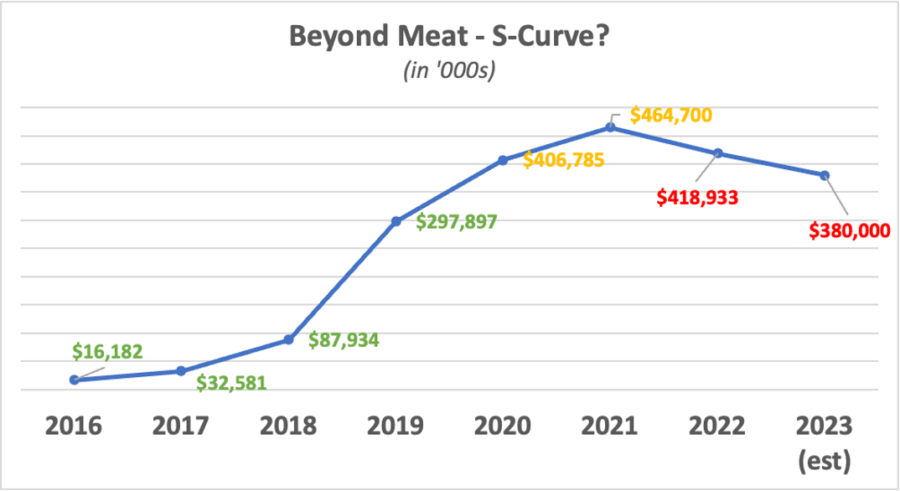

Let’s review where the business currently stands:[2]

- The stock is down 90% off its peak. You did well if you sold any initial IPO launch stock by May 31, 2021. Bill Gates, Don Thompson, and Power Plant Ventures certainly did.

- Company revenue officially peaked in 2021 at just under $500M.

- The company has $1.1B in convertible debt!

- The current run rate based on smoothing quarterly net revenue data looks like $360-400 million and still declining vs. last year (excluding any effect of inorganic growth later this year, such as new product lines and markets)

- Profitability has gone sideways due to multiple product line extensions into very different food formats, routes-to-market, and attempts to reduce prices at retail.

- Beyond Meat has yet to create a chain fast-food product line that sticks, let alone one with the potential to take a material share of menu sales. This is true for the failed U.S. McPlant pilot.

- Few have said Beyond Meat’s burger meat and patties taste like a ‘real’ 80/20 beef equivalent. Because they don’t. However, it routinely scores as much better tasting than older veggie burgers on the market. Of course, this positions Beyond Meat as a share-grab business, not the category-expanding one it has intended from 2009 to become.

- The entire plant-based meat sector is selling dollar volume at 80-85% of last year’s rate, according to the latest 12 weeks of IRI data, indicating that Beyond Meat is not alone in its struggles.[3]

- Motley Fool estimates that Beyond Meat is only a few years away from bankruptcy.[4]

So, what did Beyond Meat create? What will last? Will it ever grow again? And what can other founders learn from this classic case of irrational exuberance?

The answers are bleak but may still surprise you.

Beyond Meat Diagnosis

As of 5 PM EDT on May 10, 2023, Beyond Meat has created a highly seasonal, lower midmarket, negative EBITDA business that peaked at $464M in annualized sales in 2021. Here is the annual net revenue trend since 2016, which I’ll return to shortly.[5]

