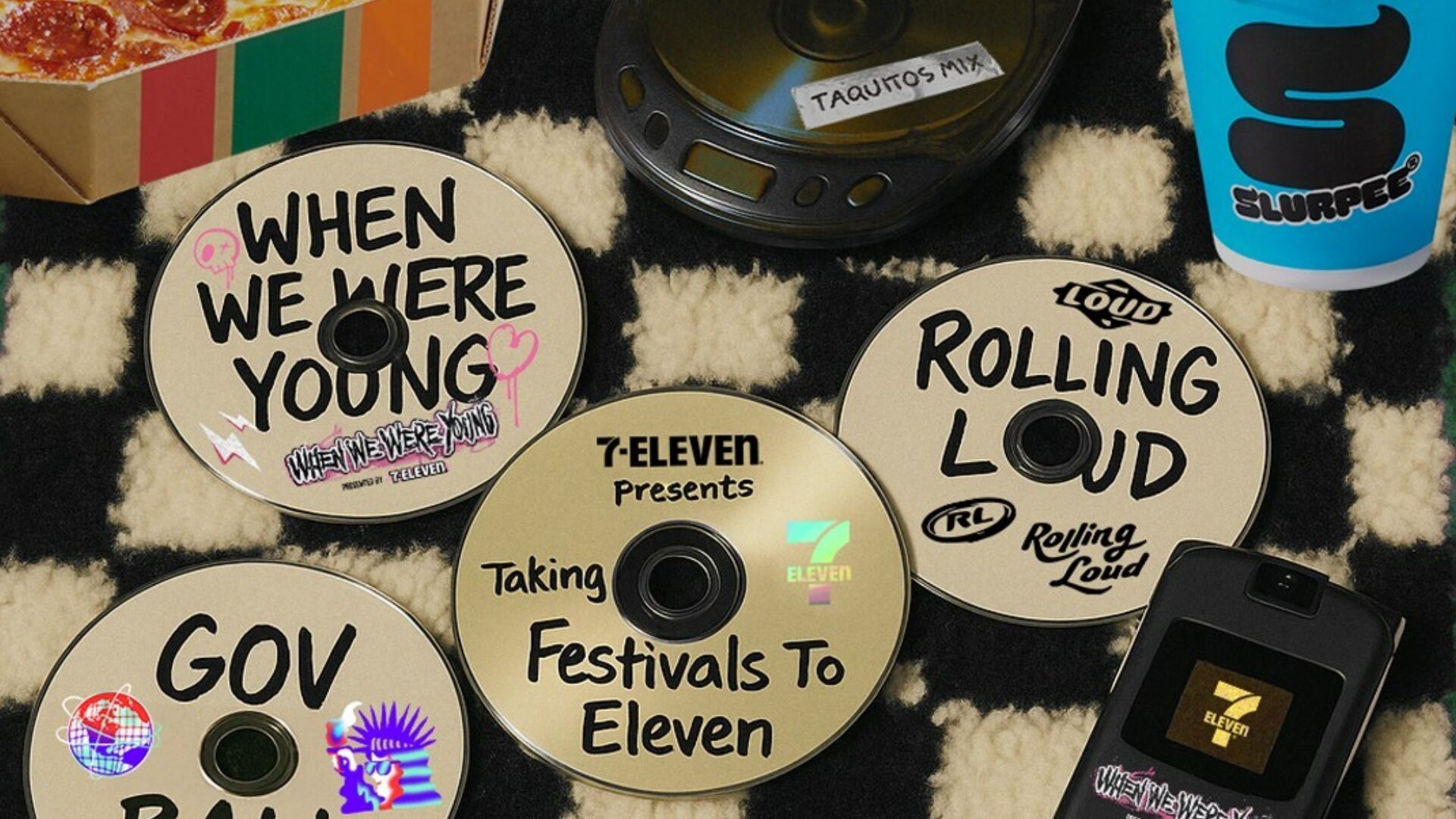

Recent announcements of summer and fall music festivals augur experiential marketing opportunities for F&B businesses endeavoring to connect with consumers. 7-Eleven has taken a unique approach to this by doubling down on live music touchpoints.

The global convenience chain teamed up with Live Nation to become the naming rights partner of pop-punk/emo music festival When We Were Young, taking place Oct. 18-19. In the meantime, it’s keeping the party going with promotional activations at New York City’s Governors Ball, June 6-8, as well as a hip-hop festival called Rolling Loud.

