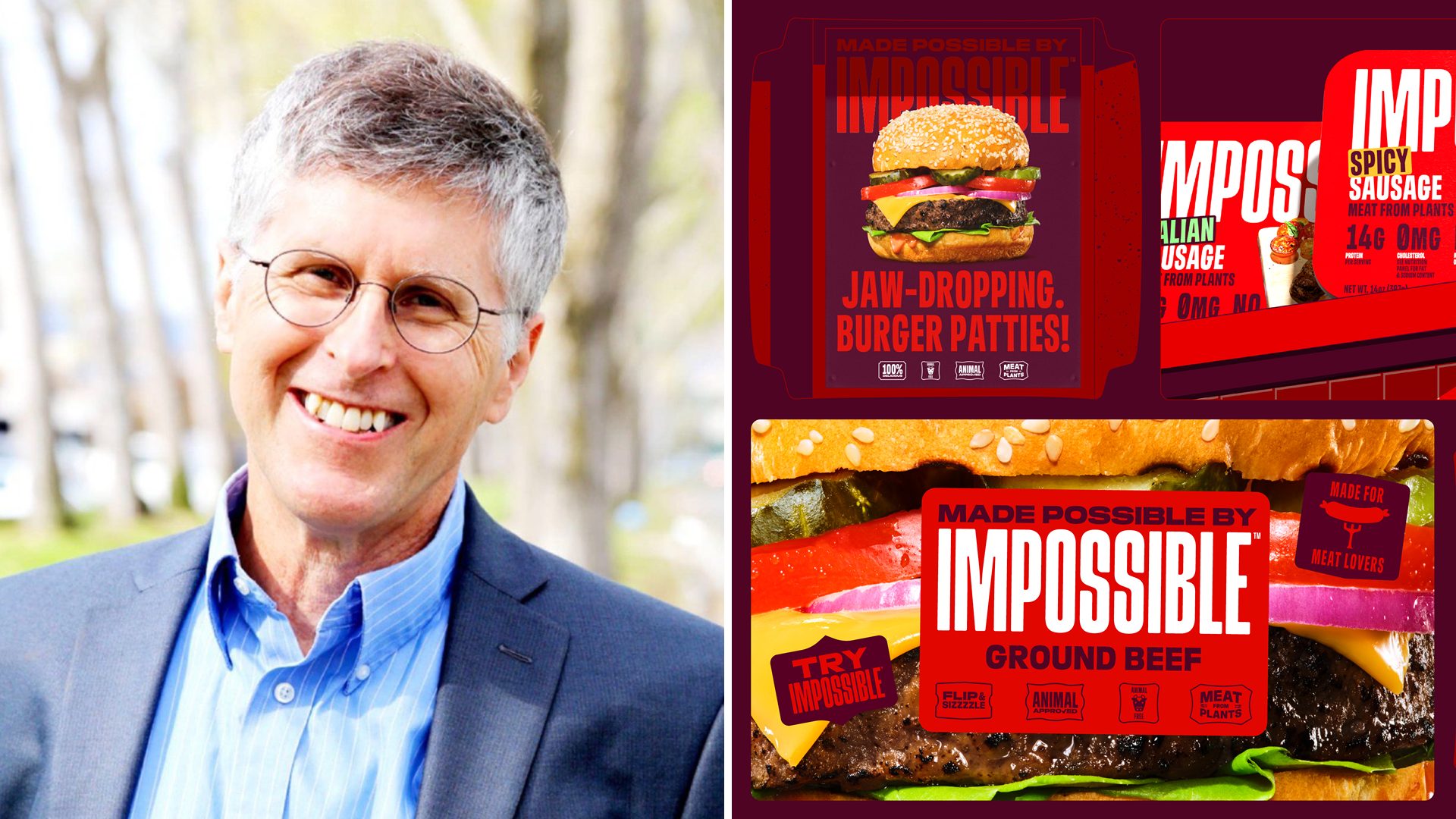

Photo Courtesy of Plant Based World Expo

NEW YORK CITY – A go-to event for vegans, vegetarians, flexitarians, and everything in between, Plant Based World Expo 2024 kicked off its fifth annual event at New York City’s Javits Center on Wednesday. The event brings together over 4,000 industry stakeholders endeavoring to learn about the future of plant-based offerings at retail and beyond.