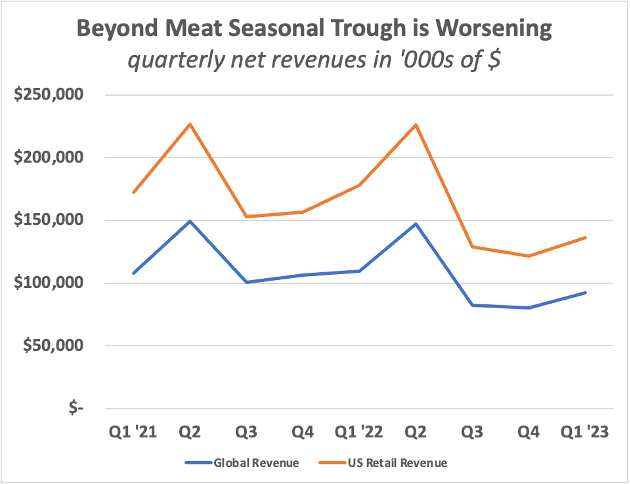

Recent quarterly trends reveal a significant seasonal spike typical of beef patties and a declining YoY baseline (globally and in U.S. retail). More concerning is the worsening seasonal trough, suggesting that the ‘summer repeat rate’ is worsening as the brand moves deeper into less friendly retail and food service territory full of 99% carnivorous shoppers.[6]

Finally, the crude $/outlets of distribution sell-in velocity of the business is declining, excluding any impact of Beyond Jerky. If sell-in is declining, sell-through is definitely declining, potentially even faster if retail warehouses were stuffed.

In lay terms, a cash register velocity decline means that Beyond Meat has a repeat purchase rate problem. It most likely also has a household penetration problem in its core, revenue-generating UPCs (the older ones). Launching new frozen products may add households (and sales), but it has to add them at a rate that compensates for the lack of proper household retention in the core patty/sausage/ground business. A leaky bucket of households is disastrous for any consumer business.

I’m surprised that Wall Street is not asking for essential marketing KPI information like household penetration and repeat purchase rates to be made public and for analytical separation of the ‘core’ from the newer parts of the business.

Thanks to their 2019-2021 PR machine, Beyond Meat has the national awareness required to drive velocity growth at 33,000 retail stores. If shoppers at those outlets try the brand with solid intent AND the purchase cycle is normative of a high-value meal ingredient (like ground beef), velocity should be stable or growing. If the purchase cycle is too long (less than monthly), the chances of simply forgetting to grab the brand rise because, implicitly, it just isn’t that important in the person’s diet.

And the last comment leads me to share some critical behavioral context. Americans love animal meat. This is a poor market to compete for meat-aversive eating dollars. Again, if you’re Ethan Brown, your social network is probably over-filled with ‘power vegans,’ and you may have limited perspective on your country’s complexity. Founder myopia continues to be a massive problem for businesses that develop like this.

Here’s the landscape of meat aversion in America, courtesy of the talented folks at The Hartman Group, Inc.[7]

- 77% happily eat meat and have no intent to change their behavior. These folks make fresh meat an $86 billion category in the United States.[8] They won’t change, but some of them did try Beyond Meat due to the excessive hype. I was one.

- 1% are vegan, and 2% are vegetarian – believe it or not, many of these folks demand the price of Morningstar Farms (at Walmart) and are still not accessible to Beyond Meat. However, I have not met a vegan/vegetarian in my years of consumer research who has any desire to have a veggie burger more than occasionally. The “veggie burger” is a known phase for new vegans/vegetarians coping with the transition. Beyond Meat can’t rely on this group anymore to produce meaningful volume.

- 2% are Pescatarians – (no meat from land animals, but fish/seafood OK)

- 8% are White-Meat only (no red meat, mainly due to health concerns w/beef)

- 9% are Flexitarian (mostly vegetarian, occasional meat eaters)

The latter three groups form 19% of households and could easily carry Beyond Meat to further growth. Theoretically, this is the absolute maximum addressable market. And they do not support their fair share of current meat dollars. Not by any means.

In reality, though, most of these remaining fishy/white-meat/flexitarian folks are priced out of brands like Beyond Meat, probably 80-90% of them at this point.[9] This is before they receive some experience or argument to look past the higher price point. Beyond Meat seems to be working aggressively to position itself as a ‘healthy’ choice in the United States. And, although Ethan keeps waving the fantasy of price parity with ground beef, the current target price reduction is 10% this year. Right now, the Beyond Burger patties sell at Walmart for $7.96 per lb. (four patties in two units). At 10% annual price reductions, it would take Beyond Meat a minimum of six years to reach the current U.S. average price per lb. of ground beef.[10] The current Hail Mary of international expansion hopes to produce the cash necessary to survive until then.