“By teaming up with Live Nation, we’re bringing the 7-Eleven brand to the heart of unforgettable fan moments,” said Marissa Jarratt, EVP and chief marketing & sustainability officer at 7-Eleven.

“We’re eager to recreate the fun and excitement that comes with visiting a 7-Eleven store in an immersive music experience.”

Rockstar Energy Drink’s sponsorship of Reading Festival and Coca-Cola’s Flow Fest both indicate a history of connection between F&B and live music, but 7-Eleven is taking it a step further by connecting it to their entire IP, rather than a strictly CPG angle.

Inside 7-Eleven’s Gen Z Strategy

The aforementioned move signals a play for 7-Eleven to connect with younger shoppers, particularly Gen Z (and Millennials) who may have ambivalent feelings toward the chain but drive the bulk of the convenience channel’s growth.

Jarratt outlined this approach back in 2022 at an industry conference called Groceryshop.

She said that 7-Eleven is devoting its efforts to target these demographics who may perceive the brand as “nostalgic” rather than the modern brand it would like to be recognized as. At the time, they discussed research efforts and social listening strategies to understand these consumers’ main drivers, while also investing in paid digital video and partnership opportunities.

A work of kismet, one opportunity came from punk rock girl band Froggy who posted a love song, “Ode to 7-Eleven Nachos,” on social media. The convenience chain worked with the band to produce a music video, which eventually helped drive a 15% increase in 7-Eleven Nachos with a recently developed cheese.

The parallels between this partnership and the latest deal with Live Nation indicate that the alternative rock scene may be a key growth motivator for a brand facing consistent same-store sales declines and decreased foot traffic. Same-store sales were down 2.7% during FY 2024 with the company forecasting a 1.5% dip for FY2025.

Moreover, last summer showed 7-Eleven consistently outmatched in terms of year-over-year foot traffic. In August, it posted a 0.8% loss while competitors such as Casey’s General Store and Wawa posted single digit gains, and Buc-ee’s hit 11% growth.

The move offers plenty of positioning opportunities for F&B retailers and CPGs alike. The market was valued at $250.8 billion in 2023 and is projected to more than triple by 2035, reaching $775.7 billion, growing at a CAGR of 10.2% between 2024-35, according to Allied Market Research.

Musicians Shaping Beverage Trends

There is also a storied history of the symbiotic relationship between music and food culture, evidenced by coveted pop-up food trucks at Coachella that inspired endless listicles ranking their unique offerings, as well as a recent partnership between open-air food market Smorgasburg and NYC music venue The Brooklyn Mirage.

“Increase in demand for unique and immersive concert experiences… and the rise of experiential marketing are driving the growth of the music event market,” read the report. 7-Eleven is engaging in these techniques with its activations and naming rights initiatives.

At the When We Were Young festival, for example, there will be “re-fuel” stations across the venue with “hangout” areas where festivalgoers can get Slurpees in between sets. This strategy supplants the brand image within the culture by playing into that same “nostalgia” that Jarrett implied to be a crutch, but now they’re banking has converted into a boon.

Moreover, this connection can be a powerful tool for industry leaders endeavoring to gain market share with the elusive Gen Z shopper. These consumers tend to value authenticity as well as brands that align with their values, which often takes the form of sustainability; however, it often extends to cultural cache, particularly among relevant influencers and beloved musicians.

In the latter vein, the convenience chain also partnered with iconic alt-rock band Green Day on a Slurpee flavor called Kerplunk Kandy Grape. This is the second collaboration between the brands, and Jarratt noted the success of the first came from consumers’ excitement of blending food and music.

The market research report noted this move was also key to the music event market’s projected growth, adding that it is helping to expand audience engagement.

These strategies show how CPG efforts can convert into meaningful revenue streams by connecting with shoppers at key touchpoints.

7-Eleven’s private label portfolio is seeing much of the growth from the recent partnership with Live Nation, and the entertainment firm is eager for more.

Monday, the company announced a partnership with Jolene, a ready-to-drink coffee brand created by Red Hot Chili Peppers lead Anthony Kiedis and his friend Shane Powers. Available at 23 Live Nation amphitheaters across 23 states as well as DTC via their online store, the merchandising strategy indicates an appetite for culturally relevant F&B options.

The Food Institute Podcast

It’s tariff time, and companies the world over are working to better understand how their operations will be impacted. Jodi Ader from RSM US LLP joined The Food Institute Podcast to discuss which products and inputs are currently subject to tariffs, and how to best mitigate supply chain risks.