U.S. dollar sales for certified organic products approached $70 billion in 2023, marking a 3.4% increase year-over-year (YOY) and setting a record for the sector.

Many shoppers are turning to organic for personal and family health, sustainability, and a desire for clean products free from antibiotics, hormones, preservatives, and dyes.

While the jump in dollar sales was driven more by inflated pricing, unit sales increases were also reported for up to 40% of the products tracked in the 2024 Organic Industry Survey conducted by the Organic Trade Association (OTA).

Furthermore, prices for many non-organic products climbed at a faster rate than organic varieties. This narrowing price gap should help fuel organic product growth in 2024.

“It is encouraging to see that organic is growing at basically the same rate as the total market. In the face of inflation and considering organic is already seen as a premium category, the current growth shows that consumers continue to choose organic amidst economic challenges and price increases,” said says Tom Chapman, co-CEO of OTA, in a company press release. “Although organic is now a maturing sector in the marketplace, we still have plenty of room to grow.”

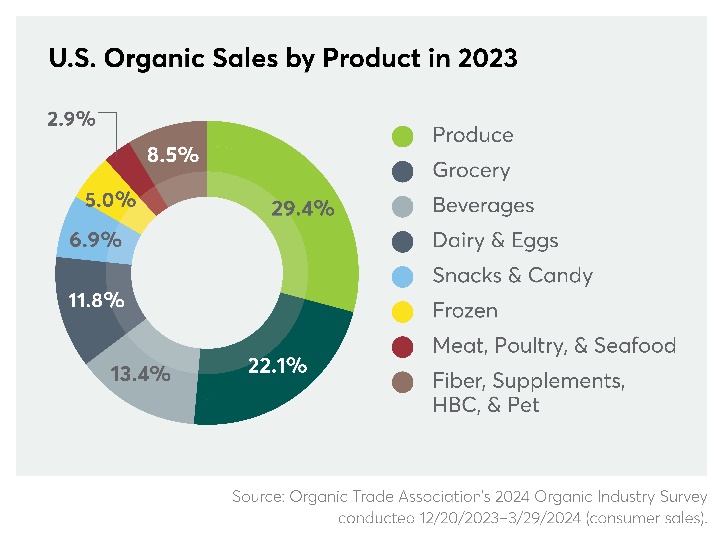

Top-Selling Organic Food Categories

Produce held its spot as the largest organic category, growing by 2.6% to $20.5 billion in 2023. Produce continues to be the primary consumer entry point for organic products and now accounts for more than 15% of total fruit and vegetable sales in the U.S.

Top-selling products were avocadoes, berries, apples, carrots, and packaged salads, and organic bananas saw stronger growth in 2023 than non-organic bananas.

With $15.4 billion in sales, grocery was the second-largest category, with dollar sales up 4.1% year-over-year. With 21 different subcategories, close to 40% of these sales were driven by the top three performers —in-store bakery and fresh breads; dry breakfast goods; and baby food and formula.

Beverages were the third-largest category for organic last year, posting $9.4 billion in sales, up 3.9%. Functional beverages for enhanced hydration and mental focus were a significant sales driver along with non-alcoholic beverages and mocktails. Organic wine sales were up 2.5% and organic liquor and cocktails posted over 13% growth.

The fourth-largest organic category was dairy and eggs — another entry point for consumers seeking clean, ethical sources of protein with lower environmental impacts. Category dollar sales reached $8.2 billion in 2023, up 5.5%, and now account for over 8% of all dairy and egg sales. Milk and cream sales were up almost 5%, and the organic dairy alternative category grew almost 14%.

Regenerative Labels Could Challenge Organic

Overall, the organic seal remained a stand-out with consumers last year despite the growing number of claims and labels popping up across the grocery store. Research also shows that millennials and Gen Z have a consistent interest in organic products, which should safeguard the category in the future.

The rise of regenerative agricultural practices and certifications, however, could cause confusion in the marketplace. While regenerative labels are not necessarily top of mind for consumers yet, the attributes they claim to represent – including soil health, animal and human welfare, and biodiversity – are also embodied by the USDA Organic seal.

The Food Institute Podcast

How are foodservice consumers contending with persistent inflation? Are they eating more at home, for example, or continuing to treat themselves at their favorite restaurants? The latest episode of The Food Institute Podcast examines that topic with Krystle Mobayeni of BentoBox, who dissected rapidly evolving consumer dining dynamics.