As the calendar turns toward a new year, many consumers continue to watch their budgets closely. And that factor is shaping retail strategies for 2024.

“The average American family has eaten into the savings it created during the pandemic,” Ben Johnston, COO of Kapitus, told The Food Institute. “American consumers today are more cautious than they have been in recent years.”

Additionally, Americans’ time is treasured nearly as much as their money these days. That’s playing a key role in the rise of convenience meals, according to good natured, a company focused on environmentally safe food packaging. The company’s recent survey noted that 69% of consumers said buying convenience foods allows them to spend more time with loved ones, for example.

“Today’s consumers place greater emphasis on the value of experiences,” said Chris Malone, Vice President, Food Retail & Assurance, NSF.

Here’s a look at other trends expected to impact retailers the most in 2024:

Artificial Intelligence

Retail data is highly complex, with siloed information in a constant state of flux. Teams equipped with inventory data management systems will play a key role in the months ahead to help produce the accurate data businesses need to take advantage of the technology of the moment: AI.

Companies and their employees need to study and test the ways in which AI can improve the efficiency of their business.

“AI had quite the year in 2023, dominating headlines,” noted Nicola Kinsella, VP of global marketing at Fluent Commerce.

“To be successful in 2024 and beyond, AI will be forced to rely on the very sources many fear the technology will replace: people and data.”

An additional sentiment to keep in mind: Cris Grossman, CEO of Beekeeper, said it’s important to remember that many shoppers still appreciate a human touch; thus, grocers must carefully consider how they use AI.

In-store Tech Standardization

The next 12 months will usher in an era of tech standardization that will address the market’s fragmented landscape of disconnected solutions, said industry exec Paul Brenner.

“In 2024, technology providers will embrace open and standardized systems, enabling seamless scalability,” said Brenner, the SVP of retail media and partnerships at Vibenomics. “Simultaneously, grocers will embark on a bolder exploration of digital tech experimentation, driven by a shared vision to foster a thriving environment for both advertisers and shoppers.”

“Placemaking”

In its latest retail white paper, Placer.ai predicted an emergence of placemaking – i.e., retailers crafting public spaces that foster social interaction (not to mention longer consumer dwell times). A prominent example is a mixed-use district in Cary, North Carolina, which opened in mid-2022 and was designed as a live-work-play community that included shops, restaurants, seasonal attractions, and entertainment venues. Since the mixed-use district opened, visits have grown more than 100%, and median dwell time has increased significantly to reach 87 minutes, Placer.ai noted.

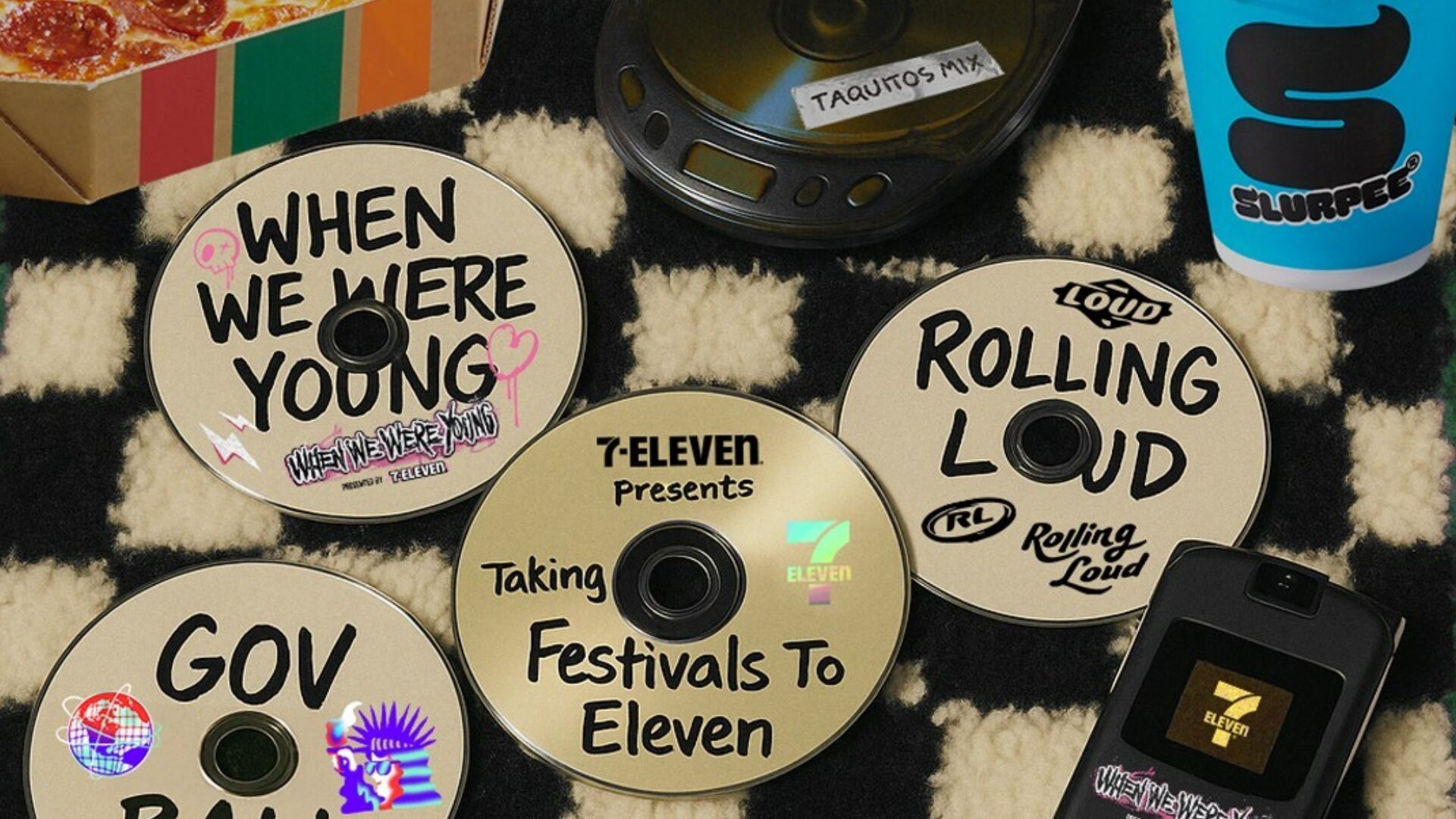

Retailers can also use placemaking tools to diversify their offerings and give shoppers multiple reasons to spend time in their stores. A prime example: In March 2023, 7-Eleven launched its electric vehicle fast-charging stations at select locations in California, Colorado, Florida, and Texas. The initiative resulted in significant year-over-year visit growth, Placer.ai reported.

Rapidly-growing National Grocers

National/discount grocers currently boast well over 60% of U.S. grocery market share – and that number is growing, noted Scott Moses, head of the grocery, pharmacy & restaurants practice at Solomon Partners. Currently, only five of the top 15 U.S. grocers are supermarket grocers, and Walmart’s U.S. grocery sales are roughly three times that of Kroger’s, Moses added.

“The competitive pressures that supermarket grocers are experiencing are severe and will likely continue to catalyze consolidation among smaller operators,” Moses told FI, “so they can improve their credit rating, lower their cost of capital, and make more of the investments required – in price, wages, marketing, logistics, technology, and growth – to counter the rapidly growing national/discount grocers.”

Packaging Barcodes Evolve

Placing 2D barcodes, or QR codes, on packaging isn’t a new concept, but brands are using the technology in innovative ways. Such barcodes can direct shoppers to dynamic product detail pages with everything from AR/VR to ratings and reviews.

Many CPG manufacturers are already using QR codes on their packaging to drive consumers to landing pages.

“In the next few years, we’ll see 2D barcodes become ubiquitous on all kinds of products, to keep up with an era where shoppers use their phones during nearly half of their shopping trips,” said Randy Mercer, chief product officer at 1WorldSync.