Roughly 69% of global consumers plan to enjoy this year’s value hunt, shopping deals, and promotional offers, according to a recent study from professional services firm EY. The Holiday Shopping Survey explored the modest three percent lift in November and December 2024 in retail sales, down from last year’s 4% bump, and 2022’s 5.2% spike.

“We’re not surprised by that because consumers have been cautious for a while,” Will Auchincloss, Americas consumer products and retail leader at EY-Parthenon, told The Food Institute. “Consumers are feeling tapped out.”

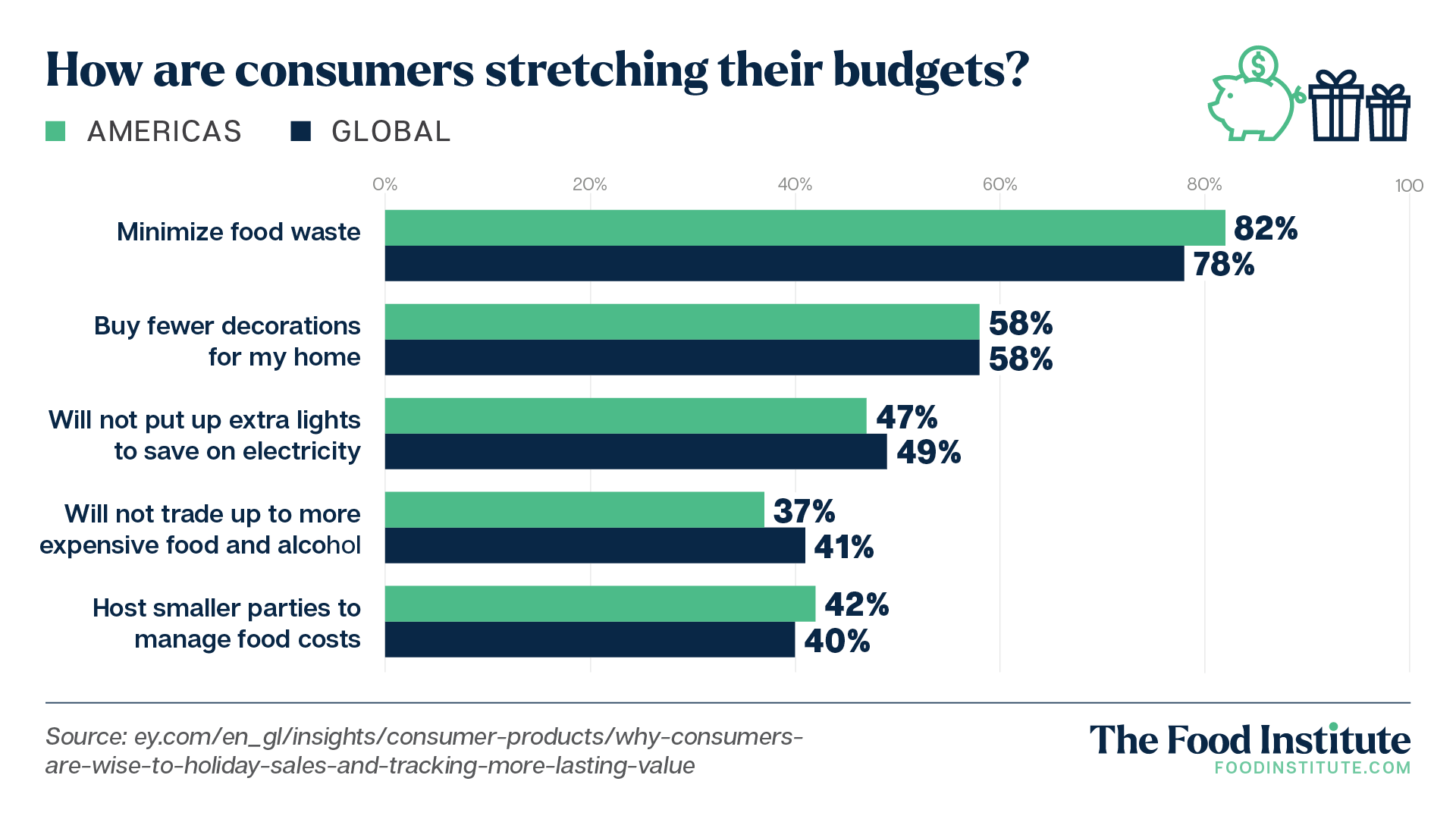

As a result, shoppers worldwide are tightening their budgets in key areas.

Despite the bleak outlook, Auchincloss cited EY data to show that consumers still want to make the holiday season special, with 70% of consumers looking forward to festive season sales events. Today’s consumer is incredibly nuanced, however, with 63% indicating skepticism about the real value of these discounts.

The bifurcated shopper is partially why the report calls this season’s shopper “smart, savvy, and shrewd.” They will navigate multiple channels with ease to cost-compare and are becoming more discerning about what value means to them, the report noted.

Beyond Black Friday

The hunt for deals has many eyeing big spending holidays to get their gifts.

This year, 54% of consumers plan to shop the upcoming Black Friday and Cyber Monday sales, up from 46% in 2023, according to a recent Civic Science report.

These promotions drive value for shoppers increasingly fatigued by elevated prices. Moreover, the report found that 42% of holiday shoppers are actively searching for “deals and promotions.”

A dark horse in the holiday savings weekend, Small Business Saturday is also slated for growth, bolstered by the value these retailers bring to a gift through its originality. A report from data insights firm NMI found that 87% of consumers say gifts from small businesses are more thoughtful, while 78% of consumers are willing to pay more to help small businesses thrive.

Topping the list of retail types set to gain traction include coffee shops, casual takeout restaurants, and bakeries, according to the report.

Nevertheless, financial pressures plague holiday shoppers, with 56% of U.S. consumers noting concerns about paying for festivities, EY noted. To bridge the gap, roughly half of U.S. credit card holders will likely open or max out cards for overall holiday spending, according to a recent report from CreditCards.com.

However, Auchincloss noted that retailers will likely have to do more than simply lower prices to get shoppers through their doors. This is especially true now that, for many members, these holiday deals have already begun. Target, for example, began offering their Black Friday deals on Nov. 21.

It appears retailers will work overtime to capture the holiday joy in-store.

Holiday Shoppers to Flock to In-Store Experiences

Sixty-eight percent of U.S. consumers anticipate doing their holiday shopping at physical locations.

Broken down by generation, one would expect this trend to skew older, as 72% of Gen X are most likely to shop in-store; however, 63% of digital-native Gen Z shoppers say they’ll go to brick-and-mortars, versus the 50% who report shopping online (the two options were not mutually exclusive).

Congruent with omnichannel macro shifts, retailers prioritizing seamless in-store and online shopping channels will be rewarded this holiday season.

“Successful retailers are meeting shoppers wherever they are with convenient, personalized, and accessible experiences both in-store and online,” said Isaac Krakovsky, EY Americas consulting retail leader, in a statement. “Now it’s up to retailers to create a workforce that can meet the demands of multiple sales channels this festive season. …”

In-store shopping allows customers to physically see and touch a product before finalizing a purchase; however, festive atmospheres and inspiration for gift ideas offer added benefits. Moreover, retailers across categories have been investing in their physical store experience to drive shopper value beyond price, engaging them with their local community while offering unique value propositions.

“You’re seeing literal bars in grocery stores and at some luxury brands,” said Auchincloss. “Consumers are actually going into their grocery stores and spending time at those bars and restaurants and then doing some shopping.”

Retailers can continue to invest in these spaces to curate an experience that caters to the needs of the core shopper by building the architecture around them, he noted. One example of this can be found overseas, where some department stores and malls have created “husband waiting areas” to engage the peripheral shopper while investing in its core shopper.

These experiences need to be “on brand,” advises Auchincloss, and must resonate with a business’s core values to some extent.

The Food Institute Podcast

Is it possible to balance a legacy brand and innovative ideas for a food company? Bibie Wu, chief communications and technical development officer with Del Monte, shares how her company respects its past while looking to the future, and how her dual roles in marketing and product development inform each other and improve the company.