The Latin American consumer is complex and multifaceted, reflecting the many cultures of the geographic region.

“Hispanic consumers are not a monolith,” Katherine Machado-O’Hara of PR firm The O’Hara Project told FI.

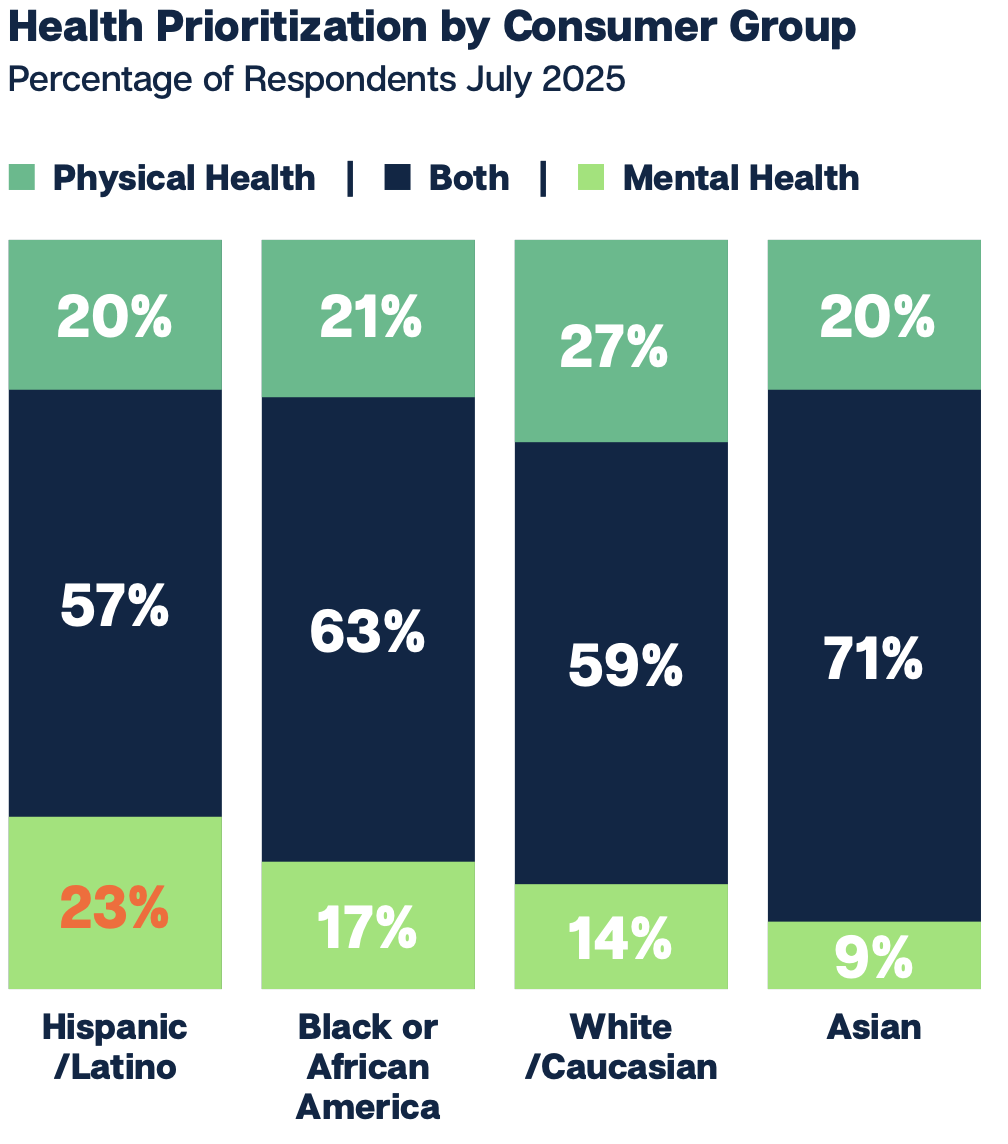

Source: Collage Group

She explained that even simple words, such as “straw,” may vary depending on the country or heritage of the Hispanic consumer. These regional differences add nuance to marketing campaigns that incorporate Spanish.

“In development, brands should make a conscious effort to honor those distinctions while also treating these consumers as distinctly American,” she added.

Every aspect of how a brand shows up for the LATAM consumer should be assessed. Although performative marketing strategies, such as campaigns around Hispanic Heritage Month, can be effective in the short term, the demographic better responds to year-round efforts to connect with these communities.

“Culturally aware marketing is more than a single or seasonal campaign now. It needs to be embedded in how brands show up all the time,” said Marika Barner, VP of marketing at Alliance Sales & Marketing.

Marketing Best Practices

Meeting Latin American consumers where they are looks different for the LATAM consumer. Machado-O’Hara noted that family-style and communal eating are more important for these communities. Emphasizing these value propositions will build deeper brand equity with these demographics.

Collage Group chief insights officer David Albert recommends brands to lean into authenticity, sensory excitement, and health-conscious messaging when marketing to Latin Americans. The platform’s data indicates that flavor variety and ingredient transparency are more important to this demographic than to the average U.S. consumer.

Karina Salvídar of Amor y Pan agreed with Albert’s assertion of the importance of authenticity.

76% of Hispanic adults in the US are more likely to purchase brands that feature diverse people, lifestyles, and cultures in their ads.

“The Hispanic consumer doesn’t want a gringo brand selling them their culture. They want to relate and know that whoever is behind the brand is really like them,” she said.

When it comes to the health-focus, Albert added that these shoppers are more likely to partake in workout prep and recovery snacking, meaning functional indulgence can be a strong value proposition for the demographic.

“Protein-rich chips, bars, and portable snacks are being reimagined with flavors like chili-lime, tamarind, or tropical fruits to meet both taste and health goals,” he said.

Hispanic consumers are more likely to prioritize mental health, providing an opportunity for CPGs to innovate with this consumer need state in mind.

Source: Numerator