But the above data reveals the massive elephant in the room of plant-based meat and a lumbering, snorting elephant that I have publicly warned about since at least 2018. It’s the word ‘occasionally.’ Let’s make this word more concrete. Culturally, when consumers say they eat something “occasionally,” this means they consume i” less than once a month, often just 2-3 times a year, usually coinciding with some seasonal event not part of your everyday life. This makes the Flexitarians dramatically less productive for Beyond Meat or any other plant-based meat brand.

In my experience, premium-priced consumer brands repeatedly scale with very low household penetrations, on average 2-3% for every hundred million dollars of retail sales. So, Beyond Meat most likely has 8-10% household penetration with its current U.S. retail business. This leaves only about 9-11% of meat aversives at most. And most of these households are not interested in paying the current premium for Mother Earth or their health. They are OK with Morningstar Farms.

So, What Went Wrong, and What Can We Learn From It?

Peaking at $464 million globally and $243 million in U.S. retail revenue is a wild success to your average food entrepreneur who never sees $1 million in annual recurring revenue.

But, when much-hyped brands scale this fast, suddenly, using primarily external capital (not their P&L) and then start declining soon after passing the scale threshold, it almost inevitably means that someone hit the gas way too fast, did not understand their competitive positioning or core consumer, and simply lost their patience.

This is when otherwise strong brands lose their way and get lost in a harried series of Hail Mary inorganic growth moves such as:

- Moving into 80 international markets!

- Adding nine product lines in two new temperature states since the IPO[11]

- Collabs with BigCo product development

- Anything to bring in cash

Most of Beyond Meat structural’ growth’ occurred in just one calendar year (2019) due to an enormous retail and food service shove. Before that, the brand had been growing exponentially, a best-in-class growth pace for premium-priced brands that need to re-position themselves and re-cast their revenue model to keep growing steadily. The latter adjustments take years and can’t be magically forced when dealing with new ingredient sources like industrial pea protein.

Beyond Meat was riding the Skate Ramp, but it got hasty or weird or both. Investors no doubt saw an easy IPO stock win (in what would become the final days of easy IPOs). Whether they pushed Ethan to go this route so they could cash out quickly or honestly thought they were building the next $1 billion food brand is something we’ll never know.

The sad irony is that the business had one brilliant idea – get plant-based meat out of the freezer case and right next to the ocean of private-label patties at every supermarket meat department. Go where the meat eyeballs are to capture all households interested in occasional non-meat burgers. My money is on recruiting the white-meat-only folks to a simulated beef experience they honestly don’t remember well.

Burgers are still the number one ‘sandwich’ Americans consume. So, choosing a patty format was also critical to boosting consumption rates after purchase. The history of Morningstar’s successful frozen veggie burgers showed that the burger form was the best way to capture vegan/vegetarian demand. When I first examined plant-based meat in 2012, the sector was about $400 million in scale or roughly $525 million in today’s dollars. Morningstar initially focused on harder-core, lifestyle vegetarians and vegans who want to participate in the all-American ‘burger’ rituals of the American summer without the beef. They didn’t want to be excluded. They still bring their frozen patties to their friends’ parties. The original purchase driver here was neither personal health nor methane gas reduction. It prevented animal cruelty, which is still the driver that creates the heaviest usage in the plant-based space overall. Many investors seem to have forgotten this basic fact. I call it the Bambi effect.

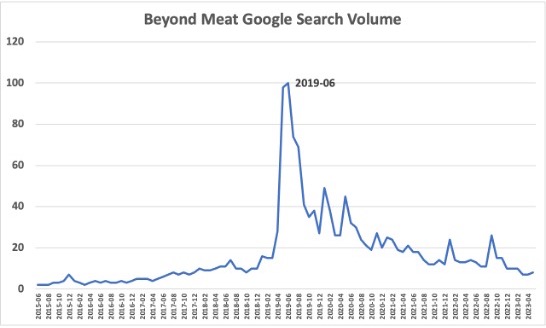

Beyond Meat created its own hype cycle, which we can safely assume led to a massive amount of curiosity trial. Huge amounts of it. Encouraging too much one-off trial from haters who had no intention of adding veggie burgers to their diet did help the IPO and kept the stock price roaring for about two years (helped in part by the Covid-19 surge in all CPG categories).

There is such a thing as too much PR for a fast-growing brand. Turbo-charging weak purchase intent trial through constant appearances on national news outlets can backfire by creating a tsunami of trial that masks the underlying core demand for the product.

The brand’s topline was doing perfectly in 2018 without all the complexity of additional product lines and servicing 80 international markets. The SG&A today at Beyond Meat is out of all proportion with what an efficient $400 million brand should have (56% of net revenue!).[13] Lay’s has a $3.6 billion in sales in the U.S. with only five product formats (from the same base ingredients) and far fewer staff.[14] That’s efficient. By going public in 2019, Beyond Meat found easy money, yes, but it brought on itself enormous pressure to prematurely solve its negative EBITDA situation under quarterly scrutiny. This first yielded a flurry of rushed product launches to mask problems with the core UPCs, and now a furious attempt to use global markets to boost cash flow and service the enormous debt the company took on in 2021.

Ultimately, Beyond Meat’s IPO will be seen as its own path to ruin, and Impossible may survive in retail. IPOs didn’t work for Amplify or Annie’s long-term; they just permitted investor wins/cash outs. This is not how you scale an innovative, low-profit brand. You have to do it the KIND way.

About the Author

Dr. Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage consumer packaged goods brands. As a professionally trained cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, including brands owned by Coca-Cola Venturing and Emerging Brands, The Hershey Company, General Mills, and Frito-Lay, as well as other emerging brands such as Once Upon a Farm, Dr. Squatch Soap, Proven skincare, Rebel creamery, and June Shine kombucha.

James is the author of “Ramping Your Brand: How to Ride the Killer CPG Growth Curve,” a #1 Best-seller in Business Consulting on Amazon.

[1] Crunchbase.com

[2] The sources here are all SEC filings unless otherwise noted

[3] IRI’s CPG Demand Index fueled by omnichannel Circana data https://indices.iriworldwide.com/covid19/?i=0 Accessed May 10, 2023

[4] https://www.fool.com/investing/2023/02/06/is-beyond-meat-stock-beyond-saving/ Accessed May 11, 2023

[5] Company SEC filings. The 2023 estimate is entirely my own based on smoothing quarterly data.

[6] Ibid.

[7] Data below is sourced from p. 6 of Modern Approaches to Eating, a national study fielded in April/May 2022, n= 2381 adults, aged 18-76; produced by the Hartman Group Inc. of Bellevue, WA

[8] Source: statista, Inc. 2022 sales data.

[9] In surveys of open-ness to a price premium within randomly selected food and beverage categories that I have conducted in the past, the average is generally 10% in any given category.

[10] My calculation here is based on April 2023 BLS data on the U.S. average price of 1 lb of ground beef ($4.79) and Beyond Meat’s Walmart price for two patties in Houston TX. Since, much of their volume isn’t trading at the Walmart price, this is an under-estimate of the required national timeline.

[11] The pre-IPO products were Beyond (ground equivalent), Beyond Burger, and Beyond Sausage. Newer lines include: Beyond Meatballs, Beyond Sausage (?), Beyond Breakfast Sausage, Cookout Classic (frozen), Beef Crumbles (frozen), Beyond Jerky, Beyond Steak (frozen), Beyond Chicken Nuggets (frozen), Beyond Popcorn Chicken (frozen), Beyond Chicken Tenders (frozen)

[12] Statista, inc.

[13] Q1 2023 10-Q filing for Beyond Meat.

[14] Statistia, inc. 2022 U.S. sales of Lay’s.