Consumer desire to eat healthier has long prevailed in retail and foodservice but the latest research from dunnhumby underscores the opportunity these shoppers offer to margin-strapped grocers today.

“BFY [Better-for-you] customers tend to be younger (18-44), have more kids, have higher incomes ($100k+), have bigger monthly grocery budgets ($60 more), and exhibit more omnichannel and loyalty behaviors,” reads the report Better for You (Customer), You (Brand) and You (Retailer). The segment engages with core retail initiatives and promises a larger return on investment.

These shoppers are worth $285 billion to the grocery industry every year, accounting for roughly 20% of the 1.7 trillion-dollar grocery industry, the report noted.

These shoppers, who constitute roughly a third of the U.S. population, are particularly valuable for retailers with curated offerings that prioritize offerings that are nutrient-dense, fresh, and sustainable. It may serve these grocers and relevant brands to invest in appealing to these shoppers.

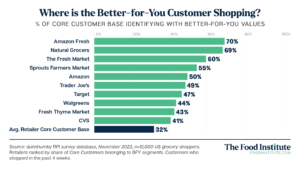

Already, fresh- and health-focused grocers are winning for the segment. The graphic below outlines the top grocers for better-for-you shoppers.

Capturing the Better-for-You Consumer

“With health and wellness predicted to be the most critical trend for decades, retailers and brands have unprecedented opportunities to meet emerging customer needs.” said Matt O’Grady, President of the Americas for dunnhumby, in a statement.

The segment over-indexes for seafood, ready-to-eat, and fresh produce, meaning these departments can be key to marketing to these shoppers, notes dunnhumby. Additionally, they care more about sustainability than their traditional shopper counterparts — they are more than twice as likely to say that a product having sustainable packaging is important, and 22% more likely to value if a retailer cares about food waste.

Additional report insights include:

- Health-focused consumers care more about quality (63% versus 47%) and less about price (64% vs 71%)

- They are more concerned with qualifiers like “organic,” “healthy,” “local,” “premium,” and “diet”

- These consumers tend to value a retailer’s shopping experience to a greater degree, with 14% more better-for-you shoppers prioritizing a store’s upscale feel, and 12% more caring about friendly employees who make them feel valued.

Better-for-You is Trending

Experts agree that 2024 was the year of health and wellness, particularly with the boom in functional snacking and the growing clean-label movement. Next year, however, well-being-focused trends are only projected to grow.

“As the grocery landscape continues to evolve, understanding and adapting to these health-centric consumer trends will be crucial for retailers aiming to remain competitive,” O’Grady said in a statement.

Kroger, for example, recently revealed that protein-rich diets and convenient and healthy meal prep are on the rise. The report found that 51% of consumers cite high protein as a top nutritional benefit they look for in a new or innovative product, followed by clean ingredients (43%), and functional benefits (40%). Additionally, Fresh Direct’s food predictions for 2025 reflect consumers’ desire for balanced eating and cleaner, more nutrient-rich diets.

Shifting consumer sentiments indicate an optimistic outlook for the better-for-you shopper, signaling the segment’s room for growth. The functional food ingredients market alone is slated to undergo an astonishing $53.14 billion growth between last year and 2028, notes a recent report from market insights firm Technavio. Drivers include preoccupation with chronic diseases motivating healthy diets, as well as the desire for ingredients like prebiotics and probiotics.

This momentum paves the way for brands and retailers to reimagine their portfolios, doubling down on products that incorporate health attributes into their value proposition.