In just a few years, consumer snacking has completely transformed. Current trends in the space explore nutrient density and one’s emotional and social connection to food at a level heretofore unprecedented.

“Ten to twenty years ago the concept of wellness and health focused on the physical side. You probably remember having the servings of fruits and vegetables, and grains,” said Food Institute CEO Brian Choi in a webinar about how consumers are snacking today, “That’s really evolved to today.

“The pandemic jumpstarted the way consumers think about wellness. Not just the physical side, but also the mental and social.”

The webinar, titled “Snacking Smarter: Consumer Trends and Product Solutions,” explored the fundamental drivers of snacking behavior and how the future of health and wellness is informing the product development, marketing, and merchandising of snack items. Bill Waltzek, senior customer marketing manager at ingredient manufacturer Glanbia Nutritionals, and Julie Murphy, director of insights at data analytics firm Brightfield Group, discussed what this means for the future of the category.

How Snacking Differs by Need State

Recent Mondelēz and Food Institute data shows that a larger percentage of today’s consumers are snacking and they’re eating snacks more often than in the past, signaling an opportunity for grocers and manufacturers to satisfy these needs. An answer to why they’re snacking more uncovers a harsh reality: consumers are skipping meals more now than 10 years ago. This fact also likely contributes to why consumers desire more nutrition when snacking.

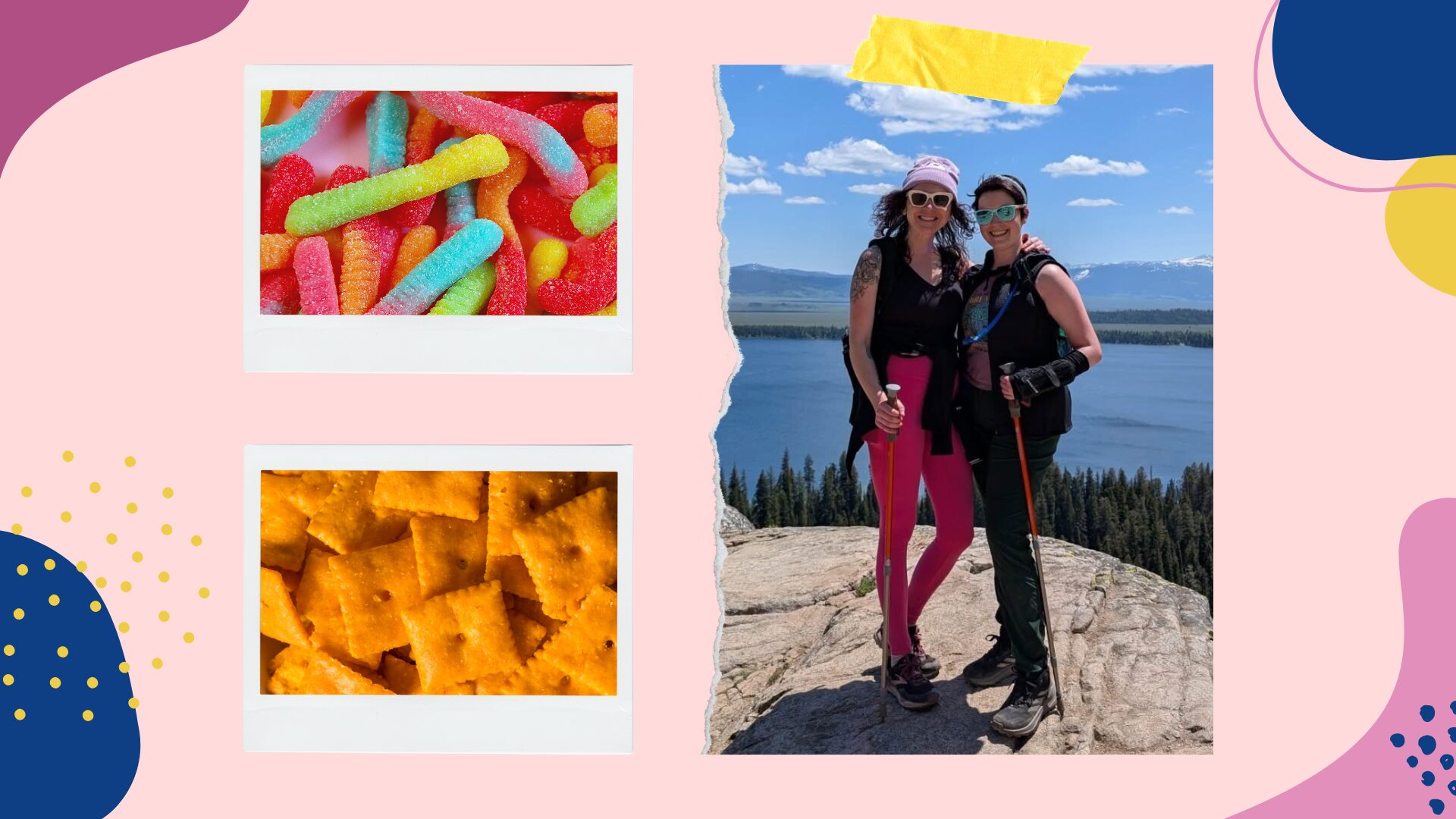

Waltzek explained that, overall, consumers are often looking for “permissible indulgence” when snacking, and positioning a CPG product through a healthy lens can help drive consumption. He noted that better-for-you snacks across sweet and savory categories are experiencing explosive growth, a testament to health and wellness’s success.

Additionally, he broke down the myriad ways consumers choose to snack, using data from Glanbia Nutritionals’ recent consumer survey. The accompanying percentages represent how many consumers seek out the eating style when snacking:

- Pleasure (39%): a guilt-free treat or a snack to accompany a relaxing moment.

- Energy management (36%): a snack that offers a quick burst of energy, sustained vitality or is enough to satiate the consumer until their next meal.

- Goal support (25%): an offering that keeps people in control of their health and supports bodybuilding.

Where the pleasure category is more emotionally driven, goal support is more concerned with functionality. Although a product in each of these categories appeals to different consumers, Waltzek noted that the fact that the pleasure category is the largest segment indicates that offerings that offer an emotional connection to the consumer win out.

“Brands that prioritize pleasure first and functionality second when developing these better-for-you products or snacks lends itself to be more aligned with what is trending with consumers,” he said.

Women’s and Men’s Snacking Needs Differ

“Women are a prime target for functional food and beverages. They make up 54% of those that are interested, and that has been growing in recent quarters,” Murphy said. She noted how, in a Brightfield report examining what consumers are looking for in a functional bar, women desire nuanced benefits.

Where the general population wants functional beverages that improve gut health and support overall well-being, women are more likely to look for products that help with sleep, inflammation, bone health, and mental relaxation, and offerings that support them through life stages like perimenopause. Murphy explained that, as consumers are seeking help with perimenopause, snacks can provide them with opportunities to support symptom management.

“We have Gen X moving into the perimenopause stage of life, and they’re not afraid to talk about it. It was once taboo and people used to only talk about hot flashes, [but] now they’re talking about the 30+ symptoms in this stage of their life,” she said.

According to Brightfield data, consumers discussing perimenopause most frequently mention collagen, caffeine, magnesium, calcium, and omega 3 and omega 6 fatty acids.

To learn more about how the snacking category is changing, click here to watch the webinar recording on demand.

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.