This year’s show highlighted the technological innovations that are enabling brands to deliver on taste and texture when developing meat and dairy-free options. Key themes also included nutrient-dense food experiences and how the industry can bring more consumers into the mission.

Let’s dive into some of the movements on display in New York City.

Tech Innovations

“Tofu has never been sexier,” said Jonathan Lawrence, VP of merchandising at Fresh Thyme Market, during a keynote about integrating plant-based foods into everyday meals.

This sentiment emphasizes the imaginative breadth of products on display, even elevating a plant-based protein source that has long since received a negative stigma.

Plant-based cheeses and meat alternatives were aplenty on the show floor. On the cheese front, products including cheesy jalapeño bites from Imposter, a debut “meltable” cheese from Stockeld Dreamery, and a diverse selection of feta and goat cheeses from Kourellas were expanding the plant-based cheese game through research and development innovation.

“The real innovation on the show floor compared to last year is the tech,” said Imposter founder Ryan Feiner, adding that these modifications have created higher-quality products that can better emulate the experiences of their dairy analogs.

Some of these changes have also enabled brands to step down on price, a longstanding pain point for consumers curious about trying plant-based foods. One such brand is Milkadamia, an alternative milk brand that debuted its Flat Pack Oat Milk, a pack of eight dried sheets that can be blended with water to produce the equivalent of two 32-ounce cartons of its standard product.

Chief commercial officer Ipek Erdogan-Trinkaus told The Food Institute that the product weighs less, thus lowering shipping costs, and is more eco-friendly because the product requires fewer packaging materials. As a result, the offering will retail in January for 30% less for the same quantity of the standard product.

Nutrient-Dense Foods

“It’s got to taste good… but nutrition benefits have to be touted,” said Steve Markenson, VP of research and insights at the Food Industry Association (FMI), during an education session about how shoppers view plant-based foods.

SPINS CEO Jay Margolis agreed. In the aforementioned keynote presentation, he said that, for brands to succeed, they must deliver on protein, fiber, or both.

“Our country is protein obsessed, far more than any other developed country. Last year and this year higher protein products continue to perform more than their lower protein counterparts. People are [also] fiber obsessed,” he said. “As we’re thinking about innovation, we need to deliver on one if not both” of protein and fiber.

The evidence is clear: protein is center stage. Joseph Saine, category manager at Impossible Foods, discussed the company’s latest hot dog innovation, noting that the value proposition it brings to stores is its nutrient density.

Additionally, alternative protein sources like tempeh were commonplace in New York City. Indonesian plant-based maker Jan’s showed off its Frozen Royal Tempeh which boasts 21 grams of protein. Meat alternative maker Paow also showcased a slate of protein-rich offerings.

Converting Consumers

Data from Plant Based World Expo estimates the plant-based market to be $11.3 billion, and, despite projecting the market to triple over the next ten years, recent data from SPINS and FMI tell a story of growing pains and stagnation.

Ben Davis, Plant Based World Expo content chair and strategic advisor, explained the problem to FI by quoting a podcast from plant-based kiosk founder Plantega Nil Zacharias: “The plant-based food industry has been high on its mission, but low on ‘vibes.’”

This year’s exhibit, however, signals a divergence – people are expanding the mission.

“The activism side got us to where we needed to be to the point where everyone knows that [plant-based foods] exist. Now it’s time to be collaborative and inclusive to lean on the positive attributes of what we’re doing rather than the negative attributes of not eating plant-based,” said Davis.

He recognized Impossible Foods as one of the companies taking charge to make plant-based for everyone, which can have a “halo effect” on the rest of the industry because it invites consumers to try other plant-based options.

On the show floor, brands emphasized accessibility and positivity. Imposter Foods was one of these companies, with Feiner noting that not every brand needs to deliver only on health benefits from meat and dairy alternatives. Many who follow a plant-based lifestyle don’t necessarily want to eat healthier.

“Sometimes [consumers] just want to relax with a beer and jalapeño poppers after work,” he said.

